Paperwork

5 Estate Distribution Tips

Understanding Estate Distribution

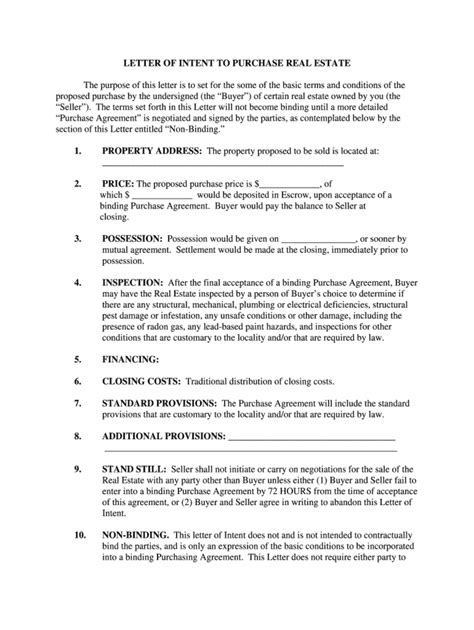

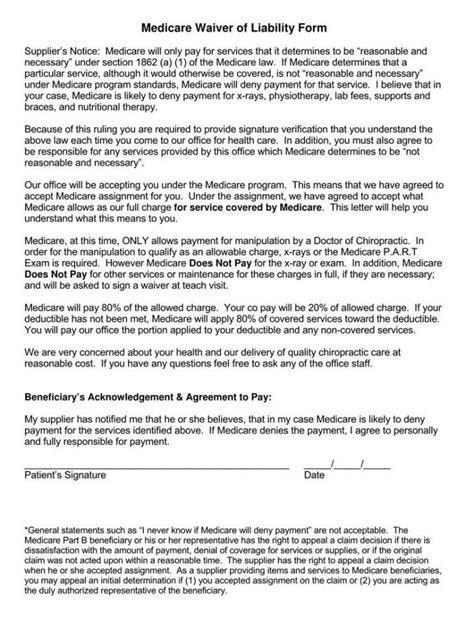

Estate distribution is a process that involves dividing a deceased person’s assets among their beneficiaries. This process can be complex and time-consuming, especially if the deceased person did not leave a will or if there are disputes among the beneficiaries. In this article, we will discuss five estate distribution tips that can help make the process smoother and less stressful.

Estate Distribution Tips

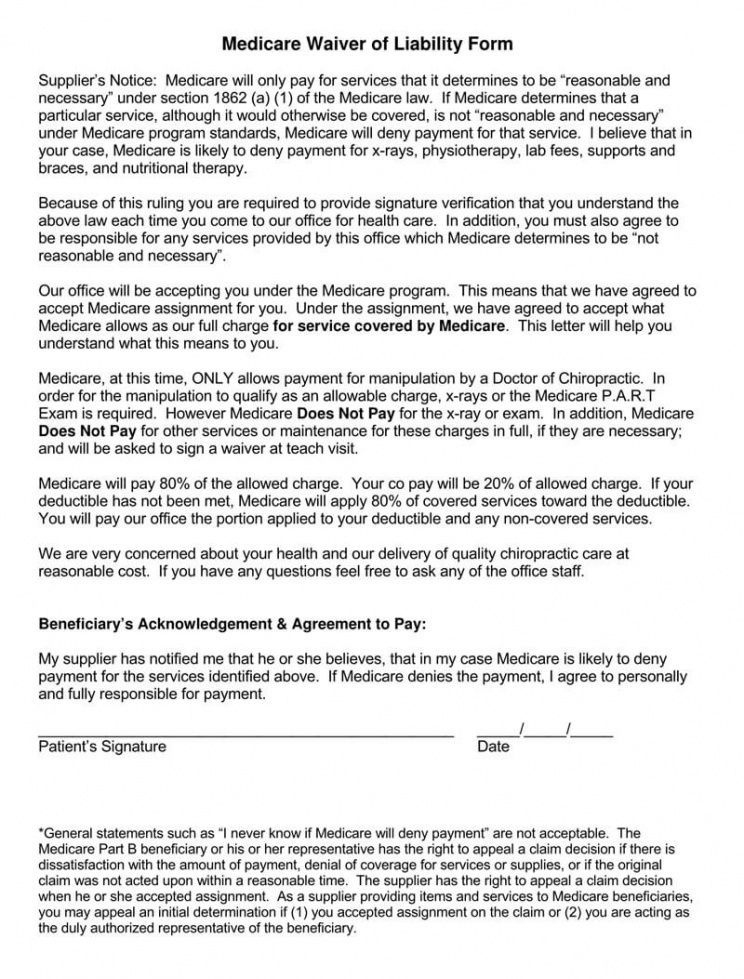

The following are five estate distribution tips that can help you navigate the process: * Plan ahead: One of the most important things you can do to ensure that your estate is distributed according to your wishes is to plan ahead. This includes creating a will, establishing a trust, and designating beneficiaries for your assets. * Communicate with your beneficiaries: It’s essential to communicate with your beneficiaries about your estate distribution plans. This can help prevent disputes and ensure that everyone is on the same page. * Consider tax implications: Estate distribution can have significant tax implications, so it’s essential to consider these when planning your estate. This may include setting up a trust or using other tax-saving strategies. * Keep accurate records: Keeping accurate records of your assets and estate distribution plans is crucial. This can help prevent disputes and ensure that your estate is distributed according to your wishes. * Seek professional advice: Estate distribution can be complex, so it’s often helpful to seek professional advice from an attorney or financial advisor. They can help you navigate the process and ensure that your estate is distributed according to your wishes.

Benefits of Estate Planning

Estate planning can provide several benefits, including: * Ensuring that your assets are distributed according to your wishes * Minimizing taxes and other expenses * Preventing disputes among beneficiaries * Providing for your loved ones * Supporting your favorite charities

Estate Distribution Process

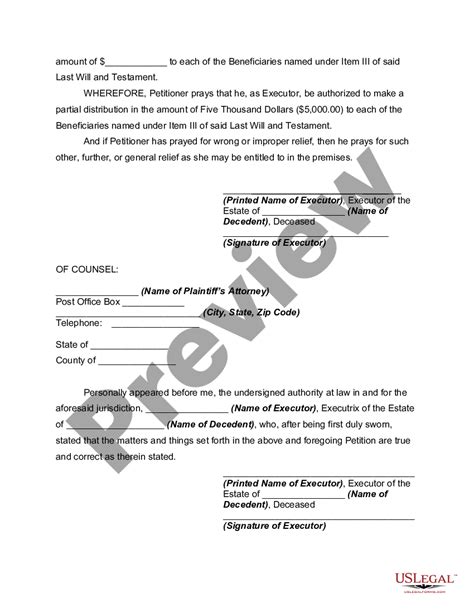

The estate distribution process typically involves the following steps: * Probate: The first step in the estate distribution process is probate, which involves verifying the deceased person’s will and appointing an executor to manage the estate. * Inventory and appraisal: The next step is to create an inventory of the deceased person’s assets and have them appraised. * Paying debts and taxes: The executor must pay any debts and taxes owed by the estate. * Distributing assets: Finally, the executor must distribute the assets according to the deceased person’s will or the laws of the state.

Common Estate Distribution Mistakes

There are several common mistakes that people make when it comes to estate distribution, including: * Failing to plan ahead * Not communicating with beneficiaries * Not considering tax implications * Not keeping accurate records * Not seeking professional advice

📝 Note: It's essential to avoid these mistakes to ensure that your estate is distributed according to your wishes and that your loved ones are taken care of.

Conclusion and Final Thoughts

In conclusion, estate distribution can be a complex and time-consuming process, but with the right planning and advice, it can be made much smoother. By following the five estate distribution tips outlined in this article, you can ensure that your estate is distributed according to your wishes and that your loved ones are taken care of. Remember to plan ahead, communicate with your beneficiaries, consider tax implications, keep accurate records, and seek professional advice.

What is estate distribution?

+

Estate distribution is the process of dividing a deceased person’s assets among their beneficiaries.

Why is estate planning important?

+

Estate planning is important because it ensures that your assets are distributed according to your wishes and that your loved ones are taken care of.

What are the benefits of estate planning?

+

The benefits of estate planning include ensuring that your assets are distributed according to your wishes, minimizing taxes and other expenses, preventing disputes among beneficiaries, providing for your loved ones, and supporting your favorite charities.