Organize Investment Paperwork Easily

Introduction to Investment Paperwork Organization

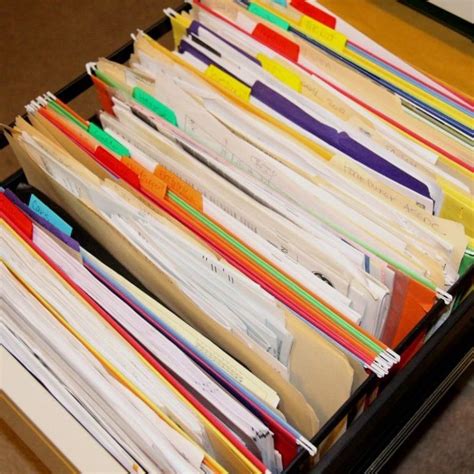

Investing in the stock market, real estate, or other financial instruments can be a lucrative venture, but it often comes with a plethora of paperwork. From stock certificates to property deeds, and from brokerage statements to tax documents, the amount of paperwork can quickly become overwhelming. However, organizing this paperwork is crucial for several reasons, including tax compliance, financial planning, and emergency preparedness. In this article, we will explore the importance of organizing investment paperwork and provide a step-by-step guide on how to do it efficiently.

Why Organize Investment Paperwork?

Organizing investment paperwork is essential for several reasons: - Tax Compliance: Accurate and up-to-date records are necessary for tax filing purposes. Disorganized paperwork can lead to missed deductions, incorrect filings, and potential audits. - Financial Planning: A clear picture of your investments is crucial for making informed financial decisions. Organized paperwork helps in tracking investments, identifying areas for improvement, and planning for the future. - Emergency Preparedness: In the event of an emergency or the passing of a loved one, organized paperwork can significantly reduce stress and facilitate the transfer of assets.

Steps to Organize Investment Paperwork

Organizing investment paperwork involves several steps, including categorization, digitization, and storage. Here’s a step-by-step guide:

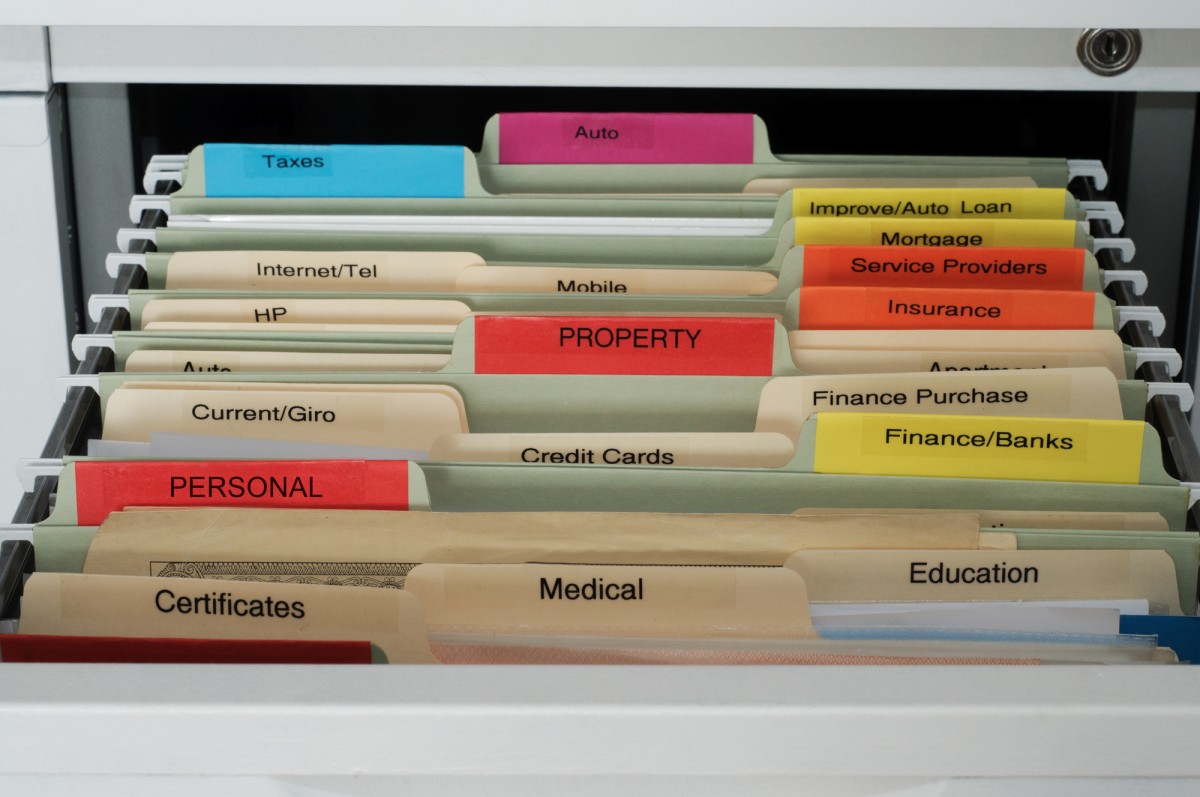

- Categorize Documents: Start by categorizing your documents into different types, such as stock market investments, real estate investments, tax documents, and insurance policies.

- Digitize Documents: Consider digitizing your paperwork to reduce physical storage needs and improve accessibility. Use a scanner or a mobile app to convert your documents into digital format.

- Use a Cloud Storage Service: Store your digitized documents in a secure cloud storage service. This provides easy access from anywhere and automatic backups.

- Implement a Filing System: Create a filing system, either physical or digital, to store and retrieve your documents efficiently. Use clear and descriptive file names and consider color-coding for different categories.

- Regularly Update Records: Regularly update your records to reflect changes in your investments, such as purchases, sales, or dividend payments.

Tools for Organizing Investment Paperwork

Several tools are available to help organize investment paperwork, including: - Spreadsheets: Useful for tracking investments and calculating returns. - Investment Tracking Software: Provides a comprehensive view of your investments and often includes features for tax reporting and financial planning. - Document Management Apps: Helps in digitizing, organizing, and securely storing documents.

Best Practices for Maintenance

To maintain your organized system: - Review and Update Regularly: Schedule regular reviews of your paperwork to ensure everything is up-to-date and accurate. - Backup Your Data: Regularly backup your digital documents to prevent loss in case of a technical failure. - Seek Professional Advice: If overwhelmed, consider seeking advice from a financial advisor or an accountant.

📝 Note: Always keep your login credentials and backup storage information in a secure location to protect your sensitive financial information.

Benefits of Organized Investment Paperwork

The benefits of organizing your investment paperwork are numerous: - Reduced Stress: Knowing that your documents are in order can significantly reduce stress related to financial management. - Improved Financial Clarity: Organized paperwork provides a clear picture of your financial situation, enabling better decision-making. - Time Savings: Easily accessible documents save time when preparing for tax filings or making investment decisions.

What is the best way to digitize investment paperwork?

+

The best way to digitize investment paperwork is by using a high-quality scanner or a mobile app designed for document scanning. Ensure the scans are clear and in a commonly used format like PDF.

How often should I update my investment records?

+

It's recommended to update your investment records at least quarterly, or whenever there is a significant change in your investments, such as buying or selling stocks, or receiving dividend payments.

What are the benefits of using cloud storage for investment paperwork?

+

The benefits include easy access from anywhere, automatic backups, and enhanced security features to protect your sensitive financial information.

In essence, organizing investment paperwork is a critical aspect of financial management. It not only helps in keeping track of investments and ensuring compliance with tax laws but also provides a clear picture of one’s financial situation, enabling better decision-making. By following the steps outlined and utilizing the right tools, individuals can maintain a well-organized system of their investment paperwork, leading to reduced stress, improved financial clarity, and significant time savings. This comprehensive approach to investment paperwork organization is indispensable for anyone seeking to navigate the complex world of investments with confidence and clarity.