5 Finance Major Tasks

Introduction to Finance Major Tasks

In the realm of finance, there are numerous tasks that individuals with a finance major are expected to perform. These tasks are crucial for the success of any organization, and they require a deep understanding of financial concepts, principles, and practices. In this article, we will explore five finance major tasks that are essential for any finance professional.

Task 1: Financial Statement Analysis

Financial statement analysis is a critical task in finance that involves examining and interpreting financial statements, such as balance sheets, income statements, and cash flow statements. This task requires a thorough understanding of accounting principles, financial ratios, and trends. By analyzing financial statements, finance professionals can identify areas of strength and weakness, assess a company’s financial performance, and make informed decisions. Some of the key aspects of financial statement analysis include: * Ratio analysis: calculating and interpreting financial ratios, such as debt-to-equity, current, and return on equity (ROE) * Trend analysis: examining trends in financial data over time * Industry comparison: comparing a company’s financial performance to that of its industry peers

Task 2: Investment Analysis

Investment analysis is another important task in finance that involves evaluating investment opportunities and making informed decisions. This task requires a deep understanding of investment principles, risk management, and portfolio management. By analyzing investments, finance professionals can identify opportunities that align with their organization’s goals and risk tolerance. Some of the key aspects of investment analysis include: * Stock analysis: evaluating the performance of individual stocks and making buy or sell recommendations * Bond analysis: evaluating the creditworthiness of bond issuers and making investment decisions * Portfolio management: creating and managing investment portfolios that meet an organization’s investment objectives

Task 3: Risk Management

Risk management is a critical task in finance that involves identifying, assessing, and mitigating risks that could impact an organization’s financial performance. This task requires a thorough understanding of risk management principles, practices, and techniques. By managing risks, finance professionals can minimize potential losses and maximize returns. Some of the key aspects of risk management include: * Identifying risks: identifying potential risks, such as market risk, credit risk, and operational risk * Assessing risks: assessing the likelihood and potential impact of identified risks * Mitigating risks: implementing strategies to mitigate or manage identified risks

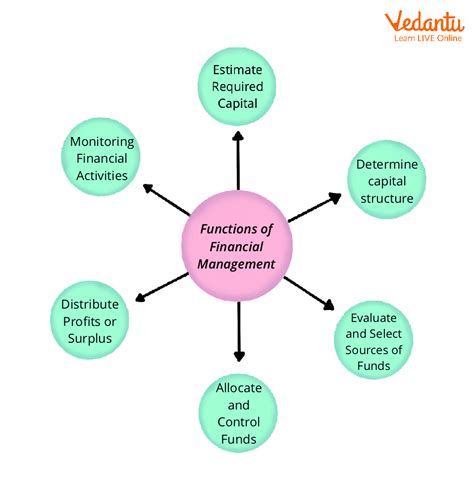

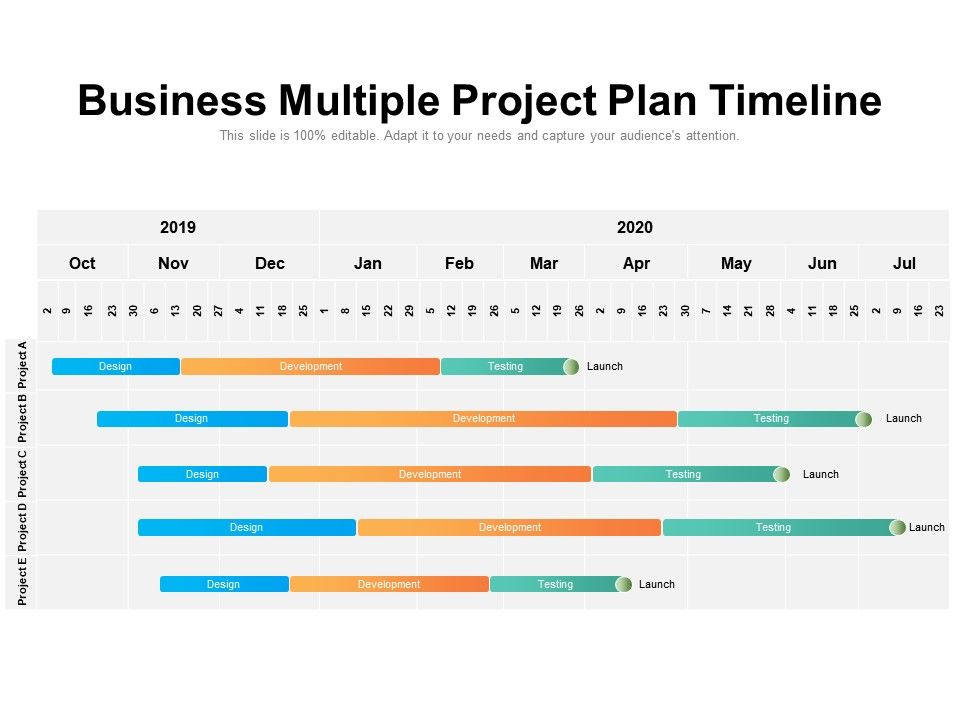

Task 4: Financial Planning and Budgeting

Financial planning and budgeting are essential tasks in finance that involve creating and managing financial plans and budgets. This task requires a deep understanding of financial planning principles, practices, and techniques. By creating and managing financial plans and budgets, finance professionals can ensure that an organization’s financial resources are allocated efficiently and effectively. Some of the key aspects of financial planning and budgeting include: * Financial goal setting: setting financial goals and objectives * Budgeting: creating and managing budgets that align with an organization’s financial goals * Financial forecasting: forecasting future financial performance and making informed decisions

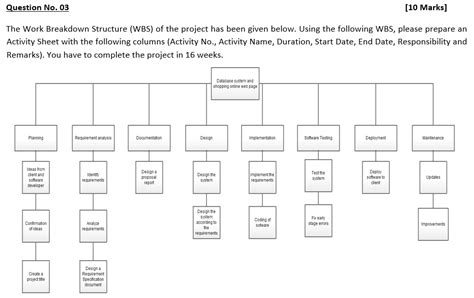

Task 5: Financial Modeling and Forecasting

Financial modeling and forecasting are critical tasks in finance that involve creating and using financial models to forecast future financial performance. This task requires a thorough understanding of financial modeling principles, practices, and techniques. By creating and using financial models, finance professionals can make informed decisions and predict future financial outcomes. Some of the key aspects of financial modeling and forecasting include: * Financial modeling: creating financial models that reflect an organization’s financial performance * Forecasting: using financial models to forecast future financial performance * Sensitivity analysis: analyzing the sensitivity of financial models to changes in assumptions and variables

💡 Note: These tasks are not mutually exclusive, and finance professionals often perform multiple tasks simultaneously.

In summary, the five finance major tasks discussed in this article are essential for any finance professional. By performing these tasks, finance professionals can make informed decisions, manage risks, and drive business success.

What is financial statement analysis?

+

Financial statement analysis is the process of examining and interpreting financial statements to assess a company’s financial performance and make informed decisions.

What is investment analysis?

+

Investment analysis is the process of evaluating investment opportunities and making informed decisions to maximize returns and minimize risks.

What is risk management in finance?

+

Risk management in finance involves identifying, assessing, and mitigating risks that could impact an organization’s financial performance.