5 Tips 529b Taxes

Introduction to 529b Taxes

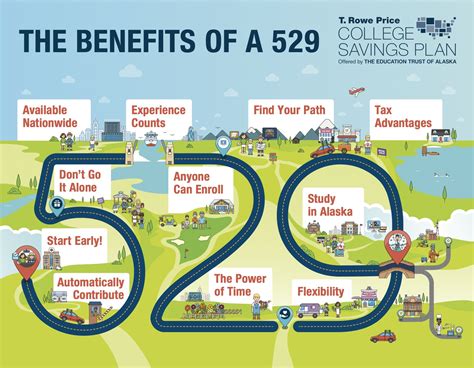

When it comes to planning for education expenses, 529 plans are a popular choice for many families. These plans offer tax benefits that can help make saving for education more efficient. However, navigating the tax implications of 529 plans can be complex. In this article, we’ll explore five key tips to help you understand and manage 529b taxes effectively.

Understanding 529 Plans

Before diving into the tax tips, it’s essential to have a basic understanding of how 529 plans work. A 529 plan is a tax-advantaged savings plan designed to help families save for future education costs. These plans are sponsored by states, state agencies, or educational institutions. Contributions to 529 plans are not deductible from federal income tax, but earnings on the investments grow tax-free. Withdrawals are tax-free if used for qualified education expenses.

Tax Benefits of 529 Plans

One of the primary benefits of 529 plans is their tax advantages. While contributions are made with after-tax dollars, the earnings on investments in a 529 plan grow tax-free. Additionally, distributions (withdrawals) from a 529 plan are tax-free if they are used to pay for qualified education expenses. This makes 529 plans an attractive option for saving for education without incurring significant tax liabilities.

5 Tips for Managing 529b Taxes

Managing the tax aspects of 529 plans requires careful consideration. Here are five tips to help you navigate 529b taxes:

- Understand Qualified Education Expenses: It’s crucial to understand what constitutes qualified education expenses to ensure that your withdrawals from a 529 plan are tax-free. These expenses include tuition, fees, and other related expenses required for enrollment or attendance at an eligible educational institution.

- Keep Accurate Records: Keeping detailed records of your contributions and withdrawals from a 529 plan is vital for tax purposes. This includes receipts for qualified education expenses, as these will be necessary if you are audited.

- Consider State Tax Benefits: Many states offer additional tax benefits for contributions to 529 plans, such as deductions or credits. Researching and understanding these benefits can help maximize your savings.

- Be Aware of the 10% Penalty: Withdrawals from a 529 plan that are not used for qualified education expenses may be subject to income tax and a 10% penalty. Understanding the rules and exceptions to this penalty is crucial for avoiding unnecessary tax liabilities.

- Consult a Tax Professional: Given the complexity of tax laws and the specific rules surrounding 529 plans, consulting a tax professional can provide personalized advice tailored to your situation. They can help you navigate the tax implications of your 529 plan and ensure you’re making the most of the available tax benefits.

Importance of Planning

Planning is key when it comes to 529b taxes. By understanding the tax implications of 529 plans and taking proactive steps to manage these taxes, you can make the most of the tax benefits available. This includes planning for contributions, understanding how to use withdrawals for qualified expenses, and being aware of any potential tax liabilities.

💡 Note: Always consult with a financial advisor or tax professional to get advice tailored to your specific situation, as tax laws and regulations can change.

Conclusion and Next Steps

In conclusion, managing 529b taxes requires a thorough understanding of how 529 plans work and the tax benefits they offer. By following the tips outlined above and seeking professional advice when needed, you can navigate the complex world of 529b taxes with confidence. Remember, planning and understanding are key to making the most of the tax advantages offered by 529 plans.

What are qualified education expenses for 529 plans?

+

Qualified education expenses include tuition, fees, and other related expenses required for enrollment or attendance at an eligible educational institution.

Can I use 529 plan funds for expenses other than tuition?

+

Yes, 529 plan funds can be used for other qualified education expenses such as fees, books, and equipment required for courses. However, it’s essential to check what expenses are considered qualified by the plan and the IRS.

How do I avoid the 10% penalty on 529 plan withdrawals?

+

To avoid the 10% penalty, ensure that withdrawals from a 529 plan are used for qualified education expenses. If you need to withdraw funds for non-qualified expenses, understand that you may be subject to income tax and the penalty, unless an exception applies.