Do I Need Secondary Insurance

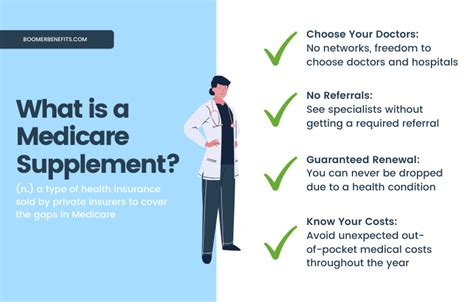

Introduction to Secondary Insurance

Secondary insurance, also known as supplemental insurance, is a type of insurance policy that provides additional coverage beyond what is offered by a primary insurance plan. It is designed to fill in the gaps and help policyholders cover out-of-pocket expenses, deductibles, and copays that are not covered by their primary insurance. In this article, we will explore the concept of secondary insurance, its benefits, and whether or not you need it.

How Secondary Insurance Works

Secondary insurance works by providing an additional layer of protection against unexpected medical expenses. When a policyholder receives medical care, their primary insurance plan pays its share of the costs first. If there are any remaining balances or out-of-pocket expenses, the secondary insurance plan kicks in to cover these costs. This can help policyholders avoid financial hardship and ensure that they receive the medical care they need without breaking the bank.

Benefits of Secondary Insurance

There are several benefits to having secondary insurance, including: * Financial protection: Secondary insurance can help policyholders avoid financial hardship by covering out-of-pocket expenses and deductibles. * Reduced stress: Knowing that you have additional coverage can provide peace of mind and reduce stress related to medical expenses. * Increased access to care: Secondary insurance can help policyholders access medical care that they might not have been able to afford otherwise. * Flexibility: Secondary insurance plans can be customized to meet the specific needs of policyholders, providing flexibility and choice.

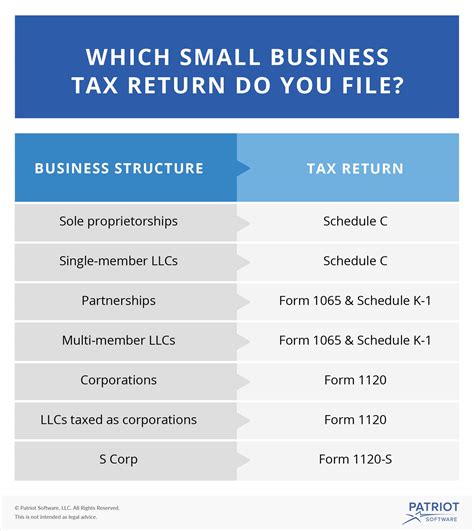

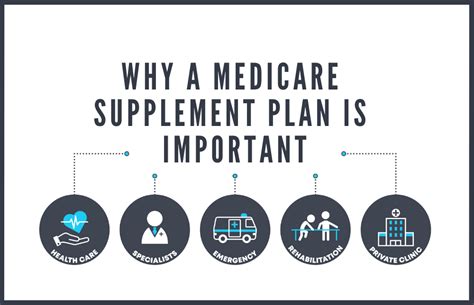

Types of Secondary Insurance

There are several types of secondary insurance plans available, including: * Medigap insurance: This type of insurance is designed to supplement Medicare coverage and fill in the gaps in coverage. * Dental and vision insurance: These types of insurance provide additional coverage for dental and vision care, which may not be included in primary insurance plans. * Disability insurance: This type of insurance provides income replacement in the event that a policyholder becomes disabled and is unable to work. * Critical illness insurance: This type of insurance provides a lump sum payment in the event that a policyholder is diagnosed with a critical illness, such as cancer or heart disease.

Who Needs Secondary Insurance

Secondary insurance can be beneficial for anyone who wants additional protection against unexpected medical expenses. However, it may be particularly useful for: * Self-employed individuals: Self-employed individuals may not have access to employer-sponsored health insurance and may need to purchase their own primary and secondary insurance plans. * Retirees: Retirees may be living on a fixed income and may need additional coverage to supplement their Medicare benefits. * Individuals with chronic illnesses: Individuals with chronic illnesses may need additional coverage to help manage their condition and cover out-of-pocket expenses. * Families with young children: Families with young children may need additional coverage to help cover the costs of pediatric care and other expenses related to raising a family.

How to Choose a Secondary Insurance Plan

Choosing a secondary insurance plan can be complex, but there are several factors to consider, including: * Cost: Consider the cost of the premium and any out-of-pocket expenses associated with the plan. * Coverage: Consider the level of coverage provided by the plan and whether it meets your needs. * Network: Consider the network of providers associated with the plan and whether your primary care physician is included. * Deductible: Consider the deductible associated with the plan and whether it is affordable.

💡 Note: When choosing a secondary insurance plan, it is essential to carefully review the policy and understand what is covered and what is not.

Conclusion

In conclusion, secondary insurance can provide valuable protection against unexpected medical expenses and help policyholders access the care they need. Whether or not you need secondary insurance depends on your individual circumstances and needs. By carefully considering the benefits and types of secondary insurance available, you can make an informed decision about whether or not to purchase a secondary insurance plan.

What is secondary insurance?

+

Secondary insurance, also known as supplemental insurance, is a type of insurance policy that provides additional coverage beyond what is offered by a primary insurance plan.

How does secondary insurance work?

+

Secondary insurance works by providing an additional layer of protection against unexpected medical expenses. When a policyholder receives medical care, their primary insurance plan pays its share of the costs first, and then the secondary insurance plan kicks in to cover any remaining balances or out-of-pocket expenses.

Who needs secondary insurance?

+

Secondary insurance can be beneficial for anyone who wants additional protection against unexpected medical expenses. However, it may be particularly useful for self-employed individuals, retirees, individuals with chronic illnesses, and families with young children.