5 Tesla Financing Tips

Introduction to Tesla Financing

When it comes to purchasing a Tesla, one of the most significant considerations is financing. Tesla, being a premium electric vehicle (EV) brand, comes with a price tag that can be daunting for many potential buyers. However, with the right financing options and strategies, owning a Tesla can become more accessible. In this article, we will explore five essential Tesla financing tips to help you navigate the process with confidence.

Understanding Tesla Financing Options

Before diving into the tips, it’s crucial to understand the financing options available for Tesla vehicles. Tesla offers various financing plans, including loans and leases, through its financial partners. These options can vary based on the model, your credit score, and other factors. It’s essential to research and compare different financing options to find the one that best suits your needs and budget.

Tesla Financing Tip 1: Check Your Credit Score

Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for financing. A good credit score can help you secure a lower interest rate, which can save you money over the life of the loan. Maintaining a good credit score is vital, so ensure you check your credit report and work on improving it if necessary.

Tesla Financing Tip 2: Consider Leasing

Leasing a Tesla can be an attractive option, especially if you want to drive a new vehicle every few years. Leasing typically requires a lower down payment and monthly payments compared to financing a purchase. However, it’s crucial to understand the terms of the lease, including the mileage limit and any fees associated with excessive wear and tear.

Tesla Financing Tip 3: Explore External Financing Options

While Tesla’s financing partners offer competitive rates, it’s worth exploring external financing options to find the best deal. Compare rates from different lenders, including banks, credit unions, and online lenders, to ensure you’re getting the most favorable terms. Some lenders may offer more flexible repayment terms or lower interest rates, so it’s essential to shop around.

Tesla Financing Tip 4: Factor in Incentives and Tax Credits

Tesla vehicles are eligible for federal and state tax credits, which can help reduce the overall cost of ownership. Research the available incentives and factor them into your financing decision. Additionally, some states offer rebates or exemptions from certain fees for EV owners, so be sure to explore these options as well.

Tesla Financing Tip 5: Review and Understand the Contract

Once you’ve selected a financing option, it’s essential to carefully review the contract before signing. Make sure you understand all the terms, including the interest rate, repayment terms, and any fees associated with the loan or lease. Don’t hesitate to ask questions or seek clarification if you’re unsure about any aspect of the contract.

💡 Note: Always read the fine print and ask questions before signing any financing contract to ensure you're making an informed decision.

Additional Considerations

In addition to these financing tips, it’s essential to consider other factors that can impact the overall cost of owning a Tesla. These include: * Insurance costs * Maintenance and repair costs * Charging costs * Any additional features or upgrades you may want

| Model | Starting Price | Financing Options |

|---|---|---|

| Tesla Model 3 | $35,990 | Loan, Lease |

| Tesla Model S | $79,990 | Loan, Lease |

| Tesla Model X | $89,990 | Loan, Lease |

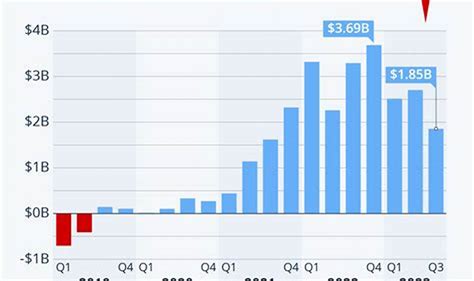

To summarize, financing a Tesla requires careful consideration of various factors, including your credit score, financing options, and additional costs. By following these five Tesla financing tips and doing your research, you can make an informed decision and find the best financing option for your needs.

In the end, owning a Tesla can be a rewarding experience, and with the right financing strategy, you can enjoy the benefits of electric vehicle ownership while managing your costs effectively. Whether you’re a first-time buyer or a seasoned Tesla owner, it’s essential to stay informed and adapt to the ever-changing landscape of EV financing.

What is the typical interest rate for a Tesla loan?

+

The typical interest rate for a Tesla loan varies depending on your credit score and other factors, but it can range from 4% to 7% APR.

Can I lease a Tesla for a longer period than 3 years?

+

Yes, Tesla offers lease options for up to 5 years, but the terms and conditions may vary depending on the model and your location.

Are there any incentives for buying a used Tesla?

+

While there may not be federal tax credits for used Teslas, some states offer incentives for buying used EVs, so it’s worth researching the options in your area.