Attorney Bankruptcy Sign Off Time

Introduction to Attorney Bankruptcy Sign Off Time

Attorney bankruptcy sign off time refers to the period during which a bankruptcy attorney is involved in the bankruptcy process, from the initial consultation to the final discharge or closure of the case. This timeframe can vary significantly depending on the complexity of the case, the type of bankruptcy filed (Chapter 7, Chapter 13, etc.), and the specific requirements of the bankruptcy court. Understanding the timeline and the attorney’s role during this period is crucial for individuals or businesses considering bankruptcy as a means to resolve debt issues.

Understanding the Bankruptcy Process

The bankruptcy process in the United States is governed by federal law and is designed to provide relief to individuals and businesses overwhelmed by debt. The two most common types of personal bankruptcy are Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves the liquidation of non-exempt assets to pay off creditors, while Chapter 13 involves a repayment plan that allows debtors to keep their assets and pay off a portion of their debts over time. For businesses, Chapter 11 bankruptcy is often used, which involves a reorganization plan to keep the business operating while it pays off its debts.

The Role of a Bankruptcy Attorney

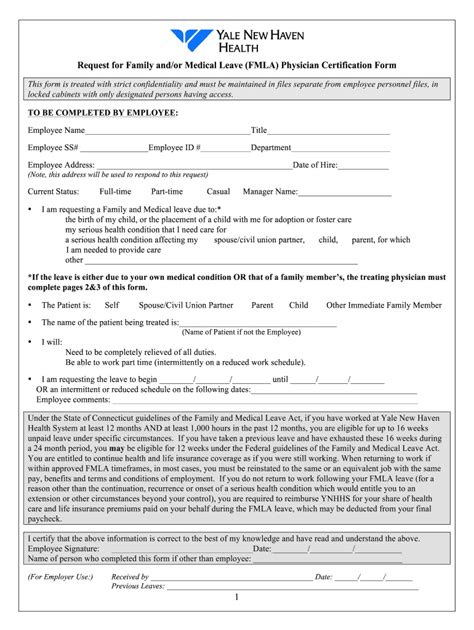

A bankruptcy attorney plays a crucial role in guiding clients through the bankruptcy process. Their responsibilities include: - Initial Consultation: Discussing the client’s financial situation and determining the best course of action. - Filing the Petition: Preparing and filing the bankruptcy petition with the court. - Representation in Court: Representing the client in court hearings and meetings with creditors. - Compliance with Bankruptcy Laws: Ensuring that the client complies with all bankruptcy laws and procedures. - Communication with Creditors: Handling communications with creditors and negotiating on behalf of the client.

Timeline of Attorney Involvement

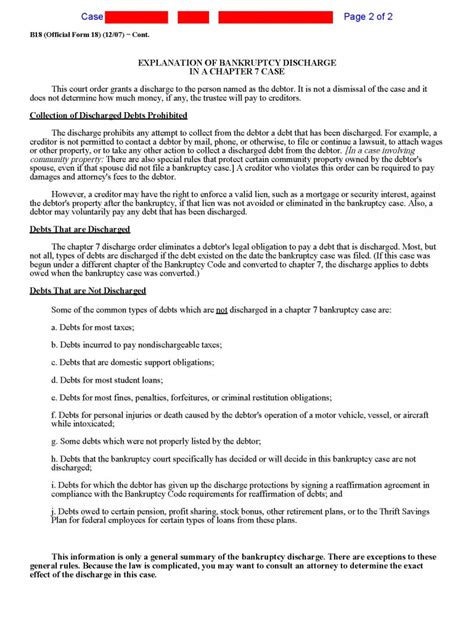

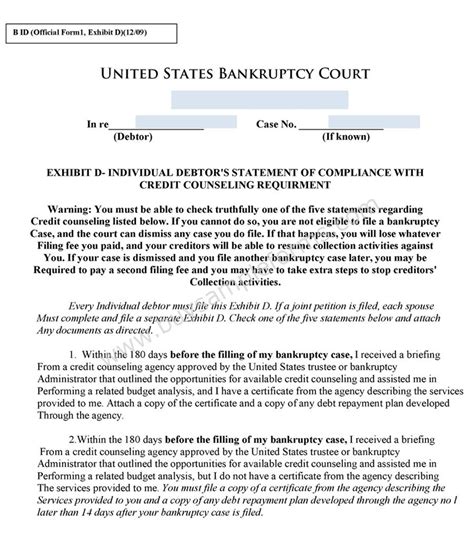

The timeline of a bankruptcy attorney’s involvement can be broken down into several stages: - Pre-Filing Stage: This involves the initial consultation, gathering financial documents, and preparing the bankruptcy petition. - Filing Stage: The attorney files the petition with the bankruptcy court. - Automatic Stay: Immediately after filing, an automatic stay goes into effect, stopping most collection activities by creditors. - Meeting of Creditors (341 Meeting): The attorney represents the client at this meeting, where creditors can ask questions about the client’s financial affairs. - Plan Confirmation (for Chapter 13): If the client has filed for Chapter 13, the attorney will help prepare and negotiate a repayment plan with the trustee and creditors. - Discharge Stage: The final stage, where the court issues a discharge order, releasing the client from personal liability for most debts.

Factors Affecting Sign Off Time

Several factors can affect how long a bankruptcy attorney is involved in a case: - Complexity of the Case: Cases involving multiple creditors, significant assets, or contentious issues can prolong the attorney’s involvement. - Type of Bankruptcy: Chapter 7 cases are generally quicker than Chapter 13 cases, which require a longer repayment period. - Client Cooperation: The speed at which the client provides necessary documents and information can impact the timeline. - Court Schedule: The availability of court dates and the workload of the bankruptcy court can also influence the duration of the attorney’s involvement.

Importance of Professional Guidance

Given the complexity and the potential long-term implications of bankruptcy, it is essential to seek professional guidance from a qualified bankruptcy attorney. They can provide critical advice on the best type of bankruptcy to file, ensure compliance with all legal requirements, and represent the client’s interests throughout the process.

💡 Note: The decision to file for bankruptcy should not be taken lightly and should be made after consulting with a financial advisor or attorney to explore all available options.

Preparing for the Bankruptcy Process

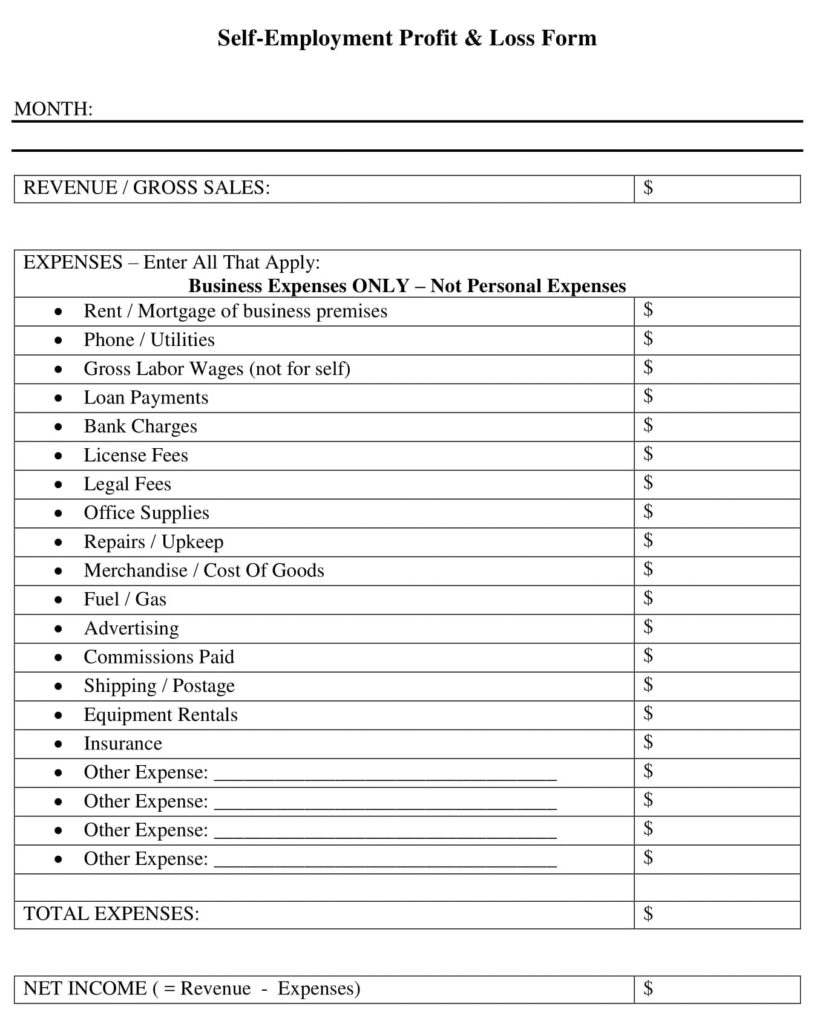

To prepare for the bankruptcy process and make the most of the attorney’s time, individuals should: - Gather all financial documents, including income statements, debt lists, and asset valuations. - Be prepared to discuss their financial situation openly with the attorney. - Ask questions about the process, including potential outcomes and the attorney’s fees.

| Type of Bankruptcy | Description | Duration |

|---|---|---|

| Chapter 7 | Liquidation of non-exempt assets to pay off creditors. | Typically 4-6 months |

| Chapter 13 | Repayment plan to pay off a portion of debts over time. | Typically 3-5 years |

In summary, the attorney bankruptcy sign off time encompasses the period from the initial consultation to the final discharge or closure of the bankruptcy case. This timeframe can vary based on several factors, including the type of bankruptcy, the complexity of the case, and the efficiency of the bankruptcy court. Working closely with a bankruptcy attorney can help navigate this process efficiently and ensure the best possible outcome for individuals or businesses seeking debt relief.

The process of bankruptcy, while complex and often daunting, offers a structured approach to managing and eliminating debt. By understanding the roles and responsibilities of a bankruptcy attorney and the general timeline of the bankruptcy process, individuals can better prepare themselves for the journey ahead and make informed decisions about their financial future. As with any significant legal process, patience, cooperation, and the right professional guidance are key to a successful outcome.