Paperwork

Mortgage Paperwork Required

Introduction to Mortgage Paperwork

When applying for a mortgage, it’s essential to understand the various documents and paperwork required to complete the process. The mortgage application process can be complex and time-consuming, but being prepared with the necessary paperwork can help streamline the procedure. In this article, we’ll delve into the world of mortgage paperwork, exploring the different types of documents you’ll need to provide and what to expect during the application process.

Types of Mortgage Paperwork

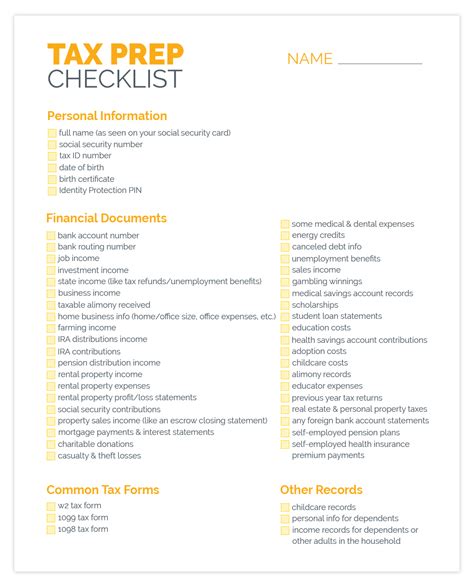

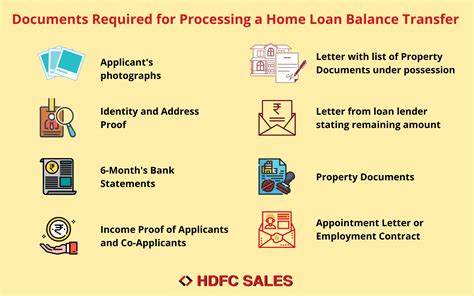

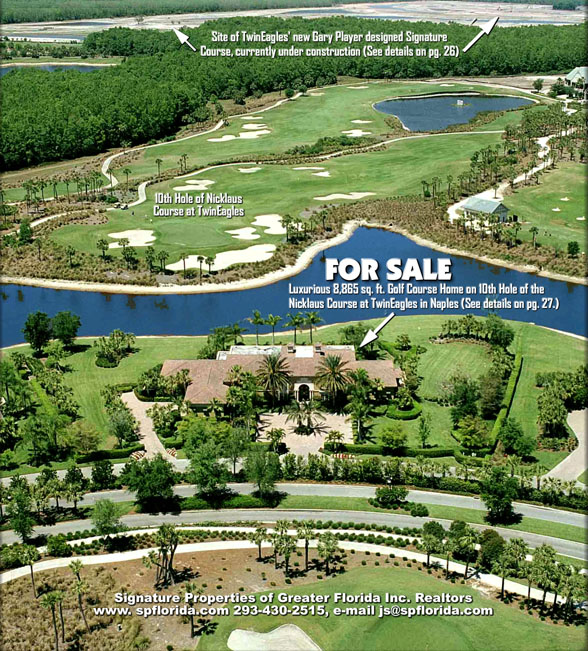

The mortgage paperwork required may vary depending on the lender, loan type, and your individual circumstances. However, there are some common documents that you’ll typically need to provide. These include: * Identification documents: Such as a valid passport, driver’s license, or state ID * Income verification: Pay stubs, W-2 forms, or tax returns to demonstrate your income * Employment verification: A letter from your employer confirming your employment status and income * Credit reports: The lender will typically pull your credit report to assess your creditworthiness * Bank statements: To verify your savings and checking account balances * Asset documentation: Such as investment accounts, retirement accounts, or other assets * Property information: Details about the property you’re purchasing, including the address, value, and any outstanding liens

Mortgage Application Process

The mortgage application process typically involves the following steps: * Pre-approval: You’ll provide basic financial information to the lender, and they’ll provide a pre-approval letter stating the amount they’re willing to lend you * Application: You’ll submit a formal mortgage application, providing detailed financial information and documentation * Processing: The lender will review your application, verify your information, and order an appraisal of the property * Underwriting: The lender will assess your creditworthiness and make a final decision on your mortgage application * Closing: You’ll sign the final loan documents, and the lender will disburse the funds

Additional Documentation

Depending on your circumstances, you may need to provide additional documentation, such as: * Divorce or separation agreements: If you’re divorced or separated, you may need to provide documentation of your divorce or separation agreement * Bankruptcy or foreclosure documents: If you’ve experienced bankruptcy or foreclosure, you may need to provide documentation of the discharge or settlement * Gift letters: If you’re using a gift from a family member or friend for your down payment, you’ll need to provide a gift letter explaining the source of the funds

📝 Note: It's essential to provide accurate and complete documentation to avoid delays in the mortgage application process.

Organizing Your Mortgage Paperwork

To ensure a smooth mortgage application process, it’s crucial to organize your paperwork efficiently. Consider using a checklist to keep track of the documents you need to provide. You can also scan or photocopy your documents to create digital or physical copies, making it easier to access and share them with your lender.

| Document Type | Description |

|---|---|

| Identification | Valid passport, driver's license, or state ID |

| Income Verification | Pay stubs, W-2 forms, or tax returns |

| Employment Verification | Letter from employer confirming employment status and income |

Conclusion and Final Thoughts

In conclusion, the mortgage paperwork required can seem overwhelming, but being prepared and understanding the process can help make it more manageable. By gathering the necessary documents, organizing your paperwork, and providing accurate information, you can increase your chances of a successful mortgage application. Remember to stay patient and flexible throughout the process, and don’t hesitate to ask your lender if you have any questions or concerns.

What is the typical turnaround time for a mortgage application?

+

The typical turnaround time for a mortgage application can vary depending on the lender and the complexity of the application, but it usually takes around 30-60 days.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications, allowing you to submit your application and upload required documents digitally.

What is the difference between pre-approval and pre-qualification?

+

Pre-qualification is an initial assessment of your creditworthiness, while pre-approval is a more formal evaluation of your financial situation, providing a clearer picture of your borrowing power.