Private Foundation Corporation Filing Requirements

Introduction to Private Foundation Corporation Filing Requirements

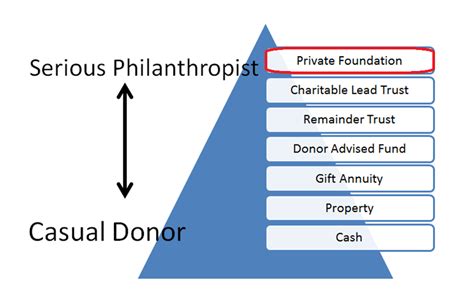

When establishing a private foundation, it is essential to understand the various filing requirements that must be met to maintain tax-exempt status. A private foundation is a type of non-profit organization that is typically established by an individual or family to support charitable causes. In the United States, private foundations are required to file certain documents with the Internal Revenue Service (IRS) and other government agencies to comply with tax laws and regulations. In this article, we will discuss the private foundation corporation filing requirements, including the initial filing, annual filings, and other necessary documents.

Initial Filing Requirements

To establish a private foundation, the following initial filing requirements must be met: * Articles of Incorporation: The private foundation must file articles of incorporation with the state in which it will operate. This document outlines the purpose, structure, and governance of the organization. * Application for Tax-Exempt Status: The private foundation must file Form 1023 with the IRS to apply for tax-exempt status under Section 501©(3) of the Internal Revenue Code. This form requires detailed information about the organization, its purpose, and its planned activities. * Obtain an Employer Identification Number (EIN): The private foundation must obtain an EIN from the IRS, which is used to identify the organization for tax purposes.

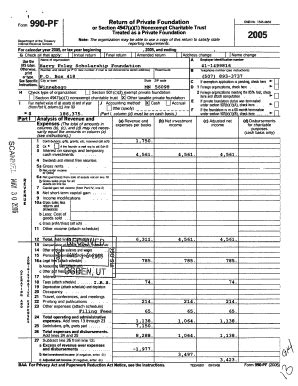

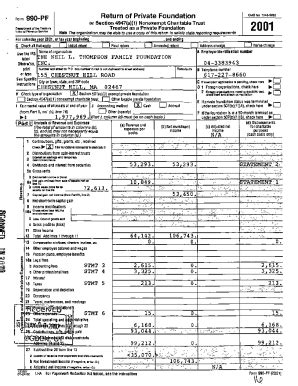

Annual Filing Requirements

Once the private foundation is established, the following annual filing requirements must be met: * Form 990-PF: The private foundation must file Form 990-PF with the IRS annually, which reports on the organization’s financial activities, governance, and compliance with tax laws and regulations. * Form 4720: If the private foundation engages in certain transactions, such as self-dealing or excess business holdings, it must file Form 4720 to report these transactions and pay any required excise taxes. * State Annual Reports: The private foundation must file annual reports with the state in which it operates, which typically require information about the organization’s activities, governance, and financial condition.

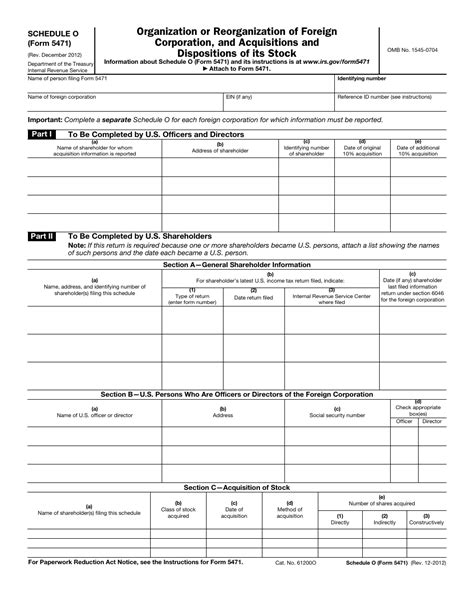

Other Filing Requirements

In addition to the initial and annual filing requirements, private foundations may need to file other documents with the IRS and state agencies, such as: * Form 5227: If the private foundation has excess business holdings, it must file Form 5227 to report on these holdings and pay any required excise taxes. * Form 8870: If the private foundation makes grants to individuals, it must file Form 8870 to report on these grants and obtain approval from the IRS. * State Charitable Solicitations Registration: The private foundation may need to register with the state in which it operates to solicit charitable contributions.

| Filing Requirement | Frequency | Purpose |

|---|---|---|

| Form 1023 | Initial | Apply for tax-exempt status |

| Form 990-PF | Annual | Report on financial activities and governance |

| Form 4720 | Annual | Report on self-dealing and excess business holdings |

| State Annual Reports | Annual | Report on activities, governance, and financial condition |

📝 Note: Private foundations must maintain accurate and detailed records of their financial activities, governance, and compliance with tax laws and regulations to ensure timely and accurate filing of required documents.

To maintain tax-exempt status, private foundations must comply with all filing requirements and regulations. Failure to file required documents or comply with tax laws and regulations can result in penalties, fines, and even loss of tax-exempt status. It is essential for private foundations to consult with tax professionals and attorneys to ensure compliance with all filing requirements and regulations.

In summary, private foundation corporation filing requirements are complex and require careful attention to detail. By understanding the initial, annual, and other filing requirements, private foundations can ensure compliance with tax laws and regulations and maintain their tax-exempt status.

What is the purpose of Form 1023?

+

Form 1023 is used to apply for tax-exempt status under Section 501©(3) of the Internal Revenue Code.

What is the deadline for filing Form 990-PF?

+

The deadline for filing Form 990-PF is the 15th day of the 5th month after the end of the private foundation’s tax year.

What are the consequences of failing to file required documents?

+

Failing to file required documents can result in penalties, fines, and even loss of tax-exempt status.