5 Steps SS Death Benefits

Understanding Social Security Death Benefits

When a family member or loved one passes away, it can be a challenging and emotional time. In addition to coping with the loss, there are often financial implications to consider. The Social Security Administration (SSA) provides survivor benefits to help support the families of deceased workers. These benefits can be a vital source of income, especially for those who rely heavily on the deceased person’s income. In this article, we will explore the 5 steps to apply for Social Security death benefits and what you need to know about the process.

Step 1: Determine Eligibility

To be eligible for Social Security death benefits, the deceased worker must have worked and paid Social Security taxes for a certain number of years. The number of years required varies depending on the worker’s age at the time of death. Generally, a worker must have earned at least 6 credits in the 3 years prior to their death to be eligible for benefits. However, this requirement may be waived if the worker was receiving Social Security benefits at the time of their death. You can use the SSA’s benefits planner to determine if you are eligible for survivor benefits.

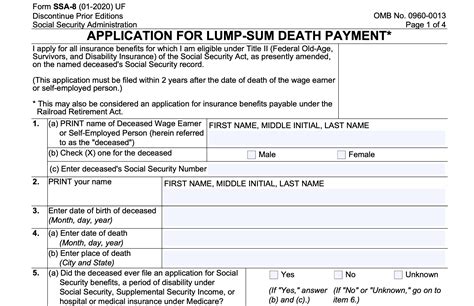

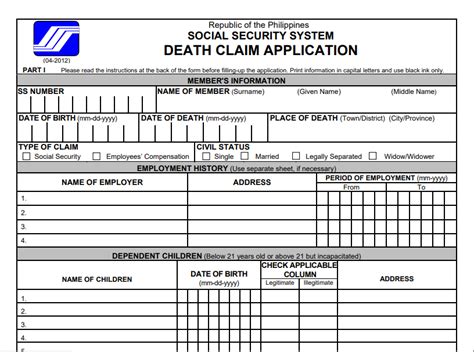

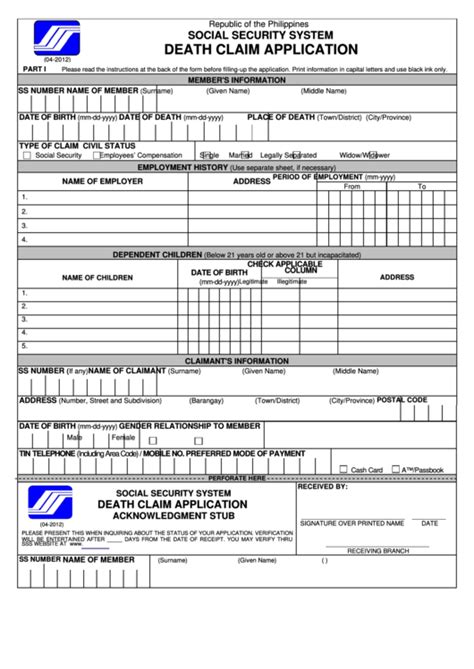

Step 2: Gather Required Documents

To apply for Social Security death benefits, you will need to provide certain documents to the SSA. These documents may include: * The deceased worker’s Social Security number * A death certificate * Proof of relationship to the deceased worker (such as a marriage certificate or birth certificate) * Proof of income and resources (such as bank statements or tax returns) * Dependent children’s birth certificates or adoption papers (if applicable)

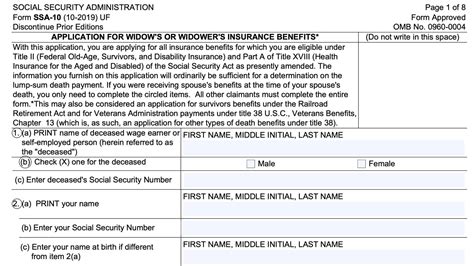

Step 3: Apply for Benefits

You can apply for Social Security death benefits by: * Calling the SSA’s toll-free number at 1-800-772-1213 (TTY 1-800-325-0778) * Visiting your local SSA office * Applying online through the SSA’s website (for some types of benefits) It’s a good idea to schedule an appointment with the SSA in advance to ensure that you can get the help you need. When you apply, you will need to provide the documents gathered in Step 2 and answer questions about the deceased worker’s employment and earnings history.

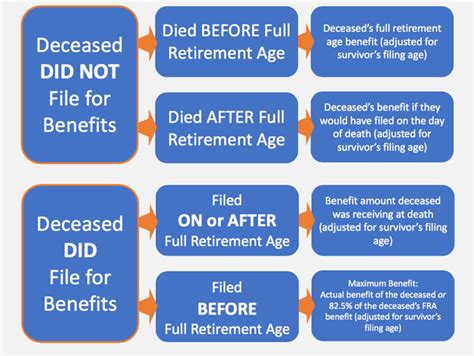

Step 4: Calculate Your Benefits

The SSA uses a formula to calculate survivor benefits based on the deceased worker’s earnings record. The amount of benefits you receive will depend on: * The deceased worker’s primary insurance amount (PIA) * Your relationship to the deceased worker (such as spouse, child, or parent) * Your age and earnings history You can use the SSA’s benefits calculator to estimate your benefits. Keep in mind that the SSA may also consider other income you receive, such as pensions or annuities, when calculating your benefits.

Step 5: Receive Your Benefits

Once your application is approved, you will begin receiving Social Security death benefits. Benefits are typically paid monthly, and you can choose to receive them by direct deposit or paper check. You will also receive a Medicare card if you are eligible for Medicare benefits. It’s essential to report any changes in your income or living situation to the SSA, as this may affect your benefits.

| Benefit Type | Eligibility | Benefit Amount |

|---|---|---|

| Widow/Widower Benefits | Age 60 or older (50 or older if disabled) | 100% of deceased worker's PIA |

| Disabled Widow/Widower Benefits | Age 50 or older and disabled | 71.5% of deceased worker's PIA |

| Child Benefits | Under age 18 (or 19 if still in high school) | 75% of deceased worker's PIA |

💡 Note: The SSA may request additional information or documentation to process your application. Be sure to respond promptly to any requests to avoid delays in receiving your benefits.

In summary, applying for Social Security death benefits involves determining eligibility, gathering required documents, applying for benefits, calculating your benefits, and receiving your benefits. It’s essential to understand the process and what to expect to ensure that you receive the benefits you are entitled to. By following these 5 steps and seeking help from the SSA when needed, you can navigate the application process with confidence.

The process of applying for Social Security death benefits can be complex, but with the right guidance, you can get the support you need during a difficult time. Remember to stay informed about your benefits and report any changes to the SSA to ensure that you continue to receive the benefits you are eligible for.

How do I apply for Social Security death benefits?

+

You can apply for Social Security death benefits by calling the SSA’s toll-free number, visiting your local SSA office, or applying online through the SSA’s website (for some types of benefits).

What documents do I need to apply for Social Security death benefits?

+

You will need to provide the deceased worker’s Social Security number, a death certificate, proof of relationship to the deceased worker, proof of income and resources, and dependent children’s birth certificates or adoption papers (if applicable).

How are Social Security death benefits calculated?

+

The SSA uses a formula to calculate survivor benefits based on the deceased worker’s earnings record. The amount of benefits you receive will depend on the deceased worker’s primary insurance amount, your relationship to the deceased worker, your age, and your earnings history.