LLC Paperwork Filing Requirements

Introduction to LLC Paperwork Filing Requirements

Forming a Limited Liability Company (LLC) is a significant step for any business, offering liability protection and tax benefits. However, the process of setting up an LLC involves several legal and regulatory steps, one of the most critical being the filing of necessary paperwork with the state. The requirements for LLC paperwork filing vary from state to state, but there are common elements that must be addressed in every jurisdiction. Understanding these requirements is essential for entrepreneurs and small business owners to ensure their LLC is properly established and compliant with state laws.

Choosing the Business Name

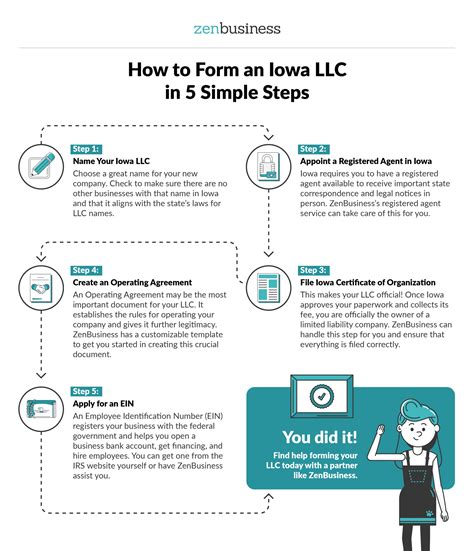

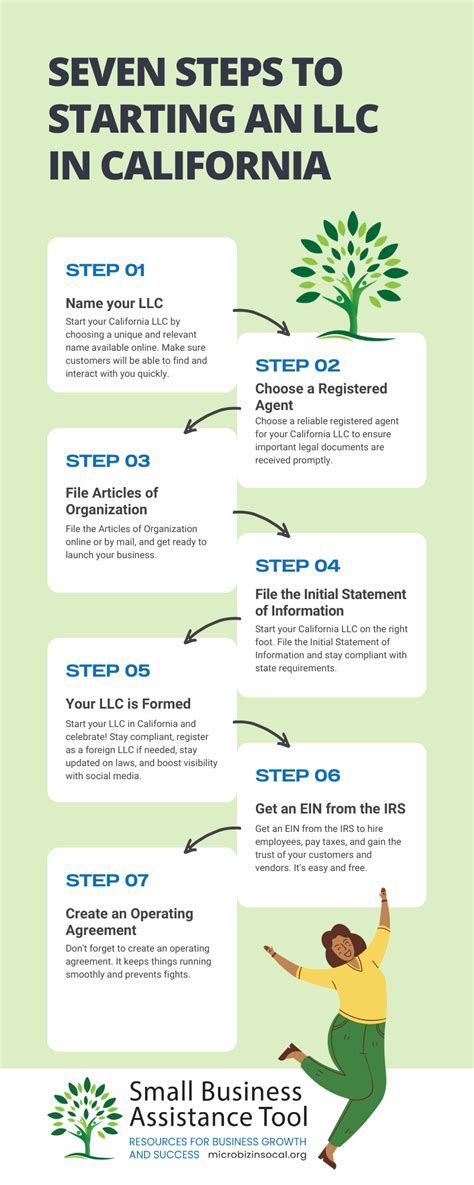

Before filing any paperwork, it’s crucial to choose a unique and compliant business name. The name must include the phrase “Limited Liability Company” or an abbreviation such as “LLC” or “L.L.C.” It’s also important to ensure the name isn’t already in use by another business in the state. Conducting a business name search through the state’s business database can help verify the availability of the desired name. Additionally, it’s wise to check if the desired web domain and social media handles are available to maintain brand consistency across platforms.

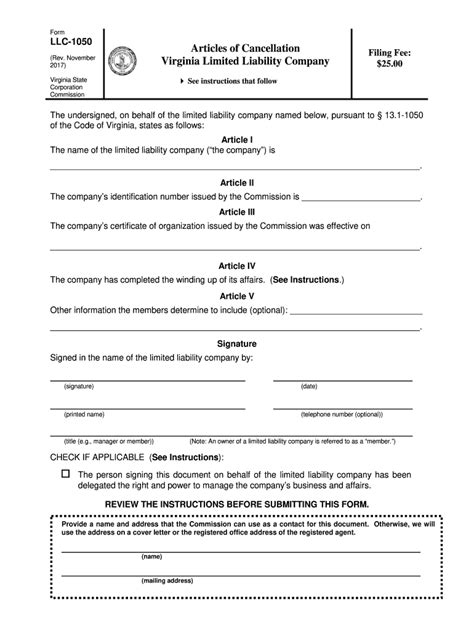

Preparing the Articles of Organization

The Articles of Organization (also known as Certificate of Organization in some states) is a foundational document that officially establishes the LLC. This document typically includes: - Business name and address - Purpose of the business - Duration of the LLC (if not perpetual) - Management structure (member-managed or manager-managed) - Registered agent information

The Articles of Organization must be filed with the state’s business registration office, usually the Secretary of State. The filing process can often be completed online, by mail, or in person, depending on the state’s requirements. There is typically a filing fee associated with this process, which varies by state.

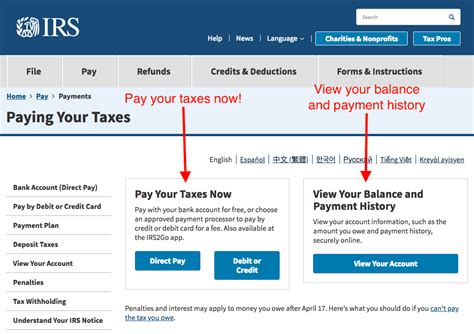

Obtaining an EIN

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses for tax purposes. Even if the LLC does not have employees, it is usually necessary to obtain an EIN to open a business bank account, file tax returns, and conduct other financial operations. The application for an EIN can be submitted online through the IRS website and is typically processed immediately.

Creating an Operating Agreement

Although not always required by state law, an Operating Agreement is a critical document for any LLC. It outlines the ownership structure, management responsibilities, and operational procedures of the company. This document helps prevent disputes and ensures all members are on the same page regarding the business’s direction and policies. Even single-member LLCs can benefit from having an operating agreement, as it provides a clear framework for the business’s operation and can be useful in demonstrating the LLC’s separate existence from its owner in case of an audit.

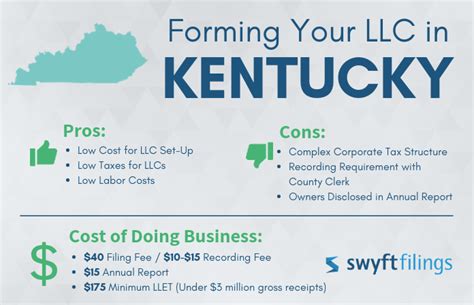

Registering for State Taxes

LLCs may need to register for state taxes, which could include sales tax, employment tax, or other state-specific taxes. The requirements depend on the nature of the business and the state in which it operates. Checking with the state’s tax authority or department of revenue is essential to understand the specific tax obligations of the LLC.

Obtaining Licenses and Permits

Depending on the type of business and its location, the LLC may need to obtain licenses and permits to operate legally. These can be issued by local, state, or federal agencies and might include business licenses, zoning permits, health department permits, or professional licenses. Researching the specific requirements for the business’s industry and location is crucial to avoid non-compliance issues.

Annual Reporting Requirements

Most states require LLCs to file annual reports to maintain their good standing. These reports typically update the state on any changes in the business’s structure, management, or contact information. The due date and required content of the annual report vary by state, so it’s essential to be aware of these requirements to avoid late fees or even dissolution of the LLC.

📝 Note: It's crucial to maintain accurate and detailed records of all filings, including receipts and confirmation documents, as these may be required for future reference or audits.

Conclusion and Next Steps

Establishing an LLC involves a series of critical steps, from choosing a compliant business name to filing annual reports. Each state has its unique set of requirements, making it essential for business owners to research and understand the specific regulations that apply to their LLC. By carefully following these requirements and maintaining compliance, entrepreneurs can ensure their LLC is properly established and positioned for success. It’s also a good idea to consult with legal or accounting professionals to ensure all aspects of the LLC formation are handled correctly, especially for complex businesses or those operating in multiple states.

What is the primary purpose of filing Articles of Organization?

+

The primary purpose of filing Articles of Organization is to officially establish the Limited Liability Company (LLC) with the state, providing fundamental information about the business.

Do all states require an Operating Agreement for LLCs?

+

No, not all states require an Operating Agreement for LLCs by law. However, it is highly recommended to have one to outline the company’s structure, management, and operational procedures, helping to prevent future disputes.

How often do LLCs need to file annual reports with the state?

+

Most states require LLCs to file annual reports once a year. The exact due date can vary by state, so it’s essential to check with the state’s business registration office for specific deadlines and requirements.