Keep Income Tax Returns

Introduction to Income Tax Returns

Income tax returns are an essential aspect of the tax system in many countries, including the United States, Canada, Australia, and the United Kingdom. The process of filing income tax returns can be complex and time-consuming, but it is a critical step in ensuring that individuals and businesses comply with tax laws and regulations. In this article, we will delve into the world of income tax returns, exploring the importance of filing, the benefits of timely submission, and the potential consequences of non-compliance.

Why File Income Tax Returns?

Filing income tax returns is a mandatory requirement for individuals and businesses that earn income above a certain threshold. The primary purpose of filing income tax returns is to report income earned during the tax year and to calculate the amount of tax owed to the government. Accurate and timely filing of income tax returns helps to ensure that individuals and businesses comply with tax laws and regulations, avoiding potential penalties and fines. Additionally, filing income tax returns allows individuals to claim tax deductions and credits, which can help to reduce their tax liability.

Benefits of Filing Income Tax Returns

There are several benefits to filing income tax returns, including: * Tax refunds: Individuals who have overpaid their taxes during the tax year may be eligible for a tax refund. * Tax deductions and credits: Filing income tax returns allows individuals to claim tax deductions and credits, which can help to reduce their tax liability. * Improved financial management: Filing income tax returns helps individuals and businesses to keep track of their income and expenses, making it easier to manage their finances. * Compliance with tax laws: Filing income tax returns ensures that individuals and businesses comply with tax laws and regulations, avoiding potential penalties and fines.

Consequences of Not Filing Income Tax Returns

Failure to file income tax returns can result in serious consequences, including: * Penalties and fines: Individuals and businesses that fail to file income tax returns may be subject to penalties and fines. * Interest on unpaid taxes: Unpaid taxes can accrue interest, increasing the amount of tax owed. * Loss of tax deductions and credits: Failure to file income tax returns can result in the loss of tax deductions and credits. * Audit and investigation: The tax authority may conduct an audit or investigation to determine the individual’s or business’s tax liability.

How to File Income Tax Returns

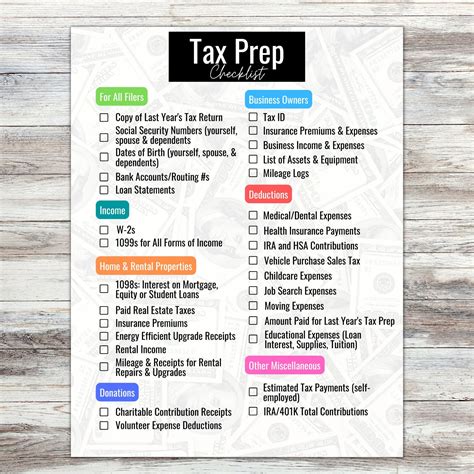

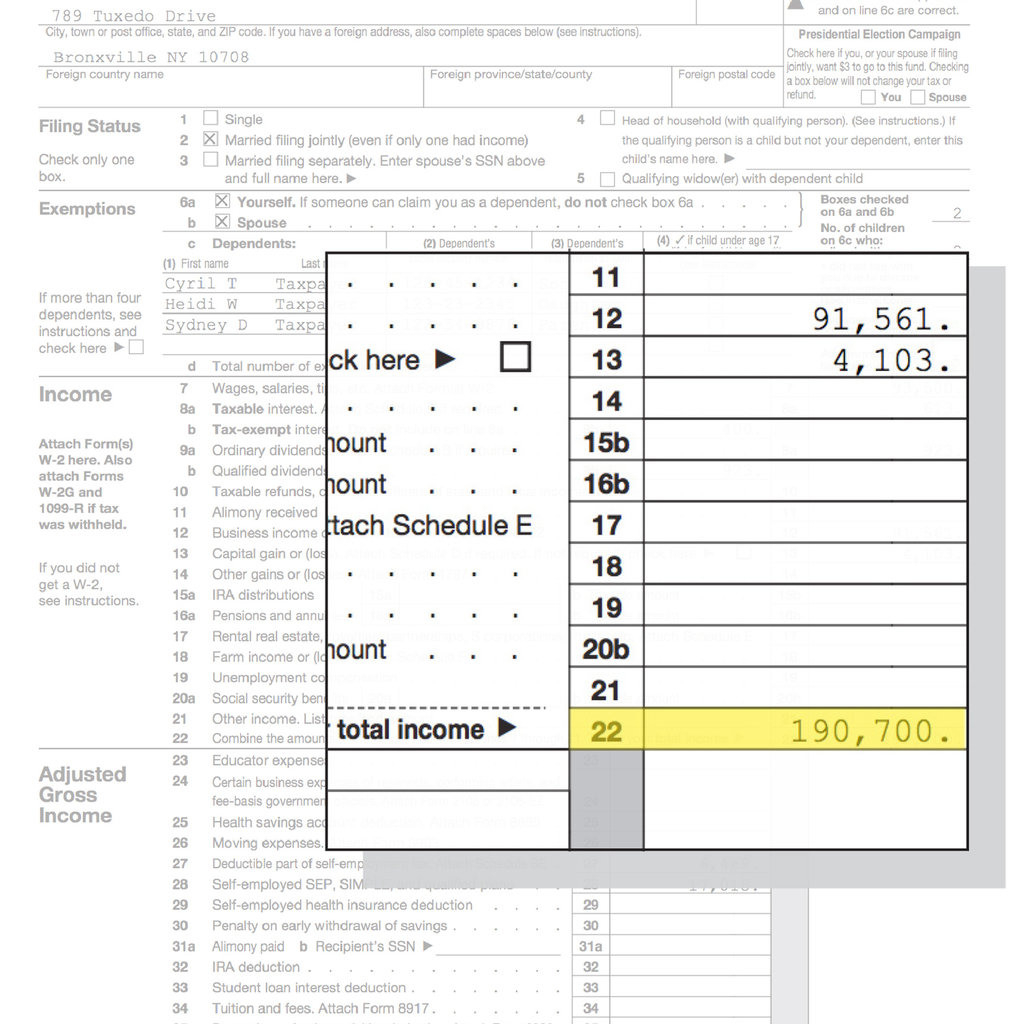

Filing income tax returns can be a complex process, but it can be broken down into several steps: * Gather necessary documents: Individuals and businesses need to gather all necessary documents, including income statements, receipts, and tax deductions. * Choose a filing status: Individuals need to choose a filing status, such as single, married, or head of household. * Complete tax forms: Individuals and businesses need to complete tax forms, such as the 1040 or 1065. * Submit tax returns: Tax returns can be submitted electronically or by mail.

Tax Filing Status

Tax filing status is an important aspect of filing income tax returns. The tax filing status determines the individual’s or business’s tax liability and eligibility for tax deductions and credits. The most common tax filing statuses include: * Single: Individuals who are not married or in a domestic partnership. * Married filing jointly: Married couples who file their tax returns together. * Married filing separately: Married couples who file their tax returns separately. * Head of household: Individuals who are unmarried and have dependents.

Tax Deductions and Credits

Tax deductions and credits can help to reduce an individual’s or business’s tax liability. The most common tax deductions and credits include: * Standard deduction: A fixed amount that can be deducted from income. * Itemized deductions: Expenses that can be deducted from income, such as mortgage interest and charitable donations. * Earned income tax credit: A tax credit for low-income individuals and families. * Child tax credit: A tax credit for families with dependents.

| Tax Deduction/Credit | Description |

|---|---|

| Standard deduction | A fixed amount that can be deducted from income. |

| Itemized deductions | Expenses that can be deducted from income, such as mortgage interest and charitable donations. |

| Earned income tax credit | A tax credit for low-income individuals and families. |

| Child tax credit | A tax credit for families with dependents. |

📝 Note: The tax deductions and credits available may vary depending on the individual's or business's circumstances and the tax laws in their country or state.

As we have explored the importance of filing income tax returns, the benefits of timely submission, and the potential consequences of non-compliance, it is clear that keeping income tax returns is a critical aspect of financial management. By understanding the tax filing process, tax deductions, and credits, individuals and businesses can ensure that they comply with tax laws and regulations, avoiding potential penalties and fines.

To recap, filing income tax returns is essential for individuals and businesses to comply with tax laws and regulations. The benefits of filing income tax returns include tax refunds, tax deductions, and credits, improved financial management, and compliance with tax laws. Failure to file income tax returns can result in serious consequences, including penalties and fines, interest on unpaid taxes, loss of tax deductions and credits, and audit and investigation. By following the steps outlined in this article, individuals and businesses can ensure that they file their income tax returns accurately and on time.

What is the deadline for filing income tax returns?

+

The deadline for filing income tax returns varies depending on the country or state. In the United States, the deadline is typically April 15th.

What are the consequences of not filing income tax returns?

+

The consequences of not filing income tax returns include penalties and fines, interest on unpaid taxes, loss of tax deductions and credits, and audit and investigation.

How do I file income tax returns?

+

To file income tax returns, gather all necessary documents, choose a filing status, complete tax forms, and submit tax returns electronically or by mail.