Child Support Tax Paperwork Received

Understanding the Process

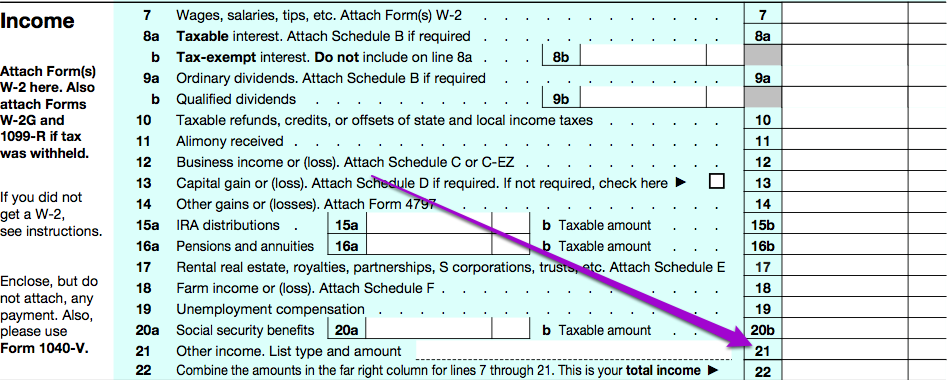

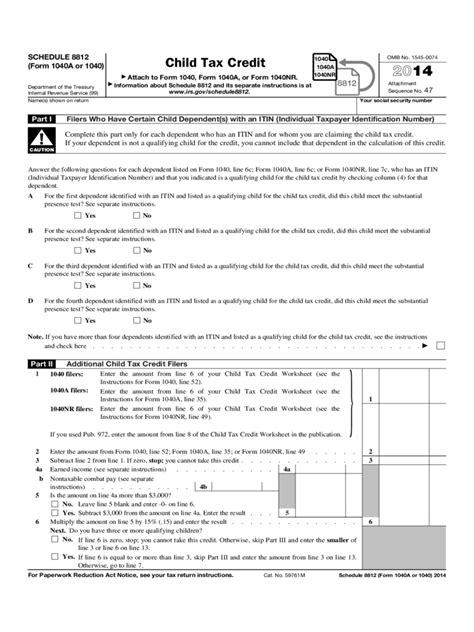

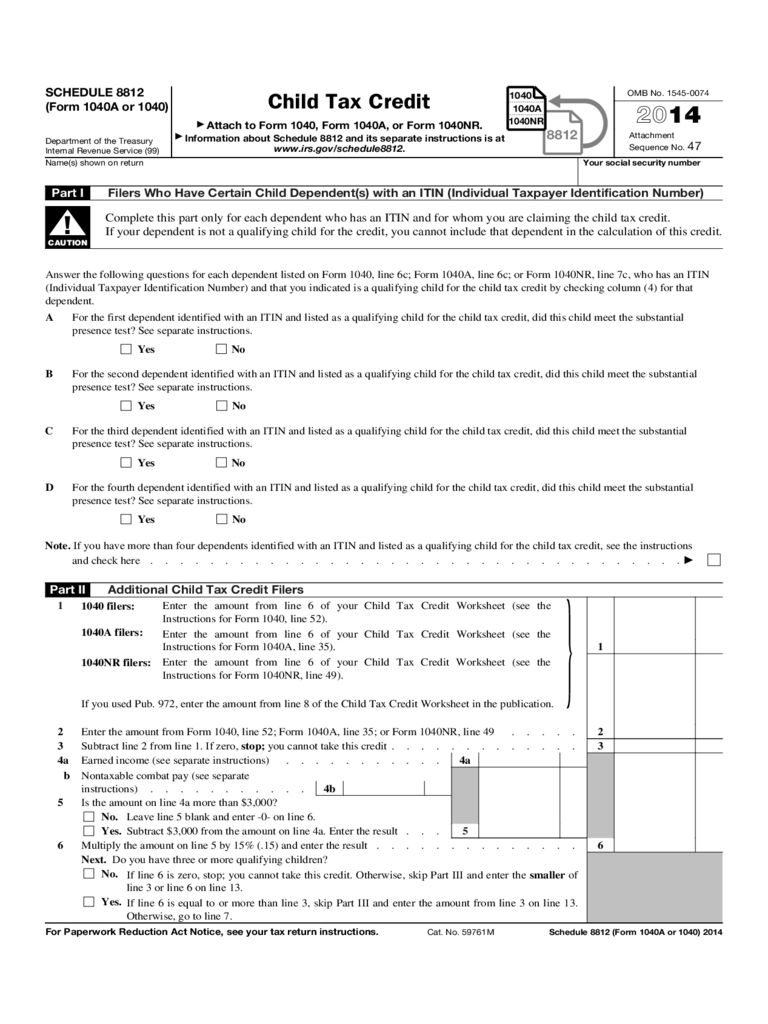

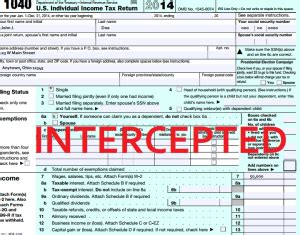

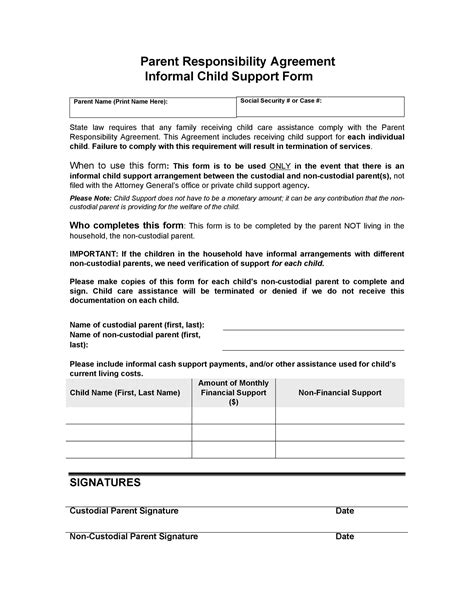

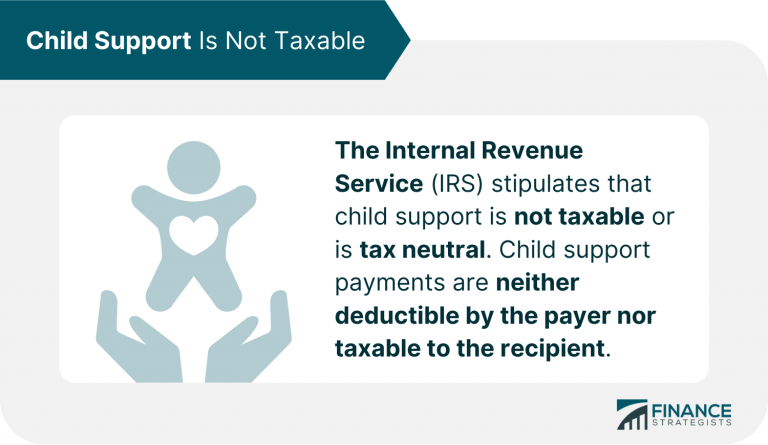

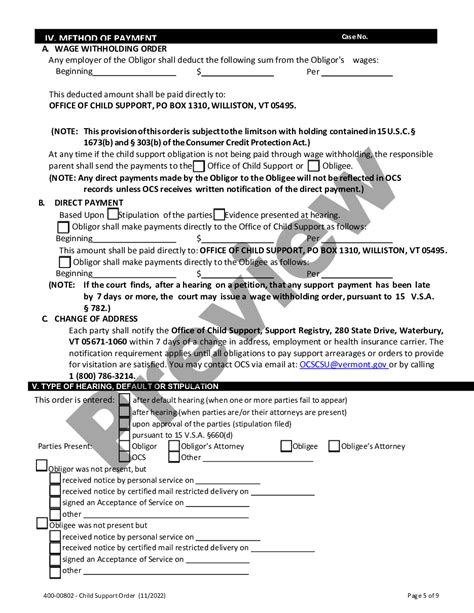

Receiving child support tax paperwork can be a confusing and overwhelming experience, especially for those who are not familiar with the process. The paperwork is typically sent by the state or local child support agency and contains important information about the child support case, including the amount of support owed, payment history, and any outstanding balances. It is essential to carefully review the paperwork to ensure that all information is accurate and up-to-date.

When receiving child support tax paperwork, it is crucial to read the documents carefully and understand the implications of the information provided. The paperwork may include details about the child support order, such as the amount of support owed, the frequency of payments, and any payment arrangements. It is also important to review the payment history to ensure that all payments have been made correctly and on time.

Types of Child Support Tax Paperwork

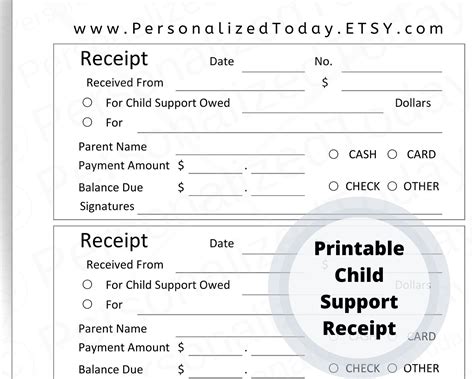

There are several types of child support tax paperwork that may be received, including: * Notice of Child Support Obligation: This document outlines the amount of child support owed and the payment schedule. * Child Support Payment Record: This document provides a record of all child support payments made, including the date and amount of each payment. * Notice of Past-Due Child Support: This document notifies the payer of any outstanding child support balances and may include information about late payment fees and interest.

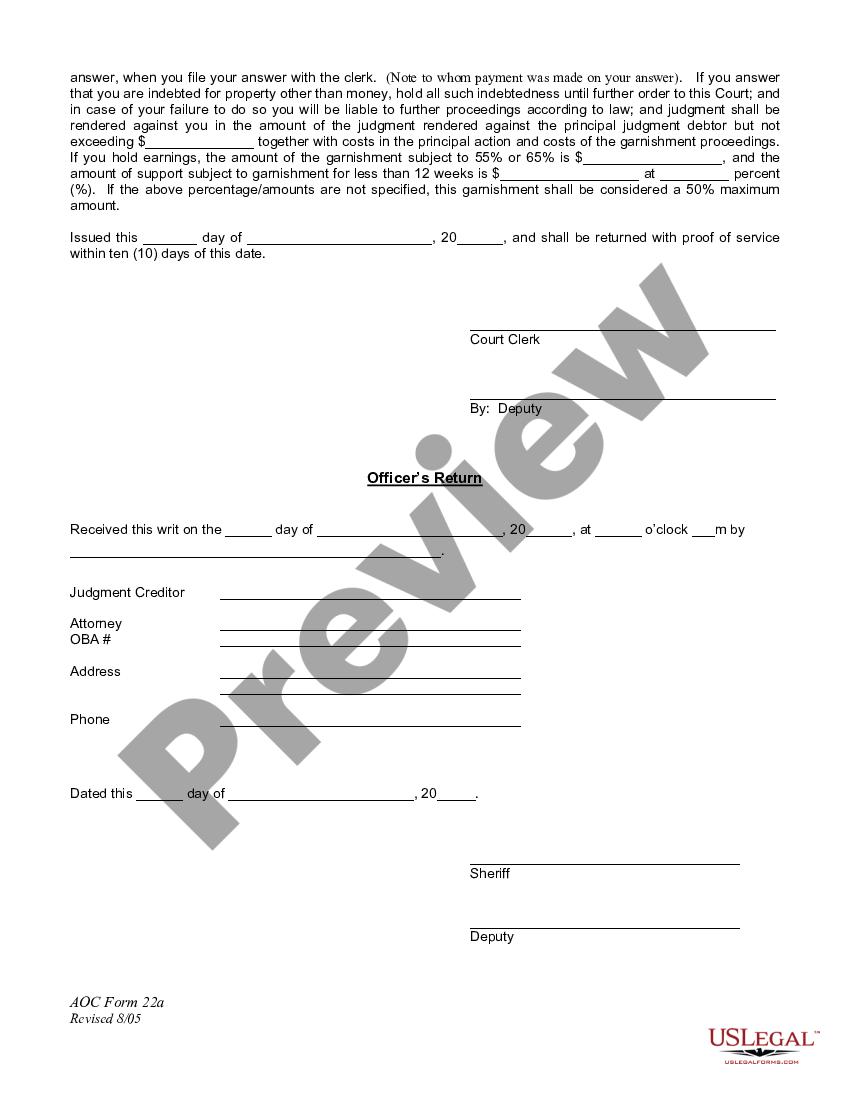

It is essential to respond promptly to any child support tax paperwork received, as failure to do so may result in further action being taken, such as wage garnishment or contempt of court. If there are any discrepancies or errors in the paperwork, it is crucial to contact the child support agency immediately to resolve the issue.

How to Handle Discrepancies

If there are any discrepancies or errors in the child support tax paperwork, it is essential to take immediate action to resolve the issue. This may include: * Contacting the child support agency to request a review of the case * Providing documentation to support any disputes or errors * Seeking the assistance of an attorney or advocate

💡 Note: It is crucial to keep accurate records of all child support payments and communications with the child support agency to ensure that any discrepancies or errors can be resolved efficiently.

Importance of Accurate Records

Maintaining accurate records of child support payments and communications with the child support agency is vital to ensuring that any discrepancies or errors can be resolved efficiently. This includes: * Keeping a record of all child support payments made, including the date and amount of each payment * Retaining copies of all child support tax paperwork and communications with the child support agency * Updating records regularly to ensure that all information is current and accurate

By maintaining accurate records and responding promptly to child support tax paperwork, individuals can ensure that their child support case is handled efficiently and effectively. It is also essential to seek professional advice if there are any concerns or questions about the child support process.

Seeking Professional Advice

If there are any concerns or questions about the child support process, it is essential to seek professional advice from an attorney or advocate. They can provide guidance on the child support process, help resolve any discrepancies or errors, and ensure that individual rights are protected.

| Professional | Services |

|---|---|

| Attorney | Provide legal guidance and representation |

| Advocate | Provide support and guidance on the child support process |

In conclusion, receiving child support tax paperwork can be a complex and overwhelming experience. However, by understanding the process, maintaining accurate records, and seeking professional advice when necessary, individuals can ensure that their child support case is handled efficiently and effectively.

What is child support tax paperwork?

+

Child support tax paperwork is documentation sent by the state or local child support agency that contains important information about the child support case, including the amount of support owed, payment history, and any outstanding balances.

Why is it essential to respond promptly to child support tax paperwork?

+

Responding promptly to child support tax paperwork is crucial to ensure that any discrepancies or errors can be resolved efficiently and to avoid further action being taken, such as wage garnishment or contempt of court.

How can I maintain accurate records of child support payments and communications with the child support agency?

+

Maintaining accurate records of child support payments and communications with the child support agency can be done by keeping a record of all child support payments made, retaining copies of all child support tax paperwork and communications, and updating records regularly to ensure that all information is current and accurate.