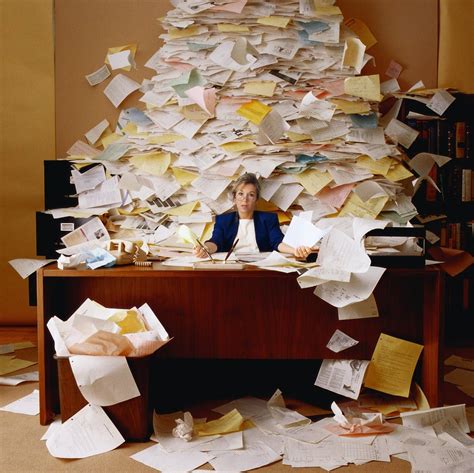

5 E-Check Paperwork Tips

Understanding E-Check Paperwork

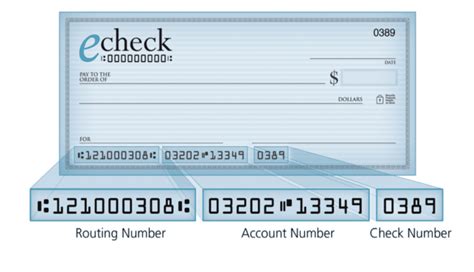

When dealing with electronic checks, or e-checks, it’s essential to have a solid grasp of the associated paperwork. E-checks are a type of electronic payment that allows individuals and businesses to make payments online by providing their checking account information. The paperwork involved in e-check transactions can be complex, but with the right guidance, you can navigate the process with ease. In this article, we will provide you with five valuable tips to help you manage e-check paperwork effectively.

Tips for Managing E-Check Paperwork

To ensure a smooth and efficient e-check payment process, follow these tips: * Verify account information: Before initiating an e-check transaction, double-check the account holder’s name, account number, and routing number to avoid any errors or discrepancies. * Keep accurate records: Maintain detailed records of all e-check transactions, including the date, amount, and purpose of the payment. This will help you keep track of your payments and resolve any potential issues that may arise. * Understand e-check laws and regulations: Familiarize yourself with the laws and regulations governing e-check transactions, such as the Electronic Fund Transfer Act (EFTA) and the Uniform Commercial Code (UCC). * Use secure payment platforms: Utilize reputable and secure payment platforms to process e-check transactions, ensuring the protection of sensitive account information. * Monitor account activity: Regularly review your account statements to detect any suspicious or unauthorized transactions, and report them to your bank or payment processor promptly.

Benefits of E-Check Paperwork

The use of e-checks offers several benefits, including: * Convenience: E-checks allow for quick and easy online payments, eliminating the need for physical checks or visits to the bank. * Cost savings: E-checks reduce the need for paper checks, envelopes, and postage, resulting in significant cost savings. * Environmental benefits: By reducing the use of paper checks, e-checks contribute to a more environmentally friendly payment process. * Improved security: E-checks provide an additional layer of security, as they are less susceptible to fraud and identity theft compared to traditional checks.

E-Check Paperwork Best Practices

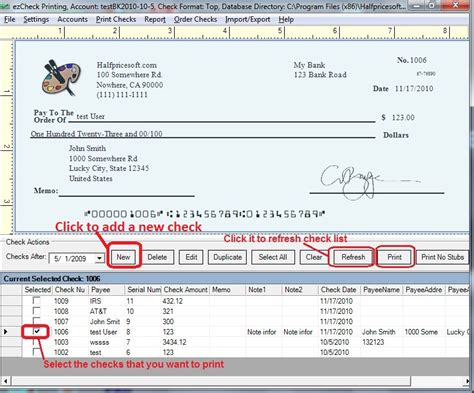

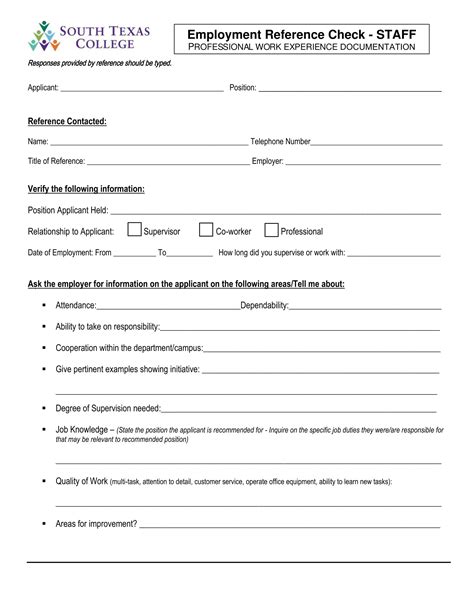

To ensure the efficient management of e-check paperwork, consider the following best practices: * Implement a centralized payment system: Use a single, centralized system to manage and process e-check transactions, reducing the risk of errors and discrepancies. * Establish clear payment policies: Develop and communicate clear payment policies and procedures to all stakeholders, including employees, customers, and vendors. * Provide training and support: Offer regular training and support to employees and customers on the use of e-checks and associated paperwork. * Continuously monitor and evaluate: Regularly review and assess your e-check payment processes to identify areas for improvement and optimize performance.

📝 Note: It's essential to stay up-to-date with the latest laws, regulations, and industry standards governing e-check transactions to ensure compliance and minimize potential risks.

In the end, effective management of e-check paperwork is crucial for individuals and businesses to navigate the complex world of electronic payments. By following the tips and best practices outlined in this article, you can streamline your e-check payment processes, reduce errors, and improve overall efficiency. Whether you’re a seasoned professional or just starting to explore the world of e-checks, understanding the associated paperwork is essential for success in today’s digital landscape.

What is an e-check?

+

An e-check is a type of electronic payment that allows individuals and businesses to make payments online by providing their checking account information.

What are the benefits of using e-checks?

+

The benefits of using e-checks include convenience, cost savings, environmental benefits, and improved security.

How can I ensure the security of my e-check transactions?

+

To ensure the security of your e-check transactions, use reputable and secure payment platforms, verify account information, and monitor account activity regularly.