Paperwork

Manage Medical Insurance Paperwork Easily

Introduction to Medical Insurance Paperwork

Managing medical insurance paperwork can be a daunting task, especially for those who are not familiar with the process. With the numerous forms, bills, and statements that come with medical insurance, it’s easy to get overwhelmed and lose track of important documents. However, with the right approach and tools, managing medical insurance paperwork can be made easier and less stressful. In this article, we will explore the ways to manage medical insurance paperwork easily and efficiently.

Understanding Medical Insurance Paperwork

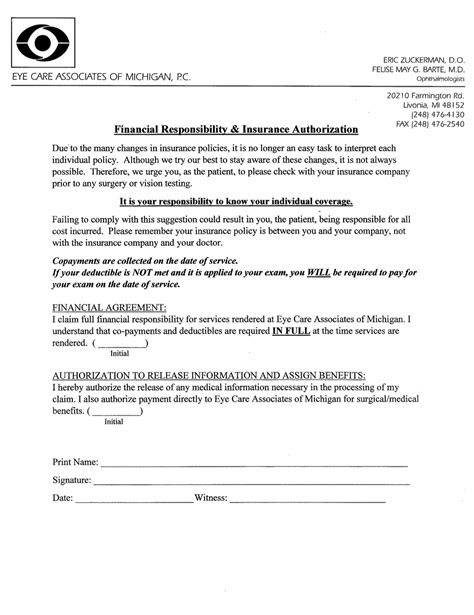

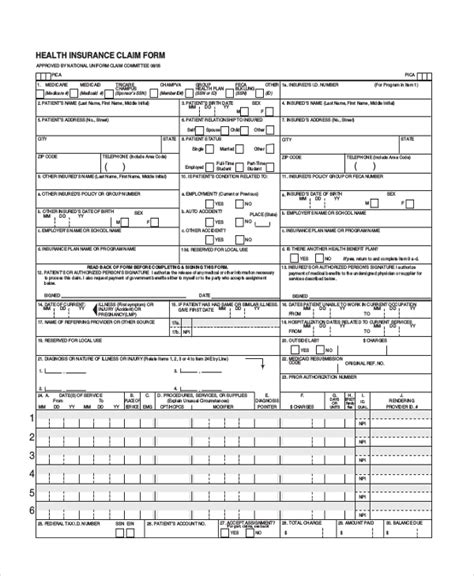

Before we dive into the ways to manage medical insurance paperwork, it’s essential to understand the different types of documents that are involved in the process. These include: * Insurance claims: These are forms submitted to the insurance company to request reimbursement for medical expenses. * Explanation of Benefits (EOB): This is a statement sent by the insurance company to the policyholder, explaining what benefits were paid and what the policyholder owes. * Medical bills: These are invoices sent by healthcare providers to the policyholder, detailing the costs of medical services received. * Policy documents: These are documents that outline the terms and conditions of the insurance policy, including coverage, deductibles, and copays.

Organizing Medical Insurance Paperwork

To manage medical insurance paperwork easily, it’s crucial to have a system in place for organizing and storing documents. Here are some tips: * Create a dedicated folder for medical insurance paperwork, where all relevant documents can be stored. * Use labels and categories to categorize documents, such as claims, EOBs, bills, and policy documents. * Consider digitizing documents by scanning and saving them to a computer or cloud storage service, to reduce clutter and make it easier to access documents. * Set up a reminder system to track deadlines for submitting claims, paying bills, and following up on pending issues.

Streamlining the Claims Process

The claims process can be a significant source of stress and frustration when dealing with medical insurance paperwork. Here are some tips to streamline the claims process: * Submit claims electronically, if possible, to reduce paperwork and speed up processing times. * Keep accurate records of medical expenses, including receipts, invoices, and statements. * Follow up with the insurance company regularly to check on the status of pending claims. * Consider working with a claims advocate or patient advocate to help navigate the claims process and resolve any issues that may arise.

Using Technology to Manage Medical Insurance Paperwork

Technology can be a powerful tool in managing medical insurance paperwork. Here are some ways to leverage technology: * Use online portals provided by insurance companies to submit claims, check claims status, and access policy documents. * Take advantage of mobile apps that allow you to track medical expenses, submit claims, and access insurance information on-the-go. * Consider using a personal health record (PHR) system to store and manage medical records, including insurance information and claims history.

Best Practices for Managing Medical Insurance Paperwork

To manage medical insurance paperwork effectively, here are some best practices to follow: * Stay organized and keep all relevant documents in one place. * Keep track of deadlines and follow up regularly on pending issues. * Communicate clearly with healthcare providers and insurance companies to avoid misunderstandings and errors. * Review and understand policy documents and explanations of benefits to ensure you’re aware of what’s covered and what’s not.

📝 Note: It's essential to keep accurate and detailed records of medical expenses and insurance correspondence to avoid disputes and ensure smooth claims processing.

Conclusion and Final Thoughts

In conclusion, managing medical insurance paperwork requires a systematic approach, attention to detail, and a willingness to leverage technology and best practices. By following the tips and strategies outlined in this article, you can simplify the process, reduce stress, and ensure that you’re getting the most out of your medical insurance coverage. Remember to stay organized, keep track of deadlines, and communicate clearly with healthcare providers and insurance companies. With the right approach, managing medical insurance paperwork can be made easier and less overwhelming.

What is an Explanation of Benefits (EOB)?

+

An Explanation of Benefits (EOB) is a statement sent by the insurance company to the policyholder, explaining what benefits were paid and what the policyholder owes.

How can I submit claims electronically?

+

Check with your insurance company to see if they offer online claims submission. You may be able to submit claims through their website or mobile app.

What is a personal health record (PHR) system?

+

A personal health record (PHR) system is a digital platform that allows you to store and manage your medical records, including insurance information and claims history.