File Bankruptcy Paperwork Requirements

Introduction to Bankruptcy Paperwork Requirements

Filing for bankruptcy can be a complex and overwhelming process, especially when it comes to the required paperwork. Bankruptcy laws are in place to help individuals and businesses restructure or eliminate debts, but the process involves a significant amount of documentation. Understanding the necessary paperwork is crucial to ensure a smooth and successful bankruptcy filing. In this article, we will delve into the various paperwork requirements for filing bankruptcy, including the necessary forms, documentation, and procedures.

Types of Bankruptcy and Paperwork Requirements

There are several types of bankruptcy, each with its own set of paperwork requirements. The most common types of bankruptcy for individuals and businesses are Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 bankruptcy involves a repayment plan. The paperwork requirements for each type of bankruptcy vary, but some common forms and documents are required for all types.

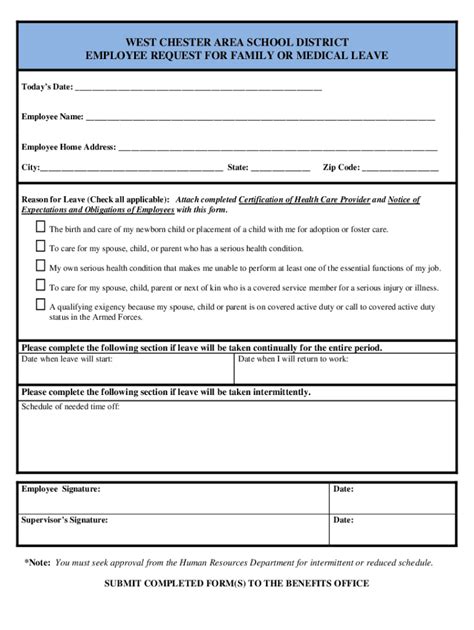

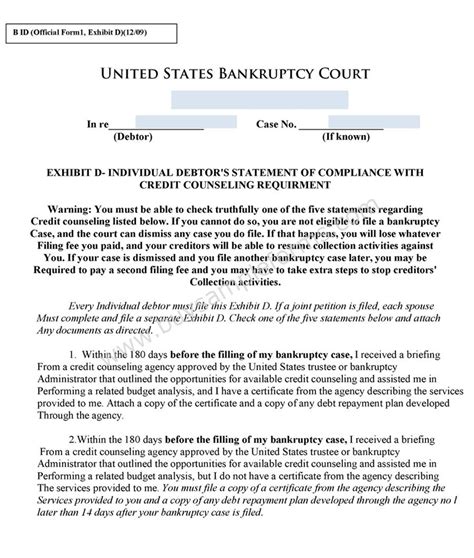

Necessary Forms and Documents

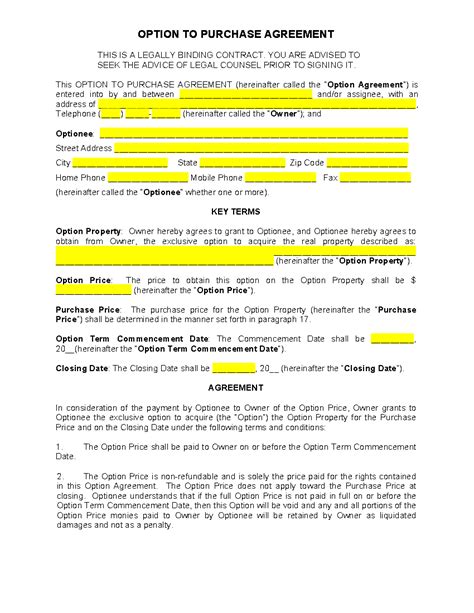

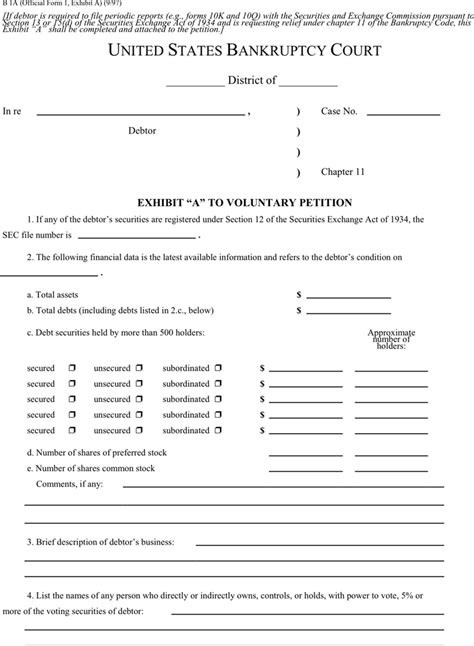

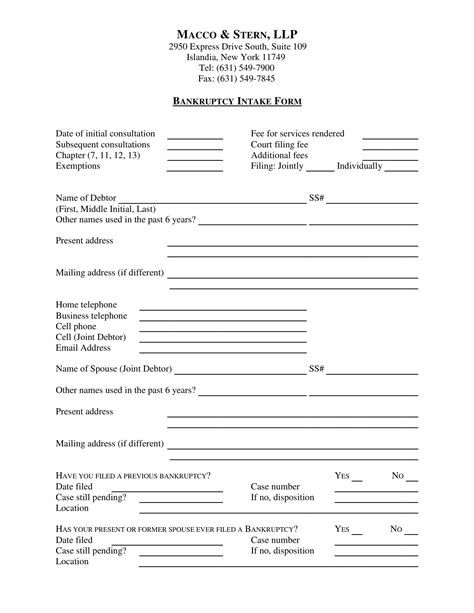

To file for bankruptcy, individuals and businesses must complete and submit various forms and documents, including: * Voluntary Petition for Individuals Filing for Bankruptcy: This form is used to initiate the bankruptcy process and provides basic information about the individual or business. * Schedules A-J: These schedules provide detailed information about the individual’s or business’s assets, liabilities, income, and expenses. * Statement of Financial Affairs: This form provides information about the individual’s or business’s financial transactions, including income, expenses, and debt payments. * Means Test: This form is used to determine whether an individual qualifies for Chapter 7 bankruptcy or must file for Chapter 13 bankruptcy. * Plan: In Chapter 13 bankruptcy, a plan must be submitted outlining the repayment terms and schedule.

Additional Documentation Requirements

In addition to the necessary forms, individuals and businesses must also provide various documents to support their bankruptcy filing, including: * Identification: A valid government-issued ID, such as a driver’s license or passport, is required. * Social Security number: A Social Security number or individual taxpayer identification number is required. * Proof of income: Pay stubs, tax returns, and other documentation may be required to verify income. * Proof of expenses: Receipts, invoices, and other documentation may be required to verify expenses. * Asset documentation: Titles, deeds, and other documentation may be required to verify ownership of assets.

| Form/Document | Description |

|---|---|

| Voluntary Petition | Initiates the bankruptcy process |

| Schedules A-J | Provides detailed information about assets, liabilities, income, and expenses |

| Statement of Financial Affairs | Provides information about financial transactions |

| Means Test | Determines eligibility for Chapter 7 bankruptcy |

| Plan | Outlines repayment terms and schedule for Chapter 13 bankruptcy |

💡 Note: The necessary forms and documents may vary depending on the type of bankruptcy and individual circumstances. It is essential to consult with a bankruptcy attorney to ensure all required paperwork is completed and submitted correctly.

Conclusion and Final Thoughts

Filing for bankruptcy requires a significant amount of paperwork, but understanding the necessary forms and documents can help make the process less overwhelming. By providing accurate and complete information, individuals and businesses can ensure a smooth and successful bankruptcy filing. It is essential to consult with a bankruptcy attorney to ensure all required paperwork is completed and submitted correctly. With the right guidance and support, individuals and businesses can navigate the bankruptcy process and start fresh.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 bankruptcy involves a repayment plan. Chapter 7 bankruptcy is typically used for individuals with limited assets and income, while Chapter 13 bankruptcy is used for individuals with a steady income and assets they want to keep.

What are the necessary forms and documents required for bankruptcy filing?

+

The necessary forms and documents required for bankruptcy filing include the Voluntary Petition, Schedules A-J, Statement of Financial Affairs, Means Test, and Plan. Additional documentation, such as identification, proof of income, and asset documentation, may also be required.

Can I file for bankruptcy without an attorney?

+

While it is possible to file for bankruptcy without an attorney, it is highly recommended that individuals seek the guidance and support of a bankruptcy attorney. Bankruptcy laws and procedures can be complex, and an attorney can help ensure all necessary paperwork is completed and submitted correctly.