What is a W2 Form

Understanding the W2 Form: A Comprehensive Guide

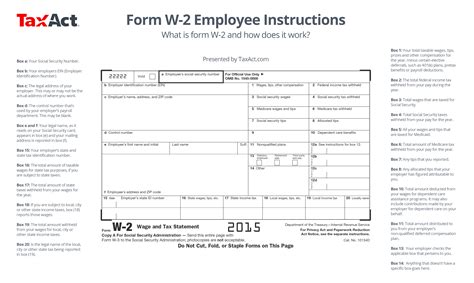

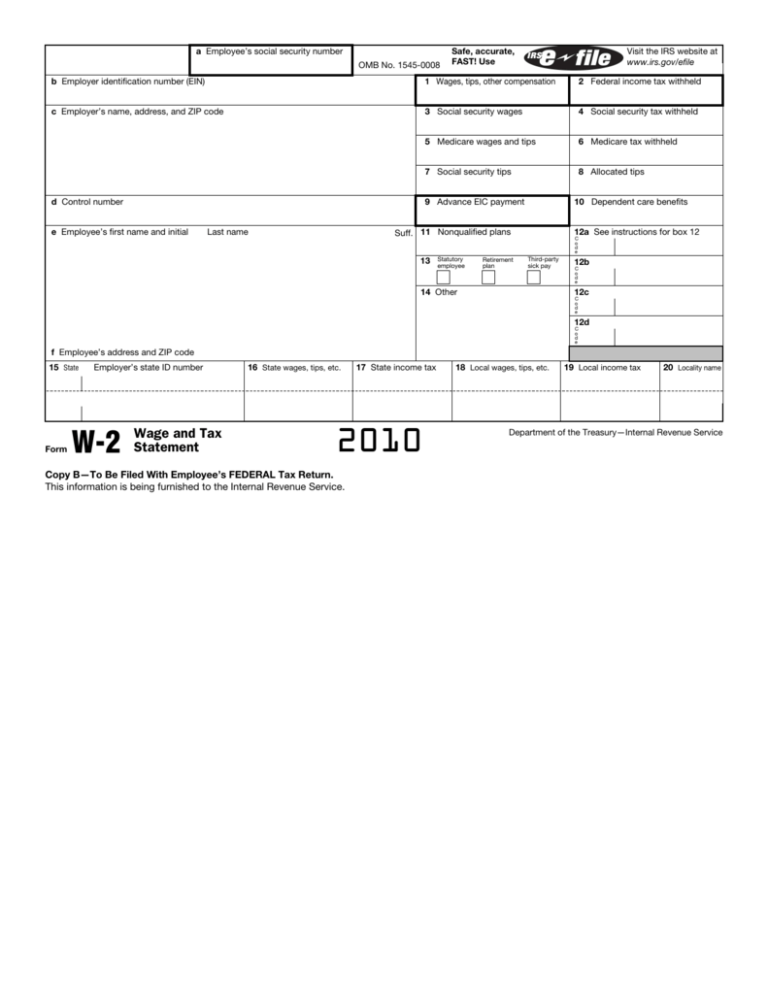

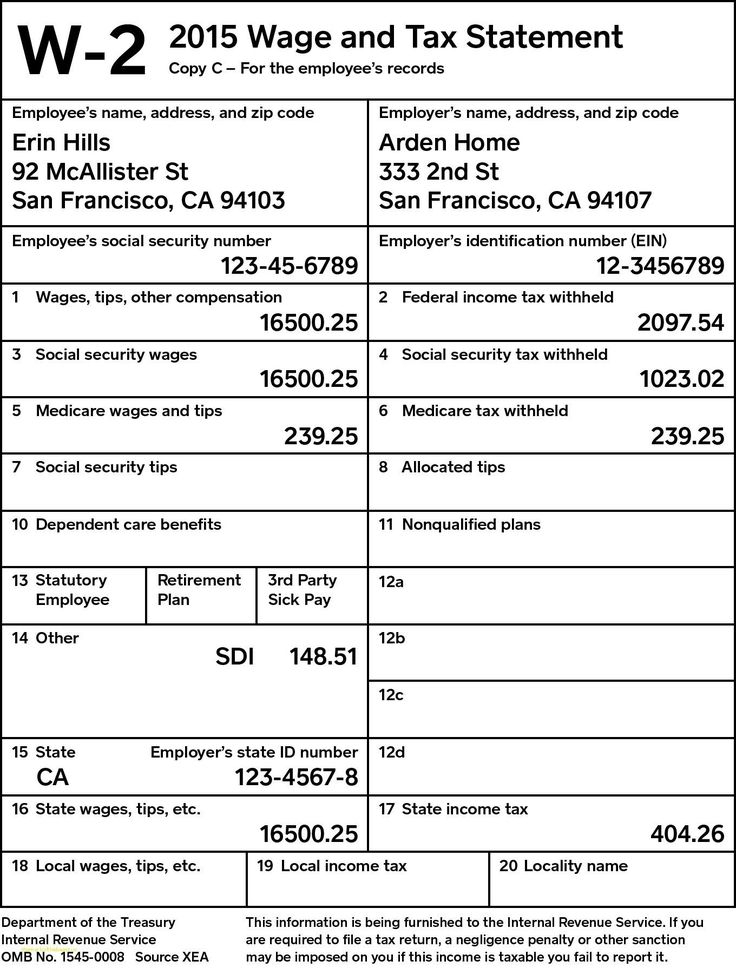

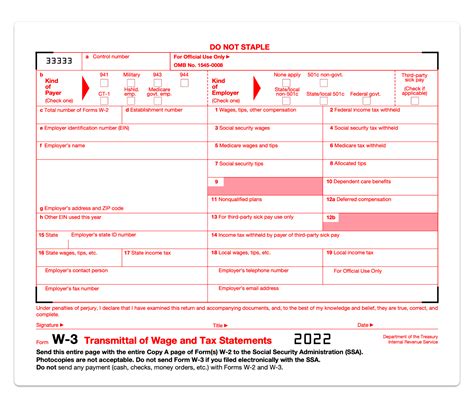

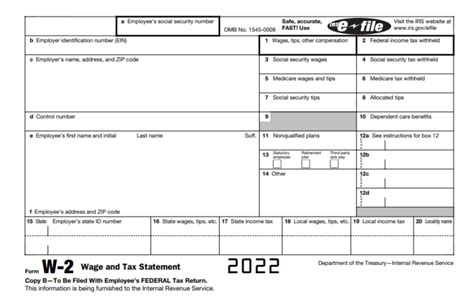

The W2 form, also known as the Wage and Tax Statement, is a crucial document that employers must provide to their employees and the Internal Revenue Service (IRS) at the end of each tax year. It serves as a record of an employee’s income, taxes withheld, and other relevant employment information. In this article, we will delve into the details of the W2 form, its components, and its significance in the tax filing process.

What is Included on a W2 Form?

A W2 form typically includes the following information:

- Employee’s name, address, and Social Security number

- Employer’s name, address, and Employer Identification Number (EIN)

- Wages, tips, and other compensation earned by the employee

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

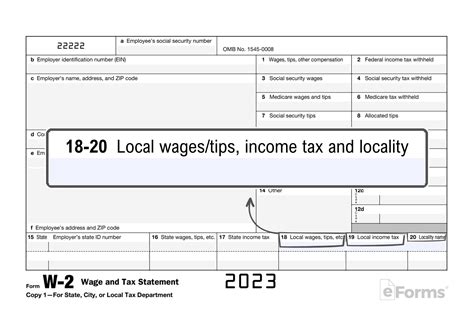

- Other relevant taxes and deductions, such as state and local taxes

Importance of the W2 Form

The W2 form plays a vital role in the tax filing process for both employees and employers. Here are some key reasons why:

- Accurate Tax Returns: The W2 form provides employees with the necessary information to complete their tax returns accurately, ensuring they report their income and taxes withheld correctly.

- Payroll Tax Reporting: Employers use the W2 form to report their payroll taxes to the IRS, including Social Security and Medicare taxes.

- Compliance with Tax Laws: The W2 form helps employers comply with tax laws and regulations, reducing the risk of audits and penalties.

How to Obtain a W2 Form

Employers are required to provide employees with a W2 form by January 31st of each year, covering the previous tax year. Employees can obtain their W2 form in the following ways:

- Mail: Employers will typically mail the W2 form to employees’ addresses on file.

- Online: Many employers offer online access to W2 forms through their payroll portals or websites.

- Request: Employees can request a copy of their W2 form from their employer if they do not receive it by the deadline.

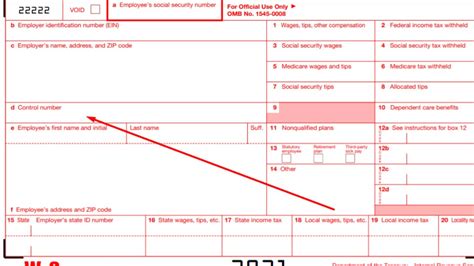

Correcting Errors on a W2 Form

If an employee discovers an error on their W2 form, they should notify their employer immediately. The employer will need to correct the error and provide a revised W2 form, known as a W2c. The W2c form will include the corrected information, and the employee should use this revised form to complete their tax return.

📝 Note: Employees should keep a copy of their W2 form for their records, as it may be required for future tax purposes or other financial transactions.

Table: W2 Form Components

| Box Number | Description |

|---|---|

| 1 | Wages, tips, and other compensation |

| 2 | Federal income tax withheld |

| 3 | Social Security wages |

| 4 | Social Security tax withheld |

| 5 | Medicare wages and tips |

| 6 | Medicare tax withheld |

This table provides a summary of the key components found on a W2 form.

In summary, the W2 form is a critical document that plays a vital role in the tax filing process. It provides employees with the necessary information to complete their tax returns accurately and helps employers comply with tax laws and regulations. By understanding the components and significance of the W2 form, individuals can ensure they are meeting their tax obligations and taking advantage of the tax benefits available to them.

To recap, the key points of this article include the importance of the W2 form, its components, and how to obtain and correct errors on the form. By following these guidelines and understanding the W2 form’s role in the tax filing process, individuals can navigate the tax season with confidence.

What is the deadline for employers to provide W2 forms to employees?

+

Employers must provide W2 forms to employees by January 31st of each year, covering the previous tax year.

How can employees obtain a copy of their W2 form if they do not receive it by the deadline?

+

Employees can request a copy of their W2 form from their employer or contact the IRS for assistance.

What should employees do if they discover an error on their W2 form?

+

Employees should notify their employer immediately, and the employer will need to correct the error and provide a revised W2 form (W2c).