Paperwork

Get Tesla Tax Paperwork Easily

Introduction to Tesla Tax Benefits

Owning a Tesla can be a thrilling experience, not just because of its exceptional performance and innovative technology, but also due to the potential tax benefits that come with it. The U.S. government offers incentives to encourage the adoption of electric vehicles (EVs), and Tesla owners can take advantage of these incentives to reduce their tax liability. In this article, we will guide you through the process of obtaining Tesla tax paperwork easily and highlight the key benefits of owning an electric vehicle.

Understanding Tesla Tax Credits

The federal government provides a tax credit of up to $7,500 for the purchase of a qualified electric vehicle, such as a Tesla. This credit is designed to offset the higher cost of EVs compared to traditional gas-powered vehicles. To qualify for the credit, the vehicle must meet certain requirements, including: * The vehicle must be a four-wheeled vehicle. * The vehicle must be powered solely by electricity. * The vehicle must have a gross vehicle weight rating of less than 14,000 pounds. * The vehicle must be used primarily for personal use.

Steps to Obtain Tesla Tax Paperwork

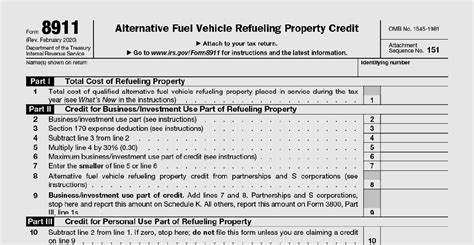

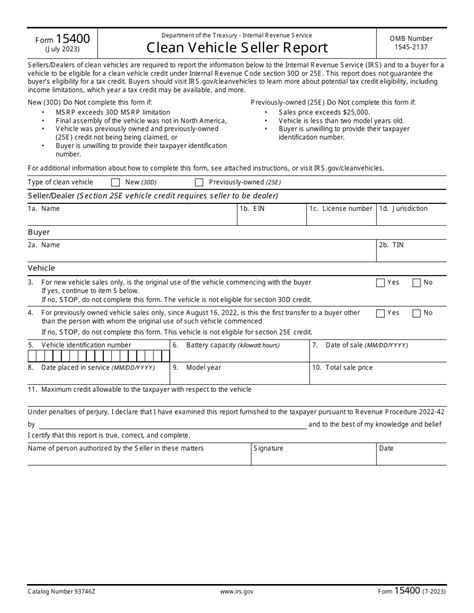

To claim the Tesla tax credit, you will need to obtain the necessary paperwork and follow these steps: * Purchase a qualified Tesla vehicle: Ensure that the vehicle you purchase meets the requirements for the tax credit. * Obtain a Manufacturer’s Certification: The manufacturer (in this case, Tesla) must certify that the vehicle meets the requirements for the tax credit. * Complete Form 8936: You will need to complete Form 8936, which is used to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit. * Attach the required documentation: You will need to attach the Manufacturer’s Certification and any other required documentation to your tax return.

Types of Tesla Tax Credits

There are two types of tax credits available for Tesla owners: * Federal Tax Credit: The federal government offers a tax credit of up to $7,500 for the purchase of a qualified electric vehicle. * State and Local Tax Credits: Some states and local governments offer additional tax credits for the purchase of an electric vehicle. These credits can range from a few hundred to several thousand dollars.

Benefits of Tesla Tax Credits

The Tesla tax credits offer several benefits, including: * Reduced tax liability: The tax credits can help reduce your tax liability, resulting in a lower tax bill. * Increased savings: The tax credits can help you save money on your vehicle purchase, making electric vehicles more affordable. * Environmental benefits: Electric vehicles produce zero tailpipe emissions, reducing air pollution and greenhouse gas emissions.

Table of Tesla Models and Tax Credits

The following table shows the Tesla models that are eligible for the federal tax credit and the amount of the credit:

| Tesla Model | Federal Tax Credit |

|---|---|

| Tesla Model 3 | up to 7,500</td> </tr> <tr> <td>Tesla Model S</td> <td>up to 7,500 |

| Tesla Model X | up to 7,500</td> </tr> <tr> <td>Tesla Model Y</td> <td>up to 7,500 |

💡 Note: The tax credits are subject to change, and not all Tesla models may be eligible for the full credit amount.

Conclusion and Final Thoughts

In conclusion, owning a Tesla can come with significant tax benefits, including the potential to claim a tax credit of up to $7,500. By following the steps outlined in this article and obtaining the necessary paperwork, you can easily claim your Tesla tax credit and enjoy the benefits of owning an electric vehicle. Remember to always consult with a tax professional to ensure you are eligible for the credit and to guide you through the process.

What is the federal tax credit for Tesla owners?

+

The federal tax credit for Tesla owners is up to $7,500 for the purchase of a qualified electric vehicle.

Which Tesla models are eligible for the federal tax credit?

+

All Tesla models, including the Model 3, Model S, Model X, and Model Y, are eligible for the federal tax credit.

How do I claim the Tesla tax credit?

+

To claim the Tesla tax credit, you will need to complete Form 8936 and attach the required documentation to your tax return.