5 Bankruptcy Paper Tips

Understanding the Bankruptcy Process

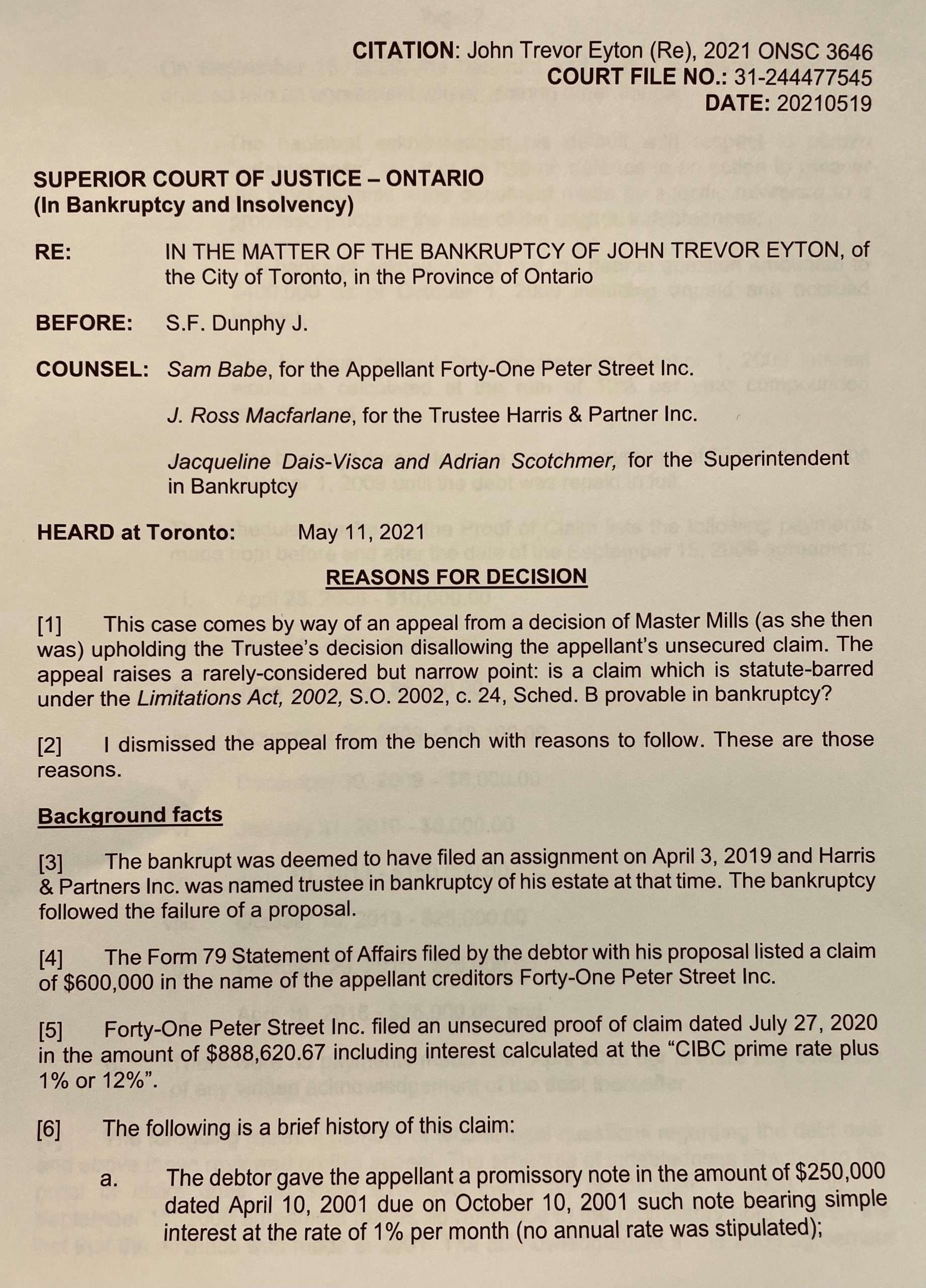

When facing financial difficulties, bankruptcy can be a viable option for individuals and businesses to regain control over their finances. The process involves submitting a petition to the court, which then oversees the distribution of assets and debts. However, navigating the complexities of bankruptcy requires careful planning and attention to detail. In this article, we will explore five essential tips for handling bankruptcy papers, ensuring a smoother and more successful process.

Tip 1: Gather All Necessary Documents

Before filing for bankruptcy, it is crucial to collect all relevant financial documents, including: * Income statements * Expense reports * Asset valuations * Debt lists * Tax returns Having these documents in order will facilitate the filing process and help ensure that all information is accurate and up-to-date. Organizing these papers can be a daunting task, but it is essential for a successful bankruptcy filing.

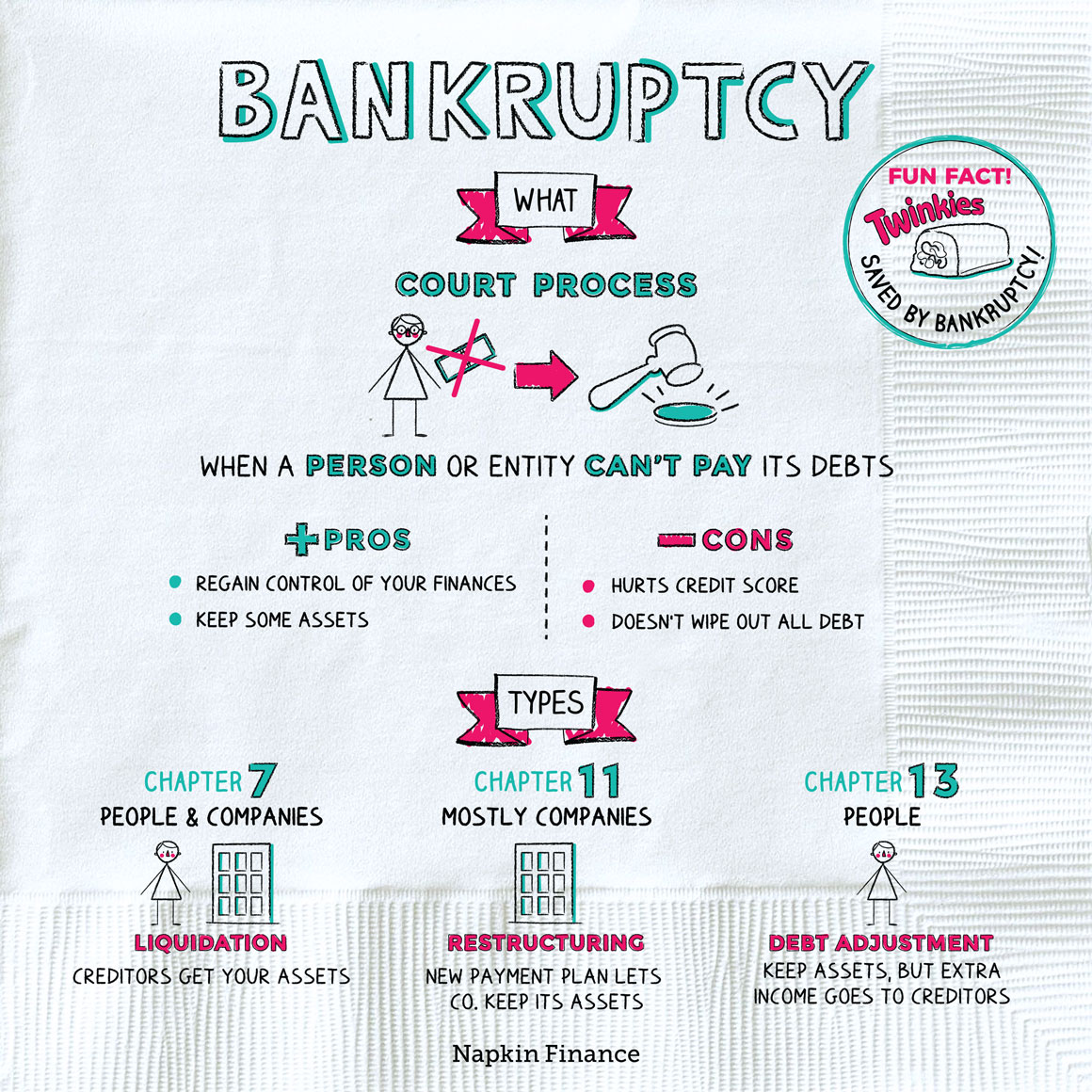

Tip 2: Choose the Correct Bankruptcy Chapter

There are several types of bankruptcy, each with its own specific requirements and benefits. The most common chapters are: * Chapter 7: Liquidation bankruptcy, which involves selling assets to pay off debts * Chapter 11: Reorganization bankruptcy, which allows businesses to restructure debts and continue operations * Chapter 13: Personal reorganization bankruptcy, which enables individuals to create a repayment plan Selecting the right chapter is vital, as it will impact the outcome of the bankruptcy process. Seeking professional advice can help individuals and businesses make an informed decision.

Tip 3: Complete Accurate and Detailed Forms

Bankruptcy forms are complex and require precise information. Incomplete or inaccurate forms can lead to delays or even dismissal of the case. It is essential to: * Fill out forms carefully and thoroughly * Ensure all information is accurate and up-to-date * Review forms multiple times for errors or omissions Using online resources or consulting with a bankruptcy attorney can help ensure that forms are completed correctly.

Tip 4: Submit Forms on Time

Meeting deadlines is critical in the bankruptcy process. Failing to submit forms on time can result in: * Delayed or dismissed cases * Additional fees and penalties * Loss of assets or privileges Creating a timeline and setting reminders can help individuals and businesses stay on track and avoid missing important deadlines.

Tip 5: Seek Professional Guidance

The bankruptcy process can be overwhelming, especially for those without experience. Seeking professional guidance from a qualified bankruptcy attorney can: * Ensure accurate and complete forms * Provide valuable advice on navigating the process * Help individuals and businesses make informed decisions A bankruptcy attorney can offer expert knowledge and support, making the process less stressful and more successful.

💡 Note: It is essential to carefully review and understand all bankruptcy papers before submitting them to the court.

In the end, handling bankruptcy papers requires attention to detail, careful planning, and a thorough understanding of the process. By following these five tips, individuals and businesses can navigate the complexities of bankruptcy and regain control over their finances. The key to a successful bankruptcy filing lies in being well-prepared, seeking professional guidance, and staying informed throughout the process.

What are the main types of bankruptcy?

+

The main types of bankruptcy are Chapter 7, Chapter 11, and Chapter 13. Each type has its own specific requirements and benefits, and the right choice depends on individual or business circumstances.

How long does the bankruptcy process take?

+

The length of the bankruptcy process varies depending on the type of bankruptcy and individual circumstances. Generally, Chapter 7 bankruptcies take around 4-6 months, while Chapter 13 bankruptcies can take 3-5 years.

Will bankruptcy affect my credit score?

+

Yes, bankruptcy can significantly affect your credit score. However, the impact can be mitigated by rebuilding credit over time through responsible financial practices and seeking professional guidance.