5 Bankruptcy Paper Tips

Understanding Bankruptcy Papers: A Comprehensive Guide

When dealing with bankruptcy, it’s essential to understand the paperwork involved. Bankruptcy papers can be overwhelming, but with the right guidance, individuals can navigate the process more smoothly. In this article, we’ll explore five tips for handling bankruptcy papers, making the process less daunting.

Tip 1: Organize Your Financial Documents

Before filing for bankruptcy, it’s crucial to gather and organize all relevant financial documents. This includes:

- Income statements

- Expense reports

- Asset lists

- Debt records

- Credit reports

Tip 2: Understand the Different Types of Bankruptcy

There are several types of bankruptcy, including Chapter 7, Chapter 11, and Chapter 13. Each type has its own set of rules and requirements. Understanding the differences between these types will help you determine which one is best for your situation. For example:

- Chapter 7: Liquidation bankruptcy, where assets are sold to pay off debts

- Chapter 11: Reorganization bankruptcy, where businesses can restructure their debts

- Chapter 13: Personal reorganization bankruptcy, where individuals can create a repayment plan

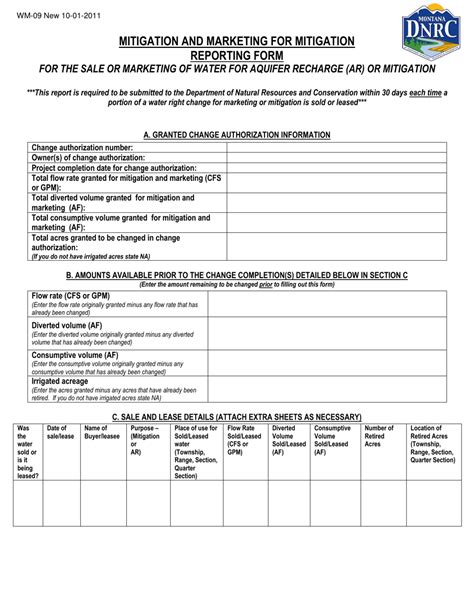

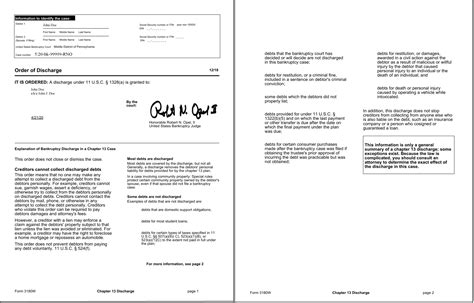

Tip 3: Complete the Bankruptcy Forms Accurately

Bankruptcy forms can be complex and time-consuming to fill out. It’s essential to complete them accurately to avoid delays or even dismissal of your case. Some of the forms you’ll need to complete include:

- Voluntary Petition for Individuals Filing for Bankruptcy

- Schedules A/B: Property

- Schedules C: Exemptions

- Schedules D: Creditors Holding Secured Claims

Tip 4: File Your Bankruptcy Papers Electronically

Many courts now offer electronic filing options for bankruptcy papers. This can save time and reduce errors. When filing electronically, make sure to:

- Use a secure internet connection

- Keep a record of your filing confirmation

- Verify that your documents have been accepted by the court

Tip 5: Keep Detailed Records of Your Bankruptcy Case

Keeping detailed records of your bankruptcy case is crucial. This includes:

- Court documents

- Communication with your attorney and creditors

- Payment records

📝 Note: It's essential to seek the advice of a qualified bankruptcy attorney to ensure you're following the correct procedures and meeting all the necessary requirements.

In the end, navigating bankruptcy papers requires patience, attention to detail, and a thorough understanding of the process. By following these five tips, individuals can make the process less overwhelming and increase their chances of a successful outcome. The key to a smooth bankruptcy process is being well-informed and prepared, and with the right guidance, anyone can achieve a fresh financial start.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy is a liquidation bankruptcy, where assets are sold to pay off debts, while Chapter 13 bankruptcy is a personal reorganization bankruptcy, where individuals can create a repayment plan to pay off debts over time.

Do I need to hire a bankruptcy attorney to file for bankruptcy?

+

While it’s not required to hire a bankruptcy attorney, it’s highly recommended. A qualified attorney can help you navigate the complex bankruptcy process and ensure that you’re meeting all the necessary requirements.

How long does the bankruptcy process typically take?

+

The length of the bankruptcy process can vary depending on the type of bankruptcy and the complexity of the case. On average, Chapter 7 bankruptcy cases can take around 4-6 months to complete, while Chapter 13 cases can take 3-5 years to complete.