Buying a House Paperwork Needed

Introduction to Buying a House

When it comes to buying a house, the process can be overwhelming, especially for first-time buyers. One of the most critical aspects of this process is the paperwork involved. Understanding what documents are required and why they are necessary can make the experience less daunting. In this article, we will delve into the various types of paperwork needed when buying a house, explaining each document’s purpose and importance in the home buying process.

Pre-Purchase Paperwork

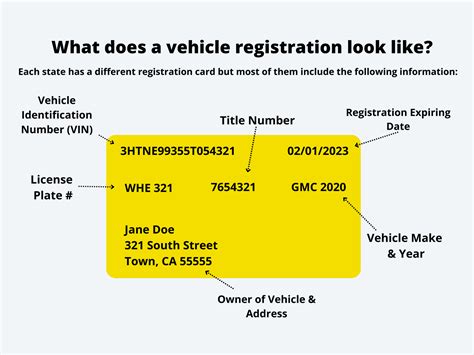

Before starting the house hunt, it’s essential to have certain documents ready. These include: - Identification Documents: A valid government-issued ID, such as a driver’s license or passport, is necessary for verification purposes. - Proof of Income: Pay stubs, W-2 forms, and tax returns are required to demonstrate financial stability and ability to secure a mortgage. - Bank Statements: Recent bank statements are needed to show savings and cash reserves, which are crucial for down payments and closing costs. - Credit Reports: A good credit score can significantly affect the mortgage interest rate and terms. Buyers should check their credit reports for any errors or negative marks.

Mortgage Application Paperwork

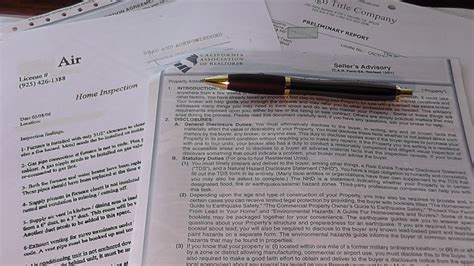

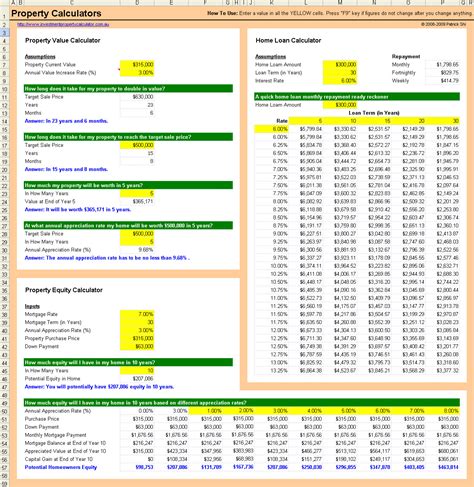

Once a house is found, and an offer is accepted, the next step is to apply for a mortgage. The paperwork required for a mortgage application includes: - Mortgage Application Form: This form requires detailed financial and personal information. - Employment Verification: The lender may contact the buyer’s employer to verify employment status and income. - Appraisal Report: An appraisal is conducted to determine the value of the property, ensuring it matches the sale price. - Title Search and Insurance: A title search is performed to ensure the seller has the right to sell the property, and title insurance protects against any future claims.

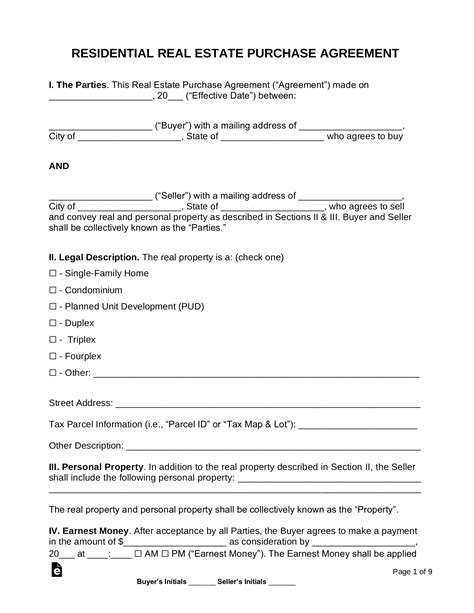

Closing Paperwork

At the closing stage, several key documents are signed and exchanged. These include: - Deed: Transfers ownership of the property from the seller to the buyer. - Mortgage Note: A promise to repay the mortgage, including the loan amount, interest rate, and repayment terms. - Mortgage Deed: Puts a lien on the property, giving the lender the right to sell the property if the mortgage is not repaid. - Closing Disclosure: Outlines the terms of the loan, including the loan amount, interest rate, and all costs associated with the transaction.

📝 Note: It's crucial for buyers to carefully review all documents before signing, ensuring they understand all terms and conditions.

Post-Purchase Paperwork

After the purchase is complete, there are a few more documents to consider: - Homeowner’s Insurance: Required by lenders to protect against damage or loss. - Property Tax Records: Buyers will need to update property tax records to reflect the change in ownership. - Warranty and Maintenance Records: Keeping track of any warranties and maintenance records for appliances and systems in the home.

Organizing Your Paperwork

With so many documents involved in the home buying process, it’s essential to stay organized. Using a folder or digital storage system to keep all paperwork in one place can help. Buyers should also make digital copies of important documents and store them securely.

| Document | Purpose |

|---|---|

| Identification Documents | Verification of identity |

| Proof of Income | Demonstrate financial stability |

| Bank Statements | Show savings and cash reserves |

| Credit Reports | Assess creditworthiness |

In the end, understanding and preparing the necessary paperwork is key to a successful and stress-free home buying experience. By knowing what to expect and being organized, buyers can navigate the process with confidence, ensuring they are well on their way to owning their dream home.

What is the first step in preparing to buy a house?

+

The first step is to check your credit score and history, as this will affect your ability to secure a mortgage and the interest rate you will qualify for.

Why is a title search necessary?

+

A title search is necessary to ensure the seller has the legal right to sell the property and to uncover any potential issues or claims against the property.

What is the purpose of the closing disclosure?

+

The closing disclosure outlines the final terms of the loan, including the loan amount, interest rate, and all costs associated with the transaction, providing a clear understanding of the buyer’s financial obligations.