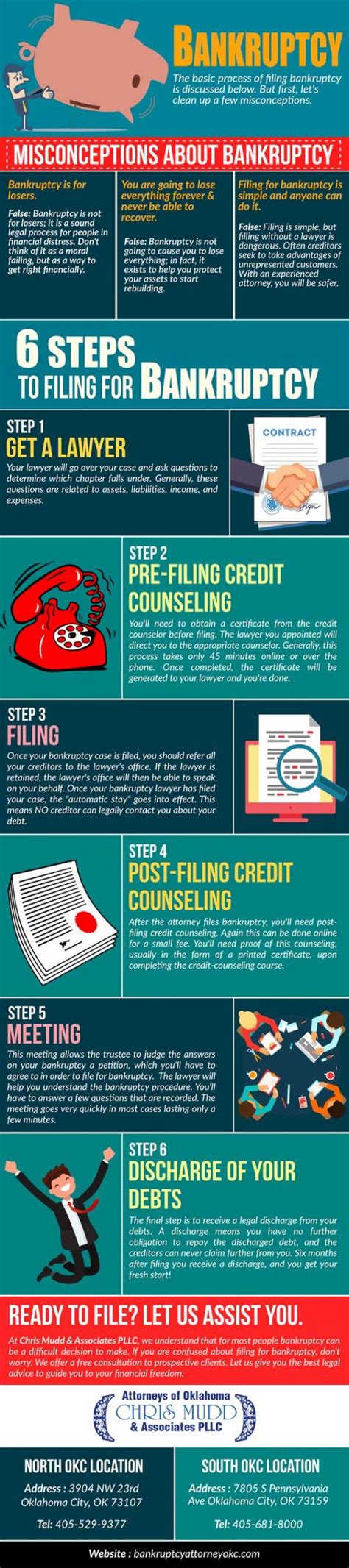

5 Steps to File Bankruptcy

Introduction to Bankruptcy Filing

Filing for bankruptcy can be a daunting and complex process, but understanding the steps involved can help individuals make informed decisions about their financial future. Bankruptcy is a legal proceeding that allows individuals or businesses to reorganize or eliminate debts under the protection of the federal bankruptcy court. In this article, we will explore the 5 key steps to file bankruptcy, providing a comprehensive guide for those considering this option.

Step 1: Determine Eligibility and Choose the Right Type of Bankruptcy

The first step in filing for bankruptcy is to determine eligibility and choose the right type of bankruptcy. There are two main types of bankruptcy for individuals: Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves liquidating non-exempt assets to pay off debts, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over time. To be eligible for Chapter 7 bankruptcy, individuals must pass the means test, which assesses their income and expenses to determine if they have sufficient disposable income to repay debts. For Chapter 13 bankruptcy, individuals must have a steady income and a willingness to repay debts over time.

Step 2: Gather Required Documents and Information

Before filing for bankruptcy, individuals must gather all required documents and information. This includes: * Financial records: income statements, expense reports, and debt statements * Asset valuation: appraisals of property, vehicles, and other assets * Credit reports: copies of credit reports from the three major credit bureaus * Tax returns: copies of tax returns for the past two years * Identification: valid government-issued ID and social security number

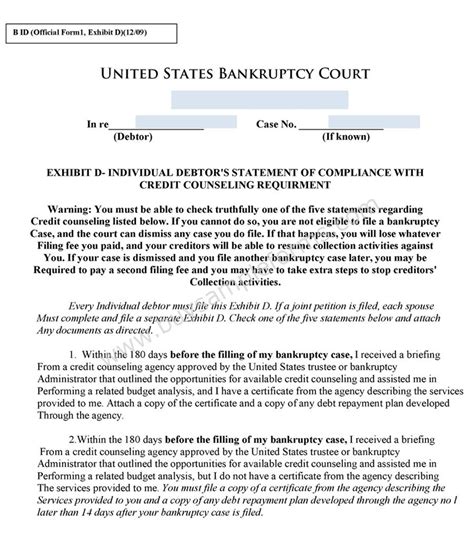

Step 3: Complete Credit Counseling and Take the Means Test

The next step is to complete credit counseling and take the means test. Credit counseling is a mandatory requirement for individuals filing for bankruptcy, and it involves working with a non-profit credit counseling agency to develop a budget and repayment plan. The means test is used to determine eligibility for Chapter 7 bankruptcy and involves assessing income and expenses to determine if there is sufficient disposable income to repay debts. Individuals who pass the means test may be eligible for Chapter 7 bankruptcy, while those who do not pass may be required to file for Chapter 13 bankruptcy.

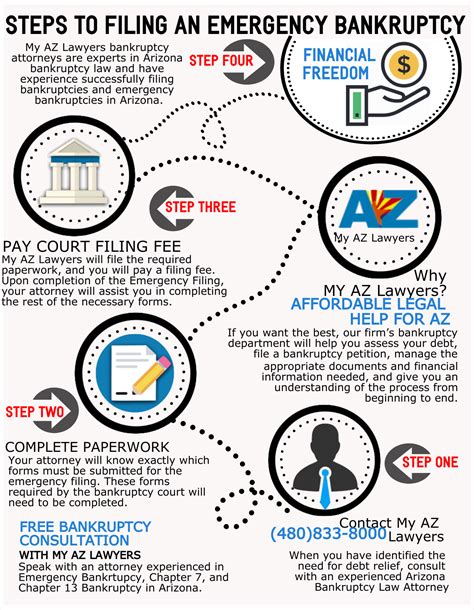

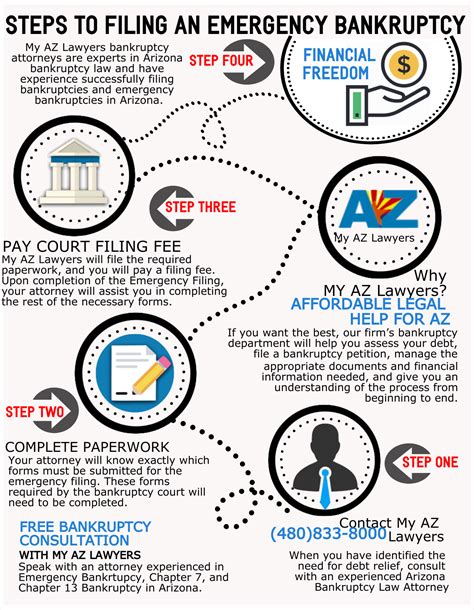

Step 4: Prepare and File the Bankruptcy Petition

Once the required documents and information have been gathered, and credit counseling and the means test have been completed, the next step is to prepare and file the bankruptcy petition. The petition must include: * Schedules: detailed lists of assets, liabilities, and creditors * Statement of financial affairs: a summary of financial transactions and activities * Plan: a proposed plan for reorganizing or eliminating debts The petition must be filed with the federal bankruptcy court, and a filing fee must be paid.

Step 5: Attend the Meeting of Creditors and Complete the Bankruptcy Process

The final step is to attend the meeting of creditors and complete the bankruptcy process. The meeting of creditors, also known as the 341 meeting, is a mandatory hearing where creditors can ask questions and object to the bankruptcy plan. After the meeting, the court will review the plan and make a determination on whether to approve or reject it. If the plan is approved, the individual will be required to make payments and complete the terms of the plan. If the plan is rejected, the individual may be required to modify the plan or convert to a different type of bankruptcy.

💡 Note: It is essential to work with a qualified bankruptcy attorney to ensure that all steps are completed correctly and that the individual's rights are protected throughout the process.

In summary, filing for bankruptcy involves determining eligibility and choosing the right type of bankruptcy, gathering required documents and information, completing credit counseling and taking the means test, preparing and filing the bankruptcy petition, and attending the meeting of creditors and completing the bankruptcy process. By understanding these steps and working with a qualified bankruptcy attorney, individuals can make informed decisions about their financial future and take the first steps towards a fresh start.

What are the main types of bankruptcy for individuals?

+

The two main types of bankruptcy for individuals are Chapter 7 and Chapter 13. Chapter 7 involves liquidating non-exempt assets to pay off debts, while Chapter 13 involves creating a repayment plan to pay off debts over time.

What is the means test, and how does it affect bankruptcy eligibility?

+

The means test is a formula used to determine if an individual has sufficient disposable income to repay debts. Individuals who pass the means test may be eligible for Chapter 7 bankruptcy, while those who do not pass may be required to file for Chapter 13 bankruptcy.

What is credit counseling, and why is it required for bankruptcy filers?

+

Credit counseling is a mandatory requirement for individuals filing for bankruptcy. It involves working with a non-profit credit counseling agency to develop a budget and repayment plan. The goal of credit counseling is to help individuals understand their financial situation and explore alternatives to bankruptcy.