IRS Receipt of Paperwork Confirmation

Understanding the IRS Receipt of Paperwork Confirmation

The Internal Revenue Service (IRS) is responsible for collecting taxes and enforcing tax laws in the United States. When individuals or businesses submit paperwork to the IRS, they often wonder if their documents have been received and are being processed. The IRS provides a confirmation of receipt for various types of paperwork, which can help alleviate concerns and provide peace of mind. In this article, we will delve into the world of IRS receipt of paperwork confirmation, exploring the different types of confirmations, how to obtain them, and what they mean for taxpayers.

Types of IRS Receipt Confirmations

The IRS issues various types of receipt confirmations, depending on the type of paperwork submitted. Some common types of confirmations include: * Electronic Filing Confirmation: When taxpayers e-file their tax returns, they receive an electronic confirmation from the IRS, indicating that their return has been received and accepted. * Mail Receipt Confirmation: For paperwork submitted by mail, the IRS may send a confirmation letter or postcard, acknowledging receipt of the documents. * Fax Receipt Confirmation: When faxing paperwork to the IRS, taxpayers may receive a fax confirmation sheet, indicating that their documents have been received. * Online Account Confirmation: Taxpayers who create an online account with the IRS can view their account activity, including confirmations of receipt for submitted paperwork.

How to Obtain an IRS Receipt Confirmation

Obtaining an IRS receipt confirmation is relatively straightforward. Here are the steps to follow: * E-filing: When e-filing a tax return, the IRS will automatically generate an electronic confirmation, which can be printed or saved for records. * Mail: Include a self-addressed, stamped envelope with mailed paperwork, and the IRS will return a confirmation letter or postcard. * Fax: Use the IRS’s fax cover sheet, which includes a confirmation page that will be returned to the taxpayer upon receipt of the faxed documents. * Online Account: Log in to the IRS online account, and view the account activity to confirm receipt of submitted paperwork.

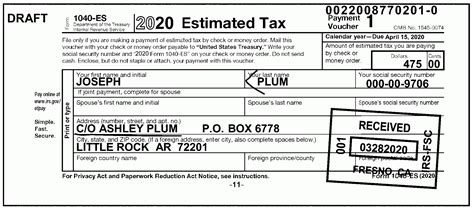

What to Expect from an IRS Receipt Confirmation

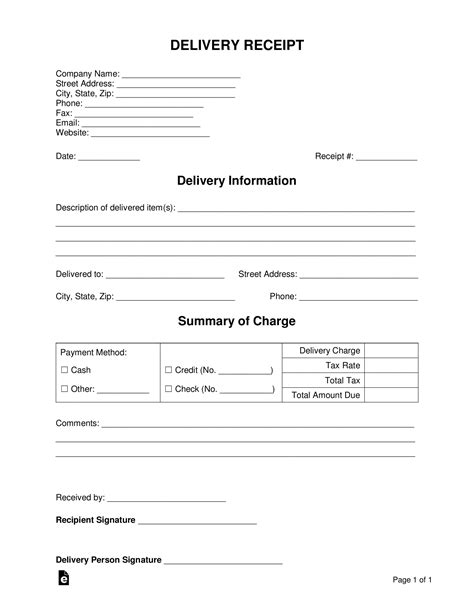

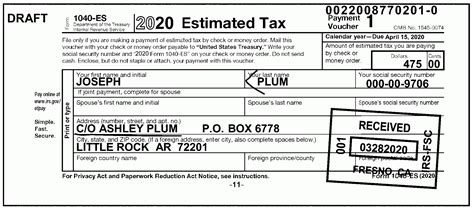

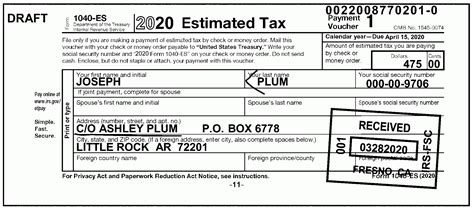

An IRS receipt confirmation typically includes the following information: * Confirmation number: A unique identifier assigned to the submitted paperwork. * Date and time of receipt: The date and time the IRS received the paperwork. * Type of paperwork: A description of the paperwork submitted, such as a tax return or amendment. * Taxpayer identification number: The taxpayer’s Social Security number or Employer Identification Number.

Importance of IRS Receipt Confirmations

IRS receipt confirmations serve several purposes: * Proof of filing: Confirmations provide proof that the taxpayer has submitted the required paperwork, which can be useful in case of an audit or dispute. * Tracking progress: Confirmations help taxpayers track the status of their submitted paperwork, ensuring that it is being processed in a timely manner. * Reducing errors: By verifying receipt of paperwork, taxpayers can minimize errors and ensure that their submissions are accurate and complete.

📝 Note: It is essential to retain IRS receipt confirmations, as they may be required in case of an audit or to resolve any issues with the submitted paperwork.

Tips for Taxpayers

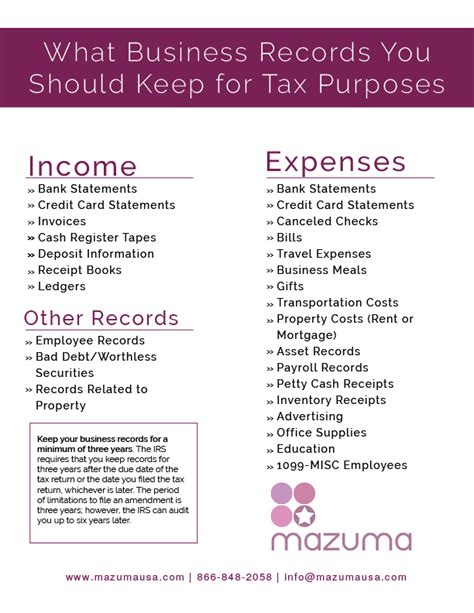

To ensure a smooth and efficient process, taxpayers should: * Verify IRS mailing addresses: Use the correct IRS mailing address to avoid delays or lost paperwork. * Use certified mail: Consider using certified mail or a trackable shipping method to ensure proof of delivery. * Keep records: Maintain accurate records of submitted paperwork, including confirmations and receipts. * Monitor online account activity: Regularly check the IRS online account for updates on submitted paperwork.

Common Issues and Solutions

Taxpayers may encounter issues with IRS receipt confirmations, such as: * Lost or missing confirmations: Contact the IRS to request a replacement confirmation or to verify receipt of submitted paperwork. * Incorrect or incomplete paperwork: Correct and resubmit the paperwork, ensuring that all required information is included. * Delays in processing: Check the IRS website for updates on processing times or contact the IRS to inquire about the status of submitted paperwork.

In summary, IRS receipt of paperwork confirmation is an essential aspect of the tax filing process. By understanding the different types of confirmations, how to obtain them, and what they mean, taxpayers can ensure a smooth and efficient experience. Retaining confirmations and maintaining accurate records can help reduce errors and provide proof of filing, making it easier to navigate the tax system.

To finalize, it is crucial for taxpayers to stay informed and up-to-date on IRS procedures and requirements. By doing so, they can avoid common issues and ensure that their paperwork is processed correctly. Whether filing electronically or by mail, taxpayers should always verify receipt of their submissions and retain confirmations for their records.

What is an IRS receipt confirmation, and why is it important?

+

An IRS receipt confirmation is proof that the IRS has received and is processing submitted paperwork. It is essential for taxpayers, as it provides proof of filing and helps track the status of submitted documents.

How do I obtain an IRS receipt confirmation for my tax return?

+

When e-filing, the IRS will automatically generate an electronic confirmation. For mailed returns, include a self-addressed, stamped envelope, and the IRS will return a confirmation letter or postcard.

What should I do if I lose my IRS receipt confirmation?

+

Contact the IRS to request a replacement confirmation or to verify receipt of submitted paperwork. It is also a good idea to maintain accurate records of submitted paperwork, including confirmations and receipts.