5 Payment Paperwork Terms

Understanding Payment Paperwork Terms

When dealing with financial transactions, whether personal or professional, it’s essential to have a grasp of common payment paperwork terms. These terms are crucial for navigating contracts, invoices, and other financial documents with clarity. In this article, we’ll delve into five key payment paperwork terms that everyone should know.

1. Invoice

An invoice is a document that outlines the goods or services provided, along with their costs, and is used to request payment from the buyer. Invoices include essential details such as the invoice number, date, billing information, a list of goods or services with their respective prices, subtotal, tax (if applicable), and the total amount due. Understanding invoices is vital for both businesses and individuals to manage their finances effectively.

2. Receipt

A receipt is a document acknowledging that a payment has been made. It serves as proof of transaction and is usually provided by the seller to the buyer after the payment has been processed. Receipts can be in the form of a paper document or a digital record. They are crucial for record-keeping and can be used for tax purposes, warranties, or returns.

3. Bill of Sale

A bill of sale is a document that verifies the transfer of ownership of goods from a seller to a buyer. It is commonly used in real estate transactions and the sale of vehicles but can apply to any transfer of goods. The bill of sale includes details about the goods being sold, the price, and the parties involved. It acts as a receipt and also as proof that the ownership has been transferred.

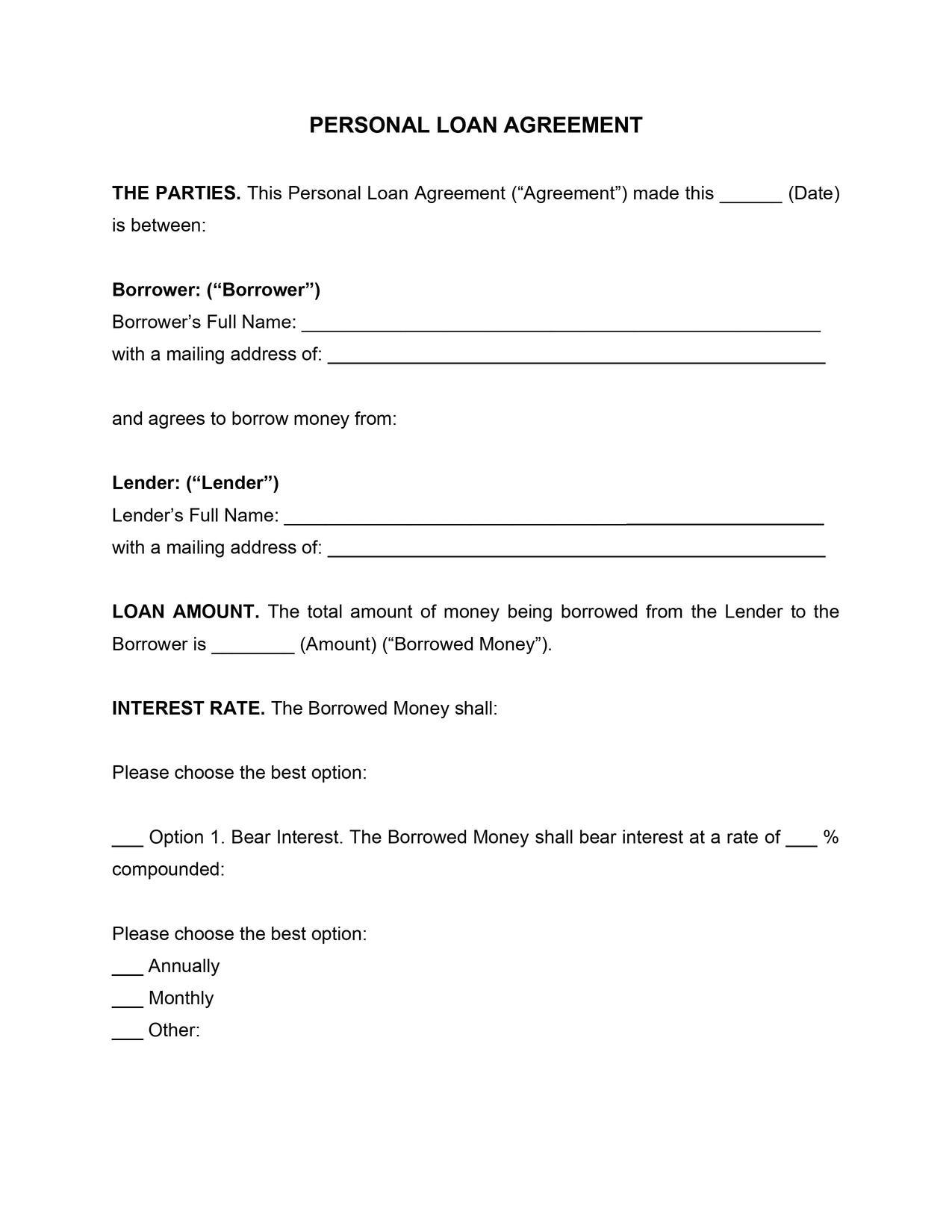

4. Promissory Note

A promissory note is a financial instrument that contains a written promise by one party (the issuer or maker) to pay another party (the payee) a definite sum of money, either on demand or at a specified future date. It is essentially an IOU that includes the amount to be paid, the interest rate (if any), the repayment terms, and the maturity date. Promissory notes are used for personal and business loans and can be secured or unsecured.

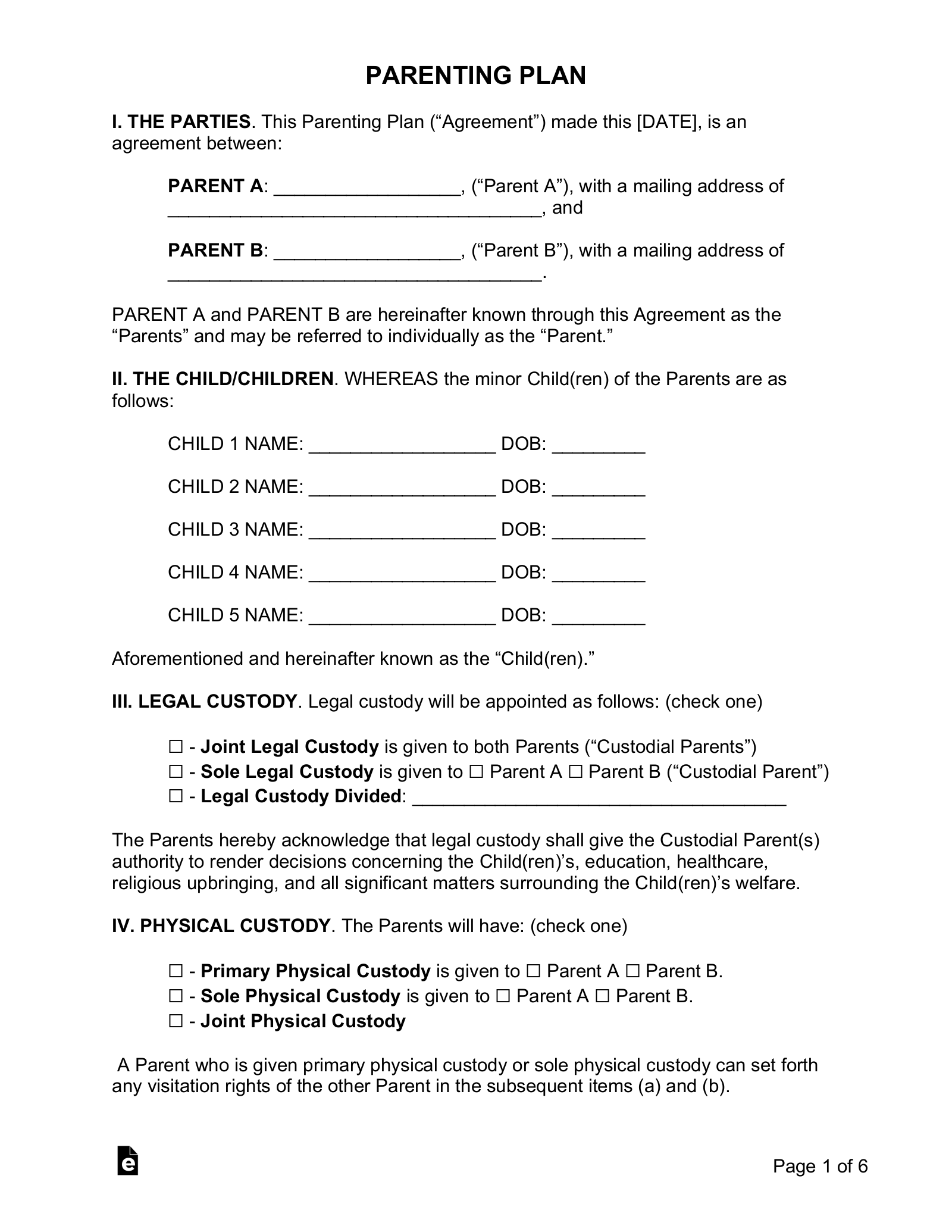

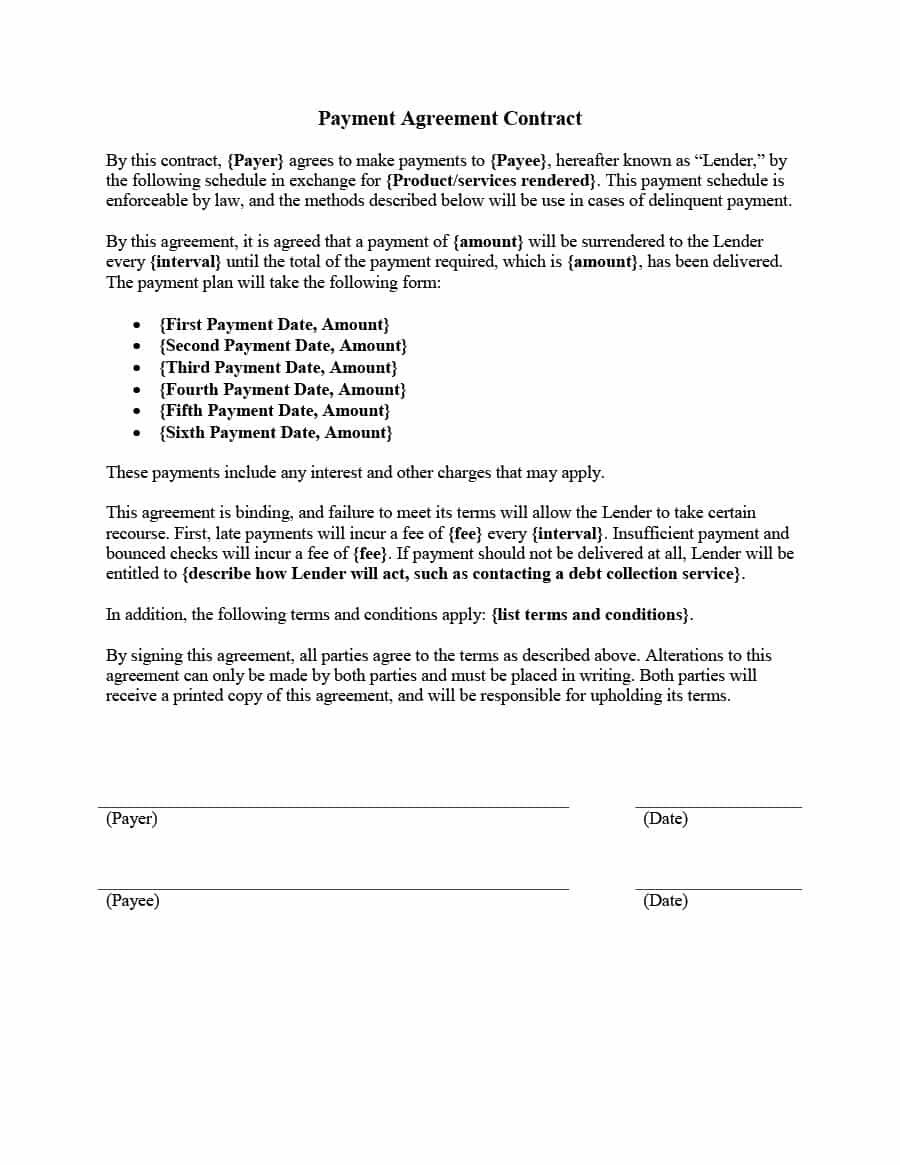

5. Payment Plan

A payment plan is an agreement between a debtor and a creditor that outlines a schedule for the debtor to make payments towards an outstanding debt. This plan can be negotiated directly between the parties or may be mandated by a court. A payment plan typically includes the total amount owed, the amount of each payment, the frequency of payments (e.g., monthly), and the duration of the payment period. It’s a flexible way for debtors to manage their debts without facing immediate legal action.

📝 Note: When entering into any financial agreement, it's crucial to read and understand all the terms before signing. This includes knowing your rights, the total cost of the credit, and any penalties for late payments.

In summary, understanding these payment paperwork terms is vital for navigating financial transactions smoothly. Whether you’re a business owner, an accountant, or an individual, familiarity with invoices, receipts, bills of sale, promissory notes, and payment plans can help you manage your finances more effectively and avoid potential disputes or misunderstandings.

What is the main difference between an invoice and a receipt?

+

An invoice is a request for payment, while a receipt is proof that a payment has been made.

Why is a bill of sale important?

+

A bill of sale serves as proof of the transfer of ownership and can protect both the buyer and the seller in case of disputes.

What is the purpose of a promissory note?

+

A promissory note is used to make a formal promise to repay a loan, providing a clear agreement between the lender and the borrower.