Prequal Paperwork Form

Introduction to Prequal Paperwork Form

The prequal paperwork form is a document that lenders use to assess the creditworthiness of potential borrowers. This form is usually the first step in the mortgage application process, and it provides lenders with essential information about the borrower’s financial situation. In this article, we will delve into the details of the prequal paperwork form, its importance, and the information it typically requires.

Importance of Prequal Paperwork Form

The prequal paperwork form is a crucial document in the mortgage application process. It helps lenders determine whether a borrower is eligible for a mortgage and, if so, how much they can borrow. The form also gives borrowers an idea of how much they can afford to spend on a house. By providing lenders with accurate and detailed information, borrowers can increase their chances of getting approved for a mortgage.

Information Required in Prequal Paperwork Form

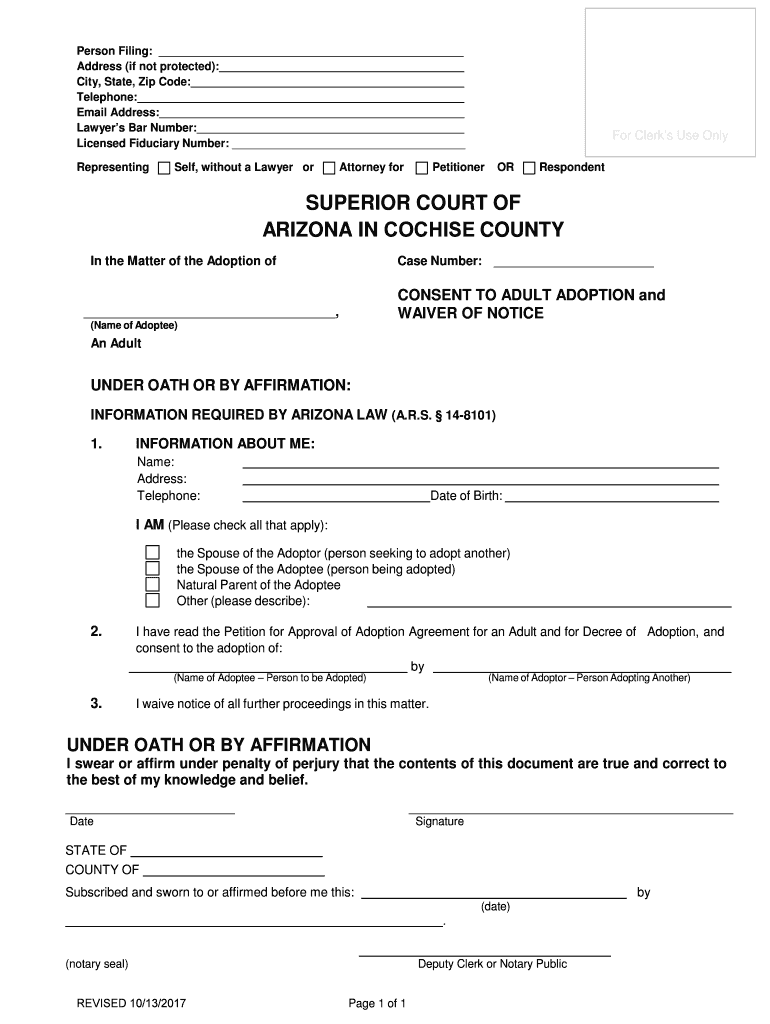

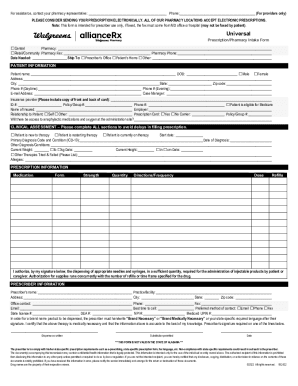

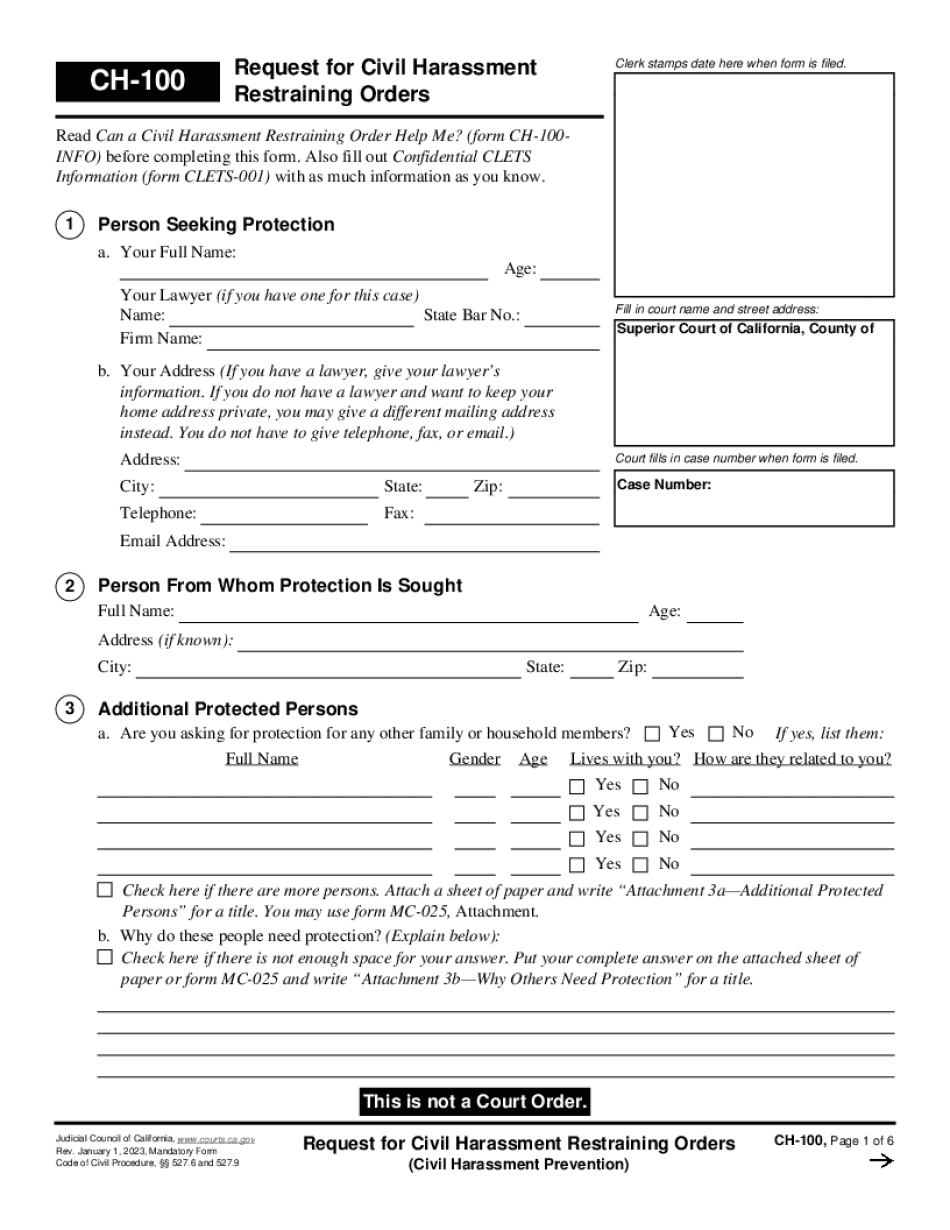

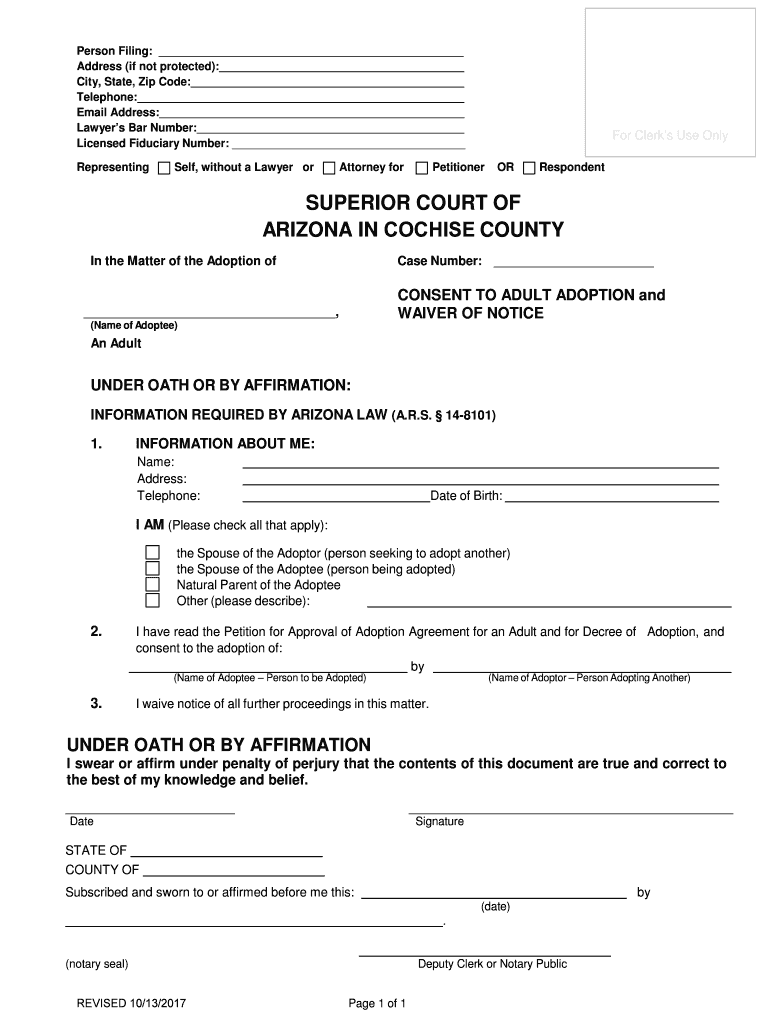

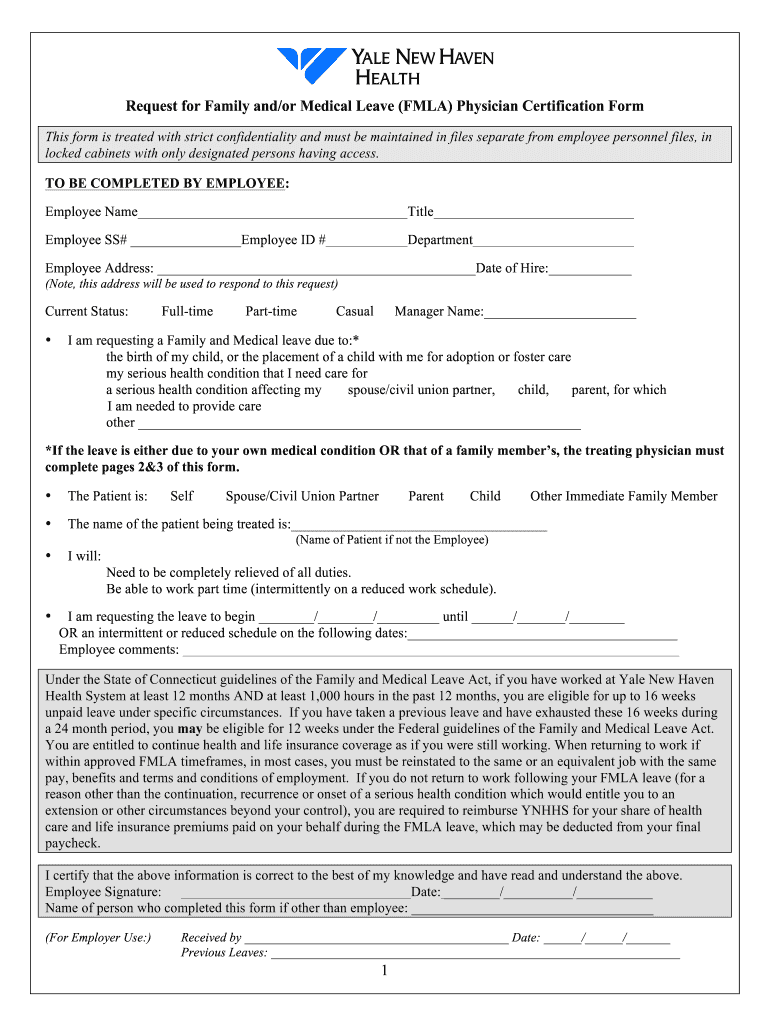

The prequal paperwork form typically requires the following information: * Personal details: Name, address, date of birth, social security number, and contact information * Employment history: Current and previous employment, income, and job title * Financial information: Bank account statements, investment accounts, and other assets * Credit history: Credit score, credit report, and any outstanding debts * Income verification: Pay stubs, W-2 forms, and tax returns * Asset verification: Bank statements, investment accounts, and other assets

Benefits of Prequal Paperwork Form

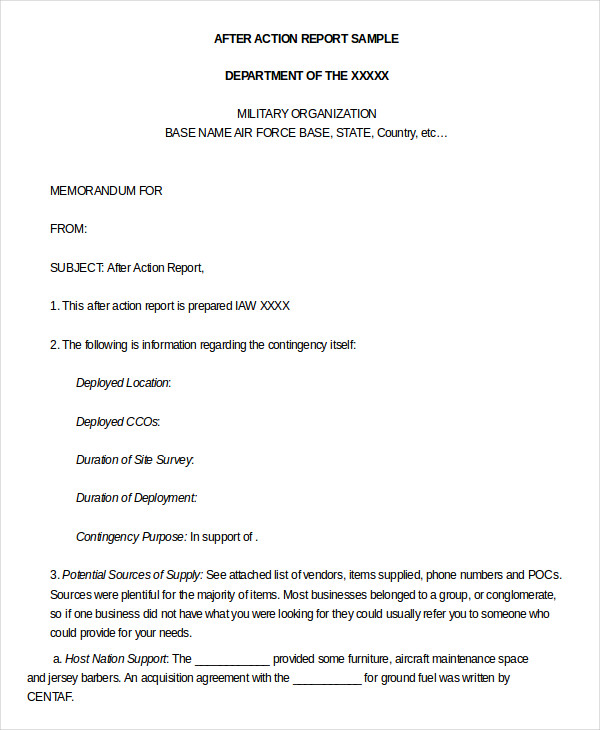

The prequal paperwork form offers several benefits to both lenders and borrowers. Some of the benefits include: * Streamlined application process: The form helps lenders quickly assess the borrower’s creditworthiness and provide a preapproval letter. * Increased accuracy: The form ensures that lenders have accurate and detailed information about the borrower’s financial situation. * Improved communication: The form facilitates communication between lenders and borrowers, helping to prevent misunderstandings and errors. * Faster decision-making: The form enables lenders to make quick decisions about mortgage applications, reducing the processing time.

Common Mistakes to Avoid in Prequal Paperwork Form

When filling out the prequal paperwork form, borrowers should avoid the following common mistakes: * Inaccurate information: Providing false or misleading information can lead to delays or even rejection of the mortgage application. * Incomplete information: Failing to provide all required documents and information can slow down the application process. * Insufficient documentation: Not providing sufficient documentation to support income and asset claims can lead to rejection of the application.

📝 Note: Borrowers should carefully review the prequal paperwork form and ensure that all information is accurate and complete before submitting it to the lender.

Prequal Paperwork Form vs. Preapproval Letter

The prequal paperwork form and preapproval letter are often confused with each other. However, they serve different purposes: * Prequal paperwork form: This form is used to assess the borrower’s creditworthiness and provide an estimate of how much they can borrow. * Preapproval letter: This letter is a formal document that confirms the borrower’s eligibility for a mortgage and specifies the loan amount and interest rate.

Conclusion

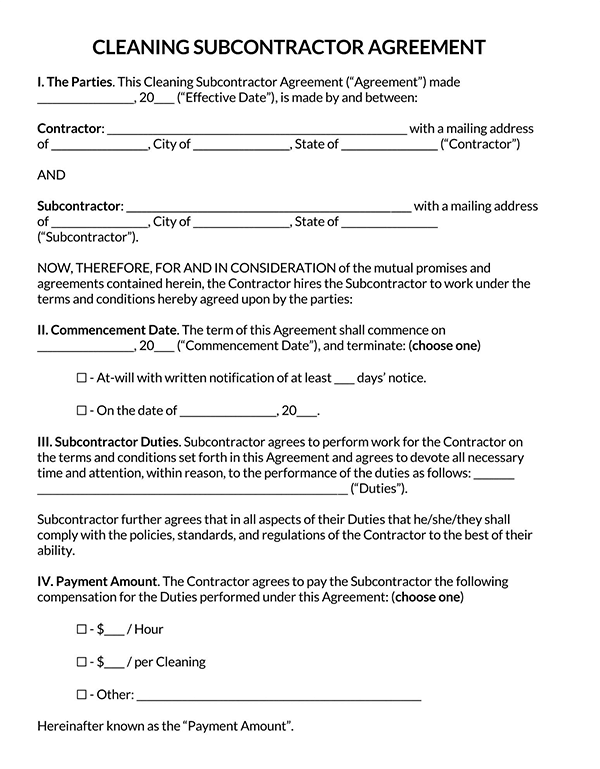

In summary, the prequal paperwork form is a critical document in the mortgage application process. It provides lenders with essential information about the borrower’s financial situation, helping them determine eligibility for a mortgage. By understanding the importance of the prequal paperwork form and avoiding common mistakes, borrowers can increase their chances of getting approved for a mortgage. To further illustrate the key points, the following table summarizes the benefits and drawbacks of the prequal paperwork form:

| Benefits | Drawbacks |

|---|---|

| Streamlined application process | Time-consuming to complete |

| Increased accuracy | Requires detailed financial information |

| Improved communication | May lead to rejection if information is inaccurate |

| Faster decision-making | May require additional documentation |

The prequal paperwork form is an essential step in the mortgage application process, and understanding its importance can help borrowers navigate the process more efficiently.

What is the purpose of the prequal paperwork form?

+

The prequal paperwork form is used to assess the borrower’s creditworthiness and provide an estimate of how much they can borrow.

What information is required in the prequal paperwork form?

+

The form typically requires personal details, employment history, financial information, credit history, income verification, and asset verification.

How long does it take to complete the prequal paperwork form?

+

The time it takes to complete the form can vary depending on the individual’s financial situation and the complexity of the application.

Can I submit the prequal paperwork form online?

+

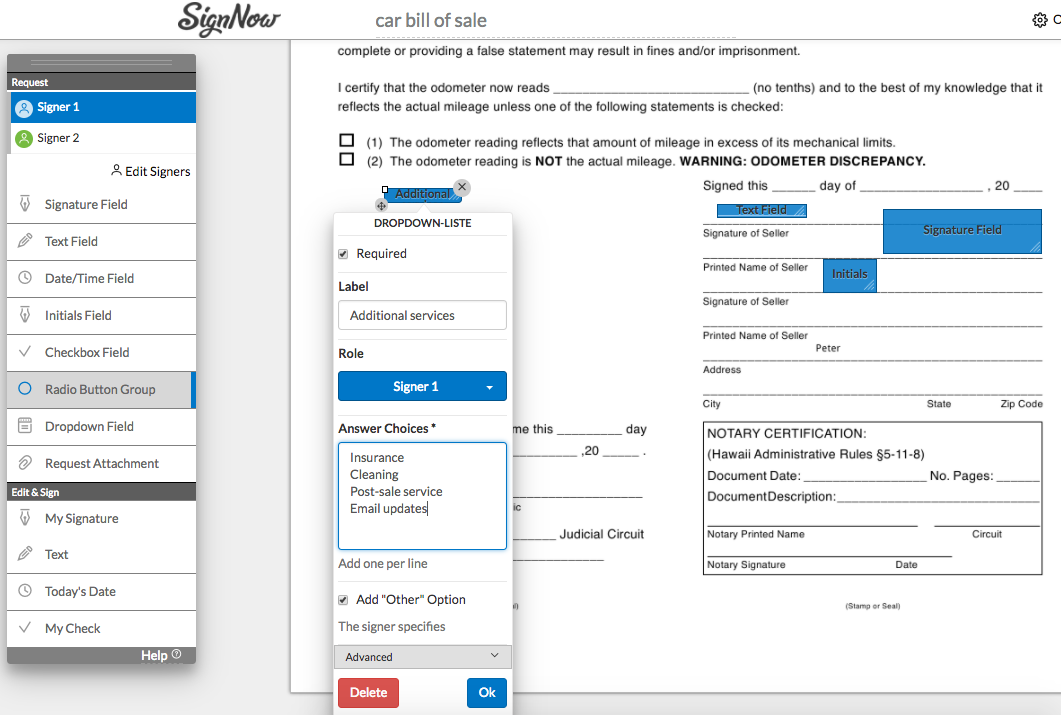

Yes, many lenders offer online applications and submission processes for the prequal paperwork form.

What happens after I submit the prequal paperwork form?

+

After submitting the form, the lender will review the information and provide a preapproval letter or request additional documentation to support the application.