5 Tips On Payment

Introduction to Payment Systems

When it comes to making payments, whether online or offline, there are numerous options available to consumers. The rise of digital payment systems has transformed the way we make transactions, offering convenience, speed, and security. However, with so many payment methods to choose from, it can be overwhelming to decide which one to use. In this article, we will explore five tips on payment systems, highlighting the benefits and drawbacks of each, to help you make informed decisions about your financial transactions.

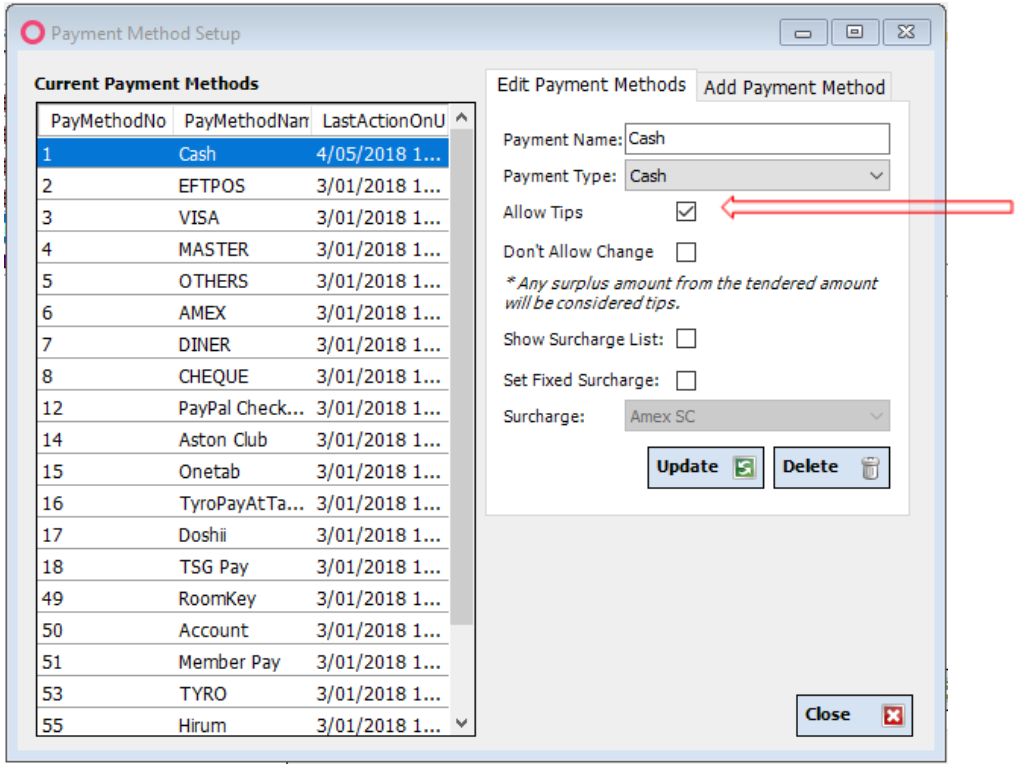

Tip 1: Understand the Fees Associated with Each Payment Method

Different payment methods come with varying fees, which can add up quickly. Credit cards, for example, often charge interest rates, late fees, and foreign transaction fees. Debit cards, on the other hand, may have lower fees, but you need to be mindful of overdraft charges. Digital payment systems like PayPal, Apple Pay, and Google Pay may charge transaction fees, especially for cross-border payments. It’s essential to read the fine print and understand the fees associated with each payment method to avoid unexpected charges.

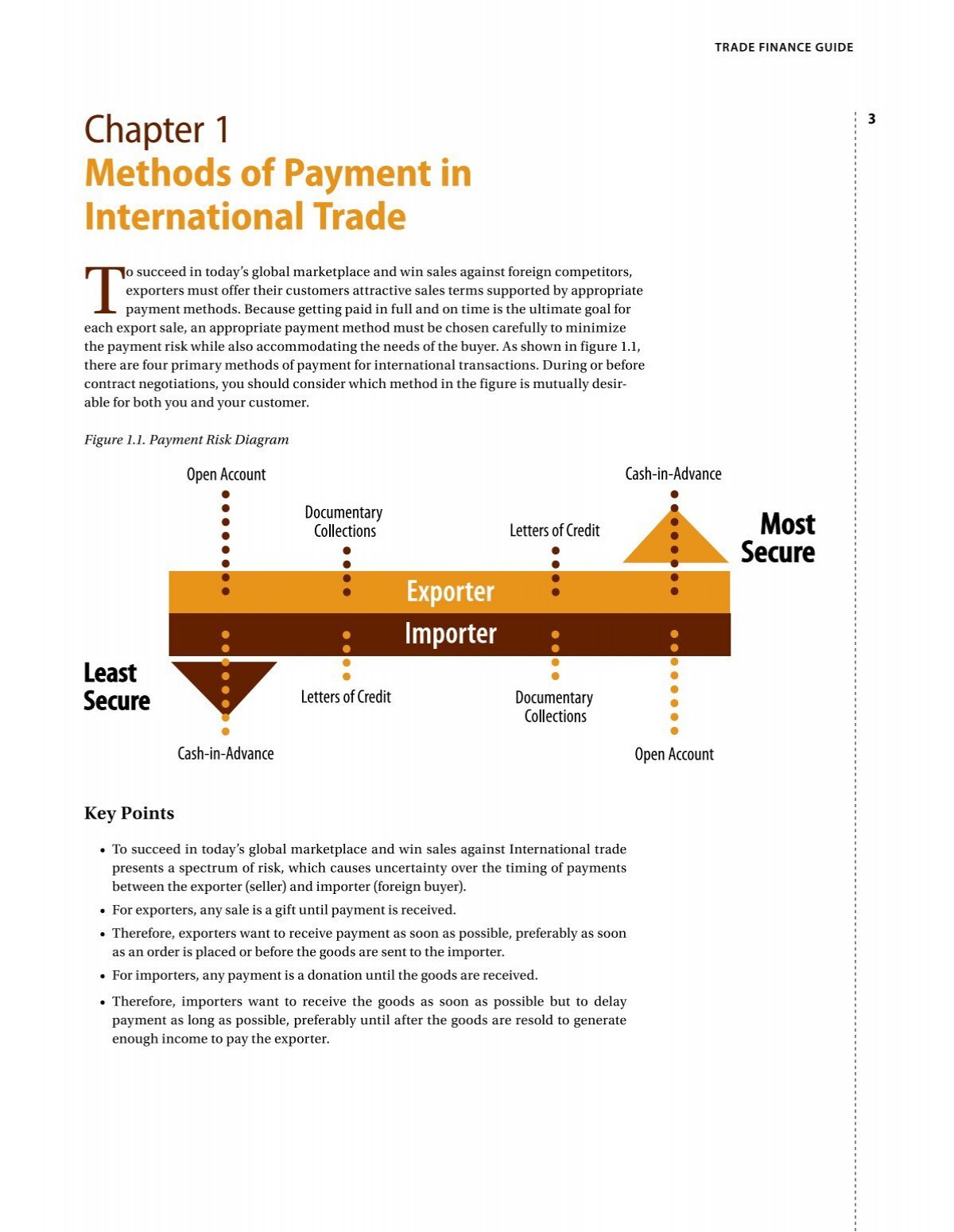

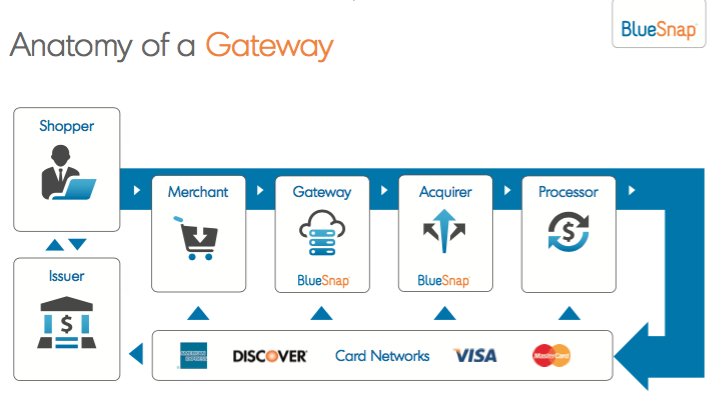

Tip 2: Consider the Security of Each Payment Method

Security is a top priority when making payments. Cash is the most straightforward payment method, but it’s not always convenient and can be lost or stolen. Credit cards offer robust security features, such as zero-liability policies and fraud protection. Digital payment systems use encryption and two-factor authentication to secure transactions. However, phishing scams and data breaches can still occur. To minimize risks, it’s crucial to use strong passwords, enable two-factor authentication, and monitor your accounts regularly.

Tip 3: Evaluate the Convenience of Each Payment Method

Convenience is a significant factor in choosing a payment method. Contactless payments like Apple Pay, Google Pay, and Samsung Pay offer a seamless payment experience, allowing you to make transactions with just a tap of your device. Mobile wallets like PayPal and Venmo enable you to send and receive money quickly and easily. Online payment systems like Stripe and Square offer streamlined checkout processes, reducing friction and increasing conversion rates. Consider the ease of use, speed, and availability of each payment method to determine which one best fits your needs.

Tip 4: Look into the Rewards and Benefits of Each Payment Method

Many payment methods offer rewards and benefits that can help you earn points, miles, or cashback. Credit cards often provide sign-up bonuses, rewards programs, and travel insurance. Digital payment systems like PayPal and Apple Pay offer rewards programs, such as cashback and discounts. Debit cards may offer rewards programs, but these are less common. Consider the rewards structure, earning potential, and redemption options to maximize your benefits.

Tip 5: Consider the Acceptance of Each Payment Method

Finally, it’s essential to consider the acceptance of each payment method. Cash is widely accepted, but digital payment systems may not be accepted everywhere. Credit cards are widely accepted, but American Express may not be accepted at all merchants. Debit cards are widely accepted, but international transactions may incur additional fees. Consider the acceptance rate, geographical limitations, and merchant support to ensure that your preferred payment method is widely accepted.

📝 Note: Always review the terms and conditions of each payment method to understand the fees, security features, and rewards programs associated with each.

In summary, when it comes to payment systems, it’s crucial to consider the fees, security, convenience, rewards, and acceptance of each method. By understanding the benefits and drawbacks of each payment method, you can make informed decisions about your financial transactions and choose the best option for your needs.

What is the most secure payment method?

+

Credit cards are generally considered the most secure payment method, as they offer robust security features, such as zero-liability policies and fraud protection.

What is the most convenient payment method?

+

Contactless payments, such as Apple Pay and Google Pay, are often considered the most convenient payment method, as they allow for seamless and quick transactions.

What is the best payment method for online transactions?

+

Paying with a credit card or a digital payment system, such as PayPal, is often the best option for online transactions, as they offer robust security features and protection against fraud.