5 Estate Paperwork Tips

Introduction to Estate Paperwork

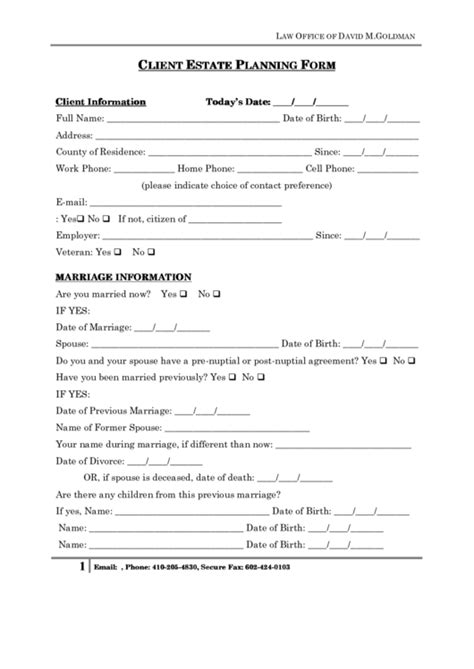

Estate planning is a crucial aspect of managing one’s assets and ensuring that loved ones are taken care of after passing away. A significant part of estate planning involves dealing with various types of paperwork, which can be overwhelming for many individuals. Estate paperwork encompasses a range of documents, including wills, trusts, powers of attorney, and beneficiary designations. In this article, we will delve into the world of estate paperwork and provide valuable tips for navigating this complex process.

Understanding the Importance of Estate Paperwork

Before we dive into the tips, it’s essential to understand why estate paperwork is so critical. Estate planning allows individuals to control how their assets are distributed after they pass away, ensuring that their wishes are respected and their loved ones are protected. Without proper estate planning, the distribution of assets can be left to the courts, which can lead to probate, a lengthy and costly process. Moreover, estate planning can help minimize taxes, avoid family conflicts, and provide for the care of minor children or pets.

Estate Paperwork Tips

Here are five essential tips for managing estate paperwork:

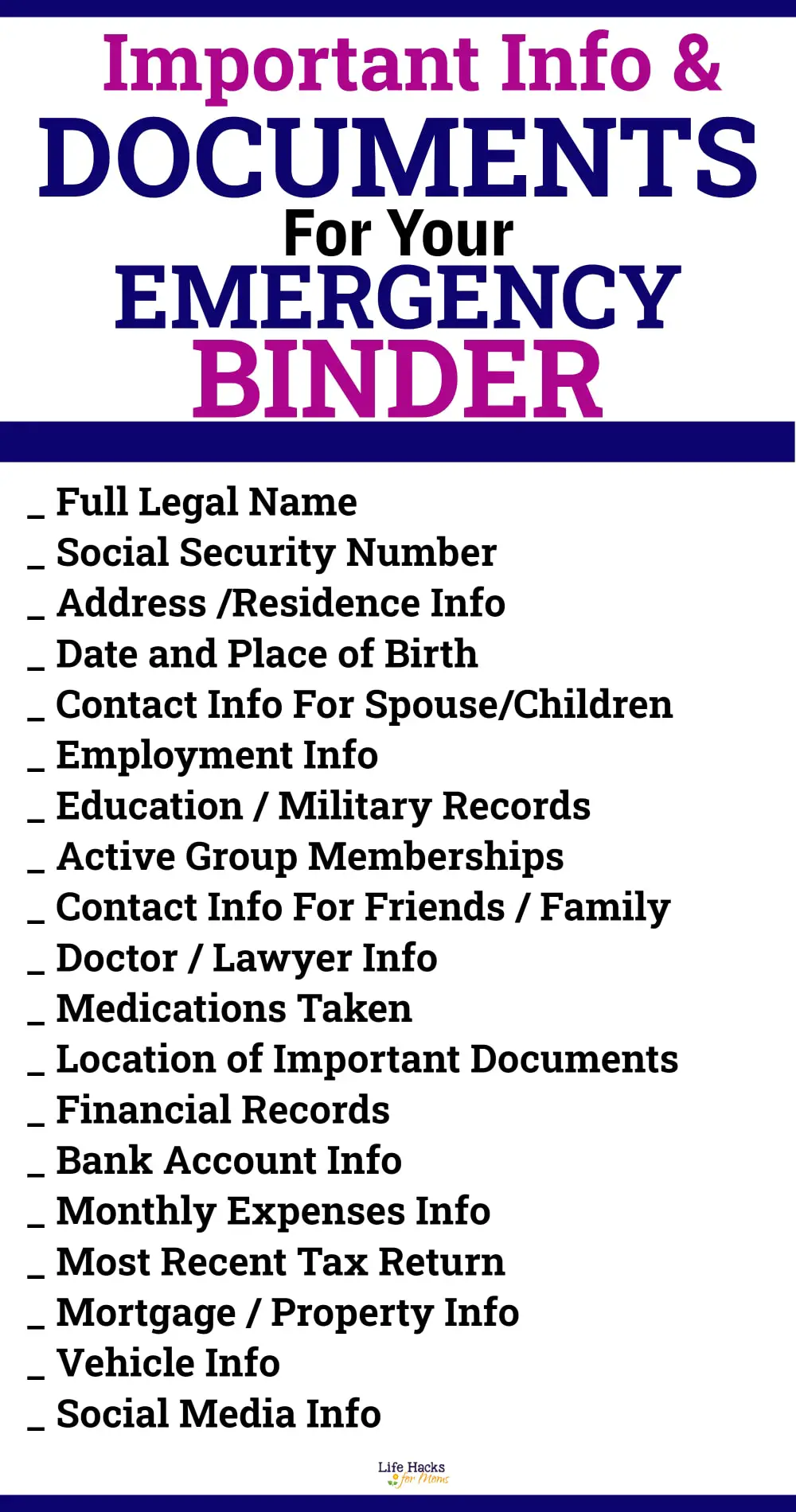

- Tip 1: Create a Comprehensive Inventory: Start by gathering all relevant documents, including property deeds, investment accounts, retirement accounts, and life insurance policies. Make a list of all assets, including their values and locations.

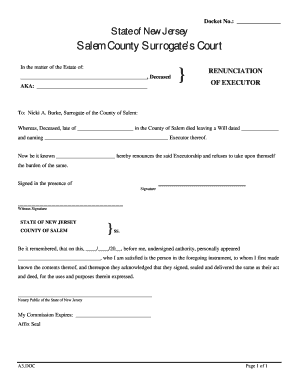

- Tip 2: Establish a Will: A last will and testament is a fundamental document that outlines how assets should be distributed after passing away. It’s crucial to work with an attorney to ensure that the will is valid and meets state requirements.

- Tip 3: Consider a Trust: A trust can be an effective way to manage assets, avoid probate, and minimize taxes. There are various types of trusts, including revocable living trusts, irrevocable trusts, and special needs trusts.

- Tip 4: Designate Beneficiaries: Beneficiary designations are critical for retirement accounts, life insurance policies, and annuities. It’s essential to review and update beneficiary designations regularly to ensure that they align with your estate plan.

- Tip 5: Review and Update Estate Paperwork: Estate planning is not a one-time task; it’s essential to review and update estate paperwork regularly to reflect changes in your life, such as marriages, divorces, births, or deaths.

Additional Considerations

In addition to these tips, it’s essential to consider the following:

- Powers of attorney: Establishing powers of attorney can ensure that someone you trust can manage your financial and medical affairs if you become incapacitated.

- Advance directives: Advance directives, such as living wills and healthcare proxies, can outline your wishes for end-of-life care.

- Tax planning: Estate planning can have significant tax implications; it’s essential to work with an attorney or tax professional to minimize taxes and ensure that your estate plan is tax-efficient.

| Document | Purpose |

|---|---|

| Will | Outlines distribution of assets |

| Trust | Manages assets, avoids probate, and minimizes taxes |

| Power of Attorney | Manages financial and medical affairs if incapacitated |

| Advance Directive | Outlines wishes for end-of-life care |

💡 Note: It's essential to work with an attorney to ensure that your estate paperwork is valid and meets state requirements.

In final thoughts, managing estate paperwork can be a complex and overwhelming process, but with the right guidance and planning, individuals can ensure that their assets are protected and their loved ones are taken care of. By following these tips and considering additional factors, you can create a comprehensive estate plan that reflects your wishes and provides peace of mind.

What is the purpose of a will in estate planning?

+

A will outlines how assets should be distributed after passing away, ensuring that your wishes are respected and your loved ones are protected.

What is the difference between a will and a trust?

+

A will is a document that outlines how assets should be distributed after passing away, while a trust is a legal arrangement that manages assets during your lifetime and after you pass away.

Why is it essential to review and update estate paperwork regularly?

+

Reviewing and updating estate paperwork regularly ensures that your estate plan reflects changes in your life, such as marriages, divorces, births, or deaths, and that your wishes are still being respected.