Paperwork

File My Own Taxes Paperwork

Introduction to Filing Your Own Taxes

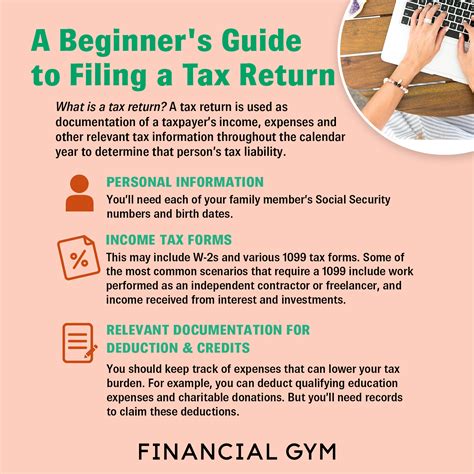

Filing your own taxes can seem like a daunting task, but with the right guidance and tools, it can be a straightforward process. The key to successfully filing your own taxes is to understand the tax laws and regulations that apply to your specific situation. In this article, we will walk you through the steps to file your own taxes, including gathering necessary paperwork, choosing the right filing status, and navigating the tax filing process.

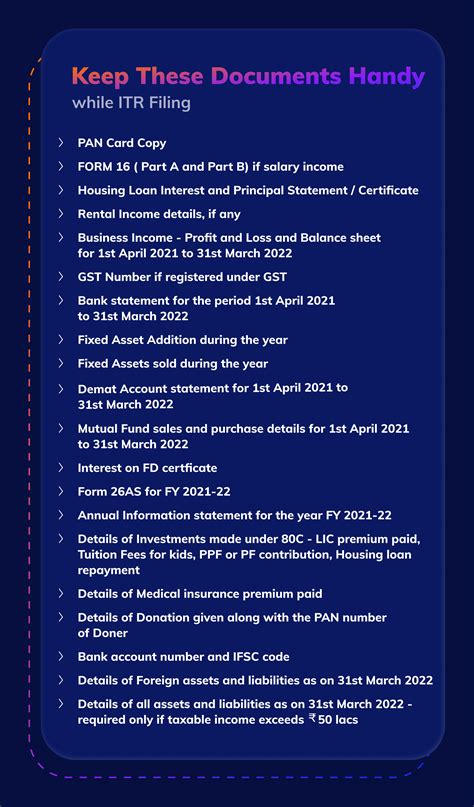

Gathering Necessary Paperwork

To file your own taxes, you will need to gather several important documents. These include:

- W-2 forms from your employer, showing your income and taxes withheld

- 1099 forms for any freelance or contract work

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements

- Property tax statements

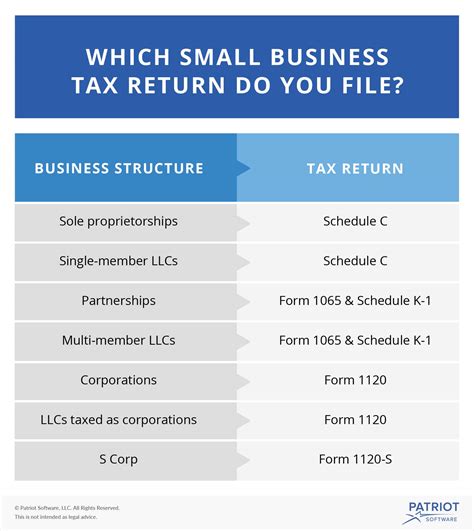

Choosing the Right Filing Status

Your filing status determines your tax rate and eligibility for certain deductions and credits. The most common filing statuses are:

- Single: unmarried individuals

- Married Filing Jointly: married couples who file together

- Married Filing Separately: married couples who file separately

- Head of Household: unmarried individuals with dependents

- Qualifying Widow(er): individuals who have lost a spouse and have dependents

Navigating the Tax Filing Process

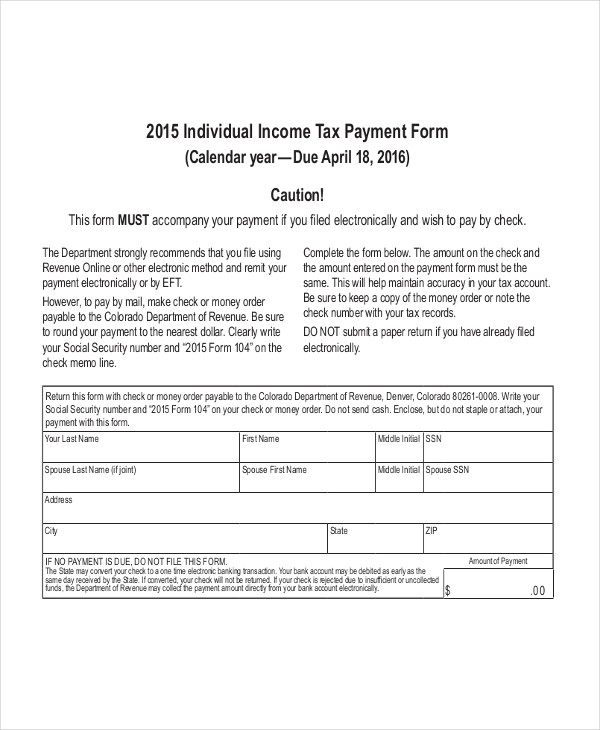

Once you have gathered your paperwork and chosen your filing status, you can begin the tax filing process. You can file your taxes:

- Electronically: using tax software or the IRS website

- By mail: mailing your tax return to the IRS

Tax Deductions and Credits

Tax deductions and credits can help reduce your tax liability. Common deductions include:

- Charitable donations

- Medical expenses

- Mortgage interest

- Property taxes

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Common Tax Filing Mistakes

To avoid delays or even an audit, it is essential to avoid common tax filing mistakes. These include:

- Inaccurate or missing information

- Math errors

- Incorrect filing status

- Missing signatures

💡 Note: If you are unsure about any aspect of the tax filing process, consider consulting a tax professional or seeking guidance from the IRS website.

Conclusion and Final Thoughts

Filing your own taxes requires careful planning and attention to detail, but with the right guidance, it can be a straightforward process. By gathering necessary paperwork, choosing the right filing status, and navigating the tax filing process, you can ensure a smooth and stress-free experience. Remember to take advantage of tax deductions and credits, and avoid common mistakes to minimize your tax liability. With these tips and a little practice, you can confidently file your own taxes and take control of your financial future.

What is the deadline for filing taxes?

+

The deadline for filing taxes is typically April 15th of each year, but it may be extended in certain circumstances.

Do I need to file taxes if I don’t owe anything?

+

Yes, even if you don’t owe anything, you should still file taxes to report your income and claim any eligible deductions and credits.

Can I file taxes electronically?

+

Yes, you can file taxes electronically using tax software or the IRS website. Electronic filing is generally faster and more convenient than mailing your return.