7 Tips Tax Papers

Introduction to Tax Papers

When it comes to handling tax papers, it’s essential to stay organized and informed to avoid any potential issues with the tax authorities. Tax papers encompass a wide range of documents, including tax returns, receipts, invoices, and more. Proper management of these documents is crucial for both individuals and businesses. In this article, we will explore seven tips for managing tax papers effectively, ensuring compliance with tax laws and regulations.

Understanding Tax Papers

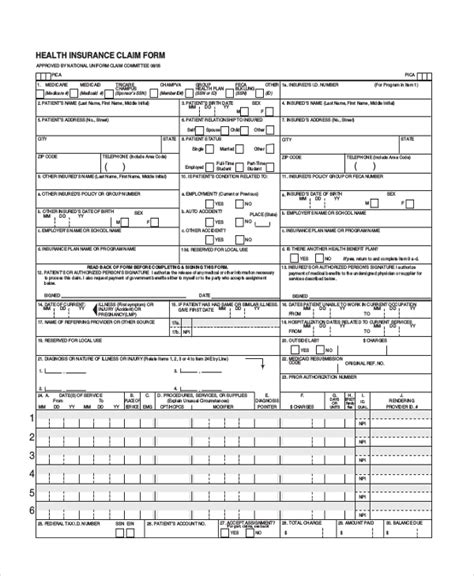

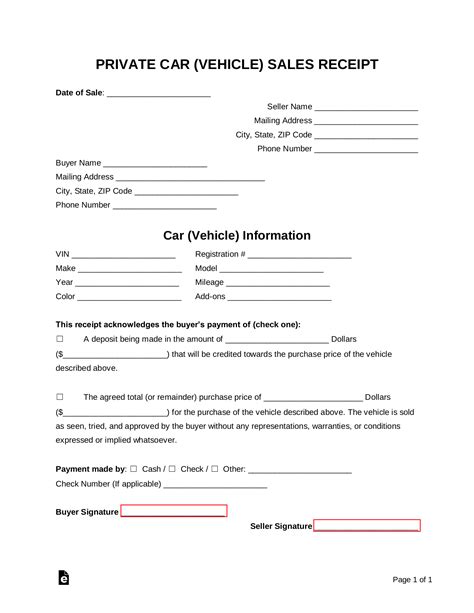

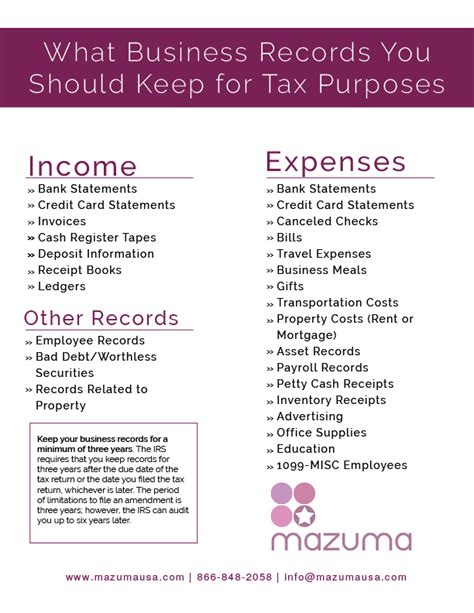

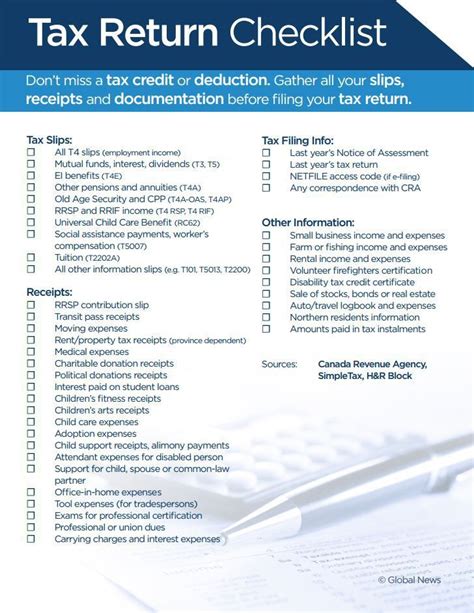

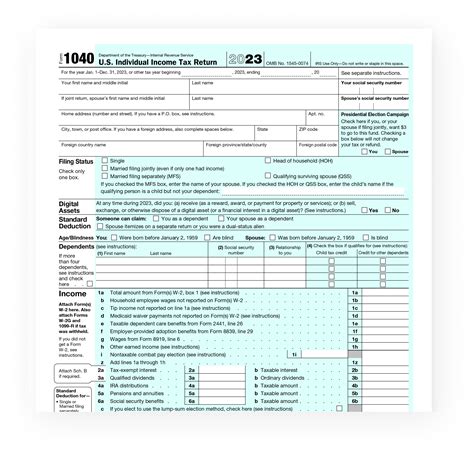

Tax papers are documents that contain information about an individual’s or business’s income, expenses, and tax liabilities. These papers are used by tax authorities to assess and collect taxes. Accurate and detailed records are vital for filing tax returns and for audits. Tax papers include, but are not limited to, W-2 forms, 1099 forms, receipts for deductible expenses, and records of charitable donations.

Tip 1: Keep Accurate Records

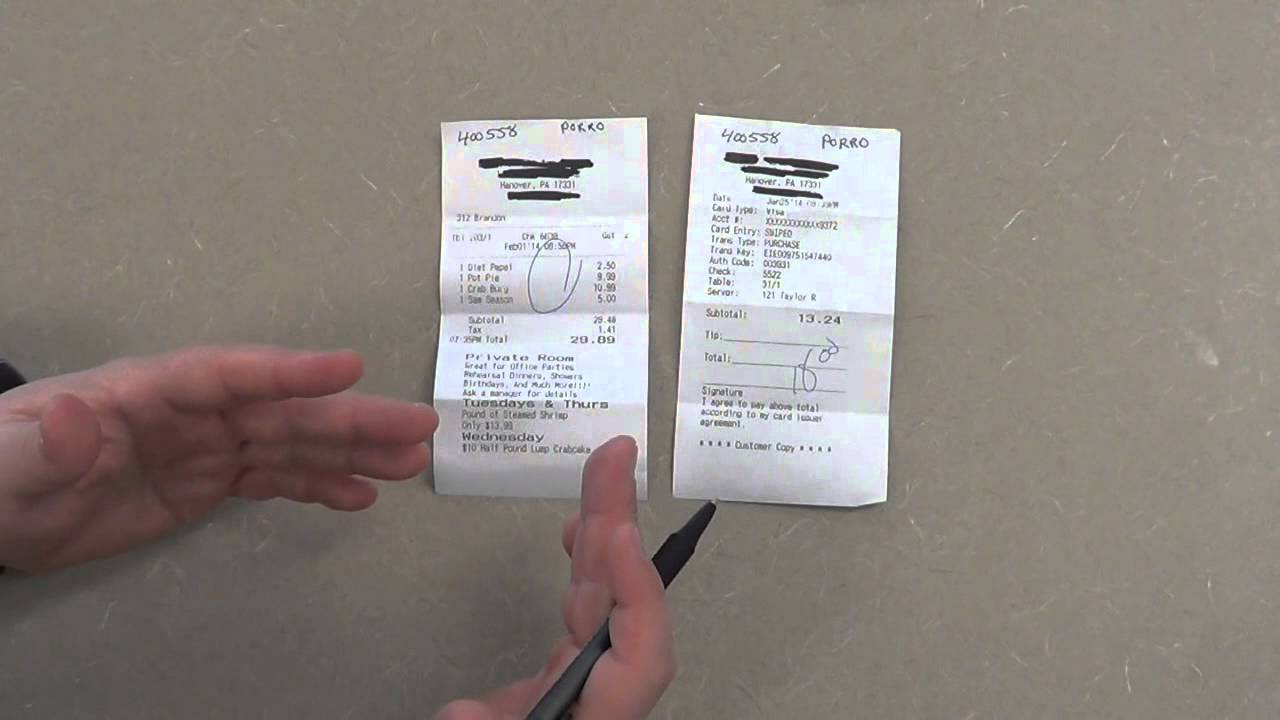

Keeping accurate and detailed records is the foundation of effective tax paper management. This includes maintaining a record of all income, expenses, and tax-related documents throughout the year. Utilizing a digital tool or a physical folder to keep track of these documents can help ensure that nothing is misplaced or forgotten.

Tip 2: Organize Digitally

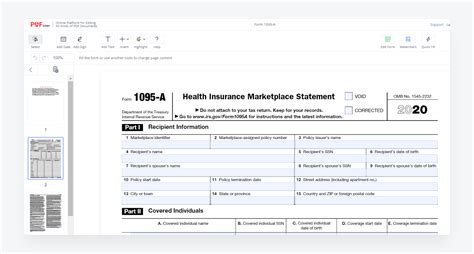

In today’s digital age, digital organization is more convenient than ever. Consider scanning physical documents and storing them digitally. Tools like cloud storage services can provide a secure and accessible place to store tax papers. Additionally, many tax preparation software programs offer digital storage for tax-related documents.

Tip 3: Use a Filing System

Implementing a filing system for tax papers can significantly reduce stress and increase efficiency when it’s time to file taxes. This can be as simple as creating separate folders for different types of documents (e.g., income, expenses, deductions) or using a more complex system tailored to specific needs.

Tip 4: Stay Informed About Tax Law Changes

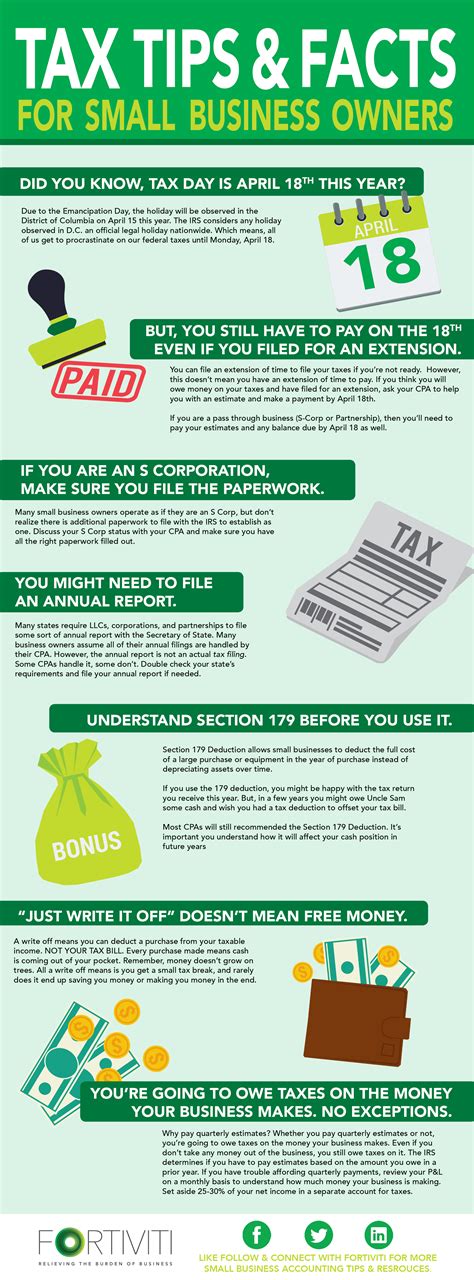

Tax laws and regulations change frequently, and staying informed about these changes is crucial for compliance. Following reputable tax news sources or consulting with a tax professional can help individuals and businesses understand how changes in tax law might affect their tax obligations.

Tip 5: Secure Your Documents

Given the sensitive nature of tax papers, security is a top priority. Whether documents are stored physically or digitally, they should be protected from unauthorized access. For physical documents, a safe or a locked cabinet can provide adequate protection. For digital documents, strong passwords, two-factor authentication, and encryption are recommended.

Tip 6: Consider Professional Help

For many, especially those with complex tax situations, seeking professional help can be incredibly beneficial. Tax professionals can provide guidance on tax preparation, help navigate complex tax laws, and ensure that all possible deductions are claimed.

Tip 7: Review and Update Regularly

Finally, regular review and updates of tax papers are essential. This involves periodically checking for any errors or discrepancies in the records and ensuring that all documents are up-to-date. This practice can help identify and resolve any issues before they become major problems.

📝 Note: Always ensure that your tax papers are compliant with the current tax laws and regulations, and consider seeking professional advice if you're unsure about any aspect of your tax obligations.

In summary, managing tax papers effectively is about being organized, informed, and proactive. By keeping accurate records, organizing digitally, using a filing system, staying informed about tax law changes, securing documents, considering professional help, and reviewing and updating regularly, individuals and businesses can ensure they are well-prepared for tax season and any potential audits. Effective tax paper management not only reduces the risk of errors and penalties but also helps in maximizing deductions and refunds, ultimately leading to better financial health.

What are the most common types of tax papers?

+

The most common types of tax papers include W-2 forms, 1099 forms, receipts for deductible expenses, and records of charitable donations.

How long should I keep my tax papers?

+

It’s generally recommended to keep tax papers for at least three years from the date of filing, but this can vary depending on the specific circumstances of your tax situation.

Can I store my tax papers digitally?

+

Yes, storing tax papers digitally is a convenient and secure way to manage your documents. Consider using cloud storage services or tax preparation software that offers digital storage.