Get Copy of EIN Paperwork

Understanding the Importance of EIN Paperwork

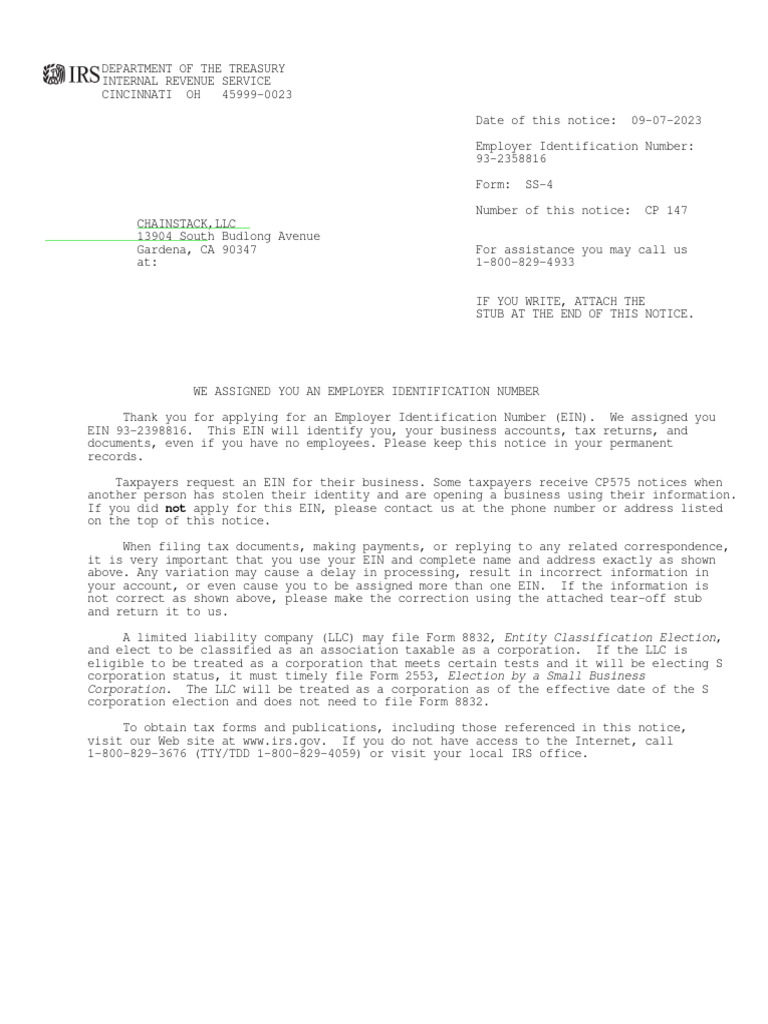

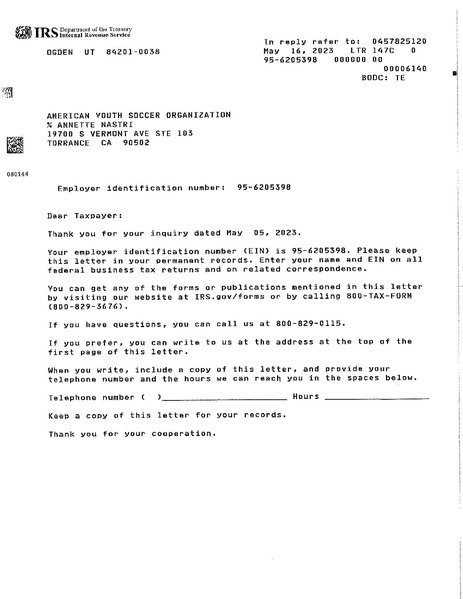

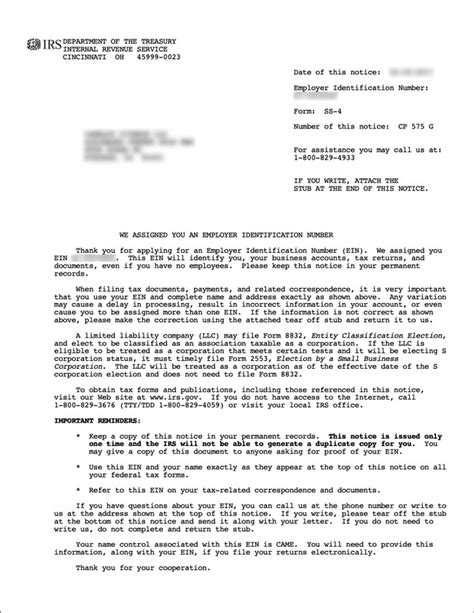

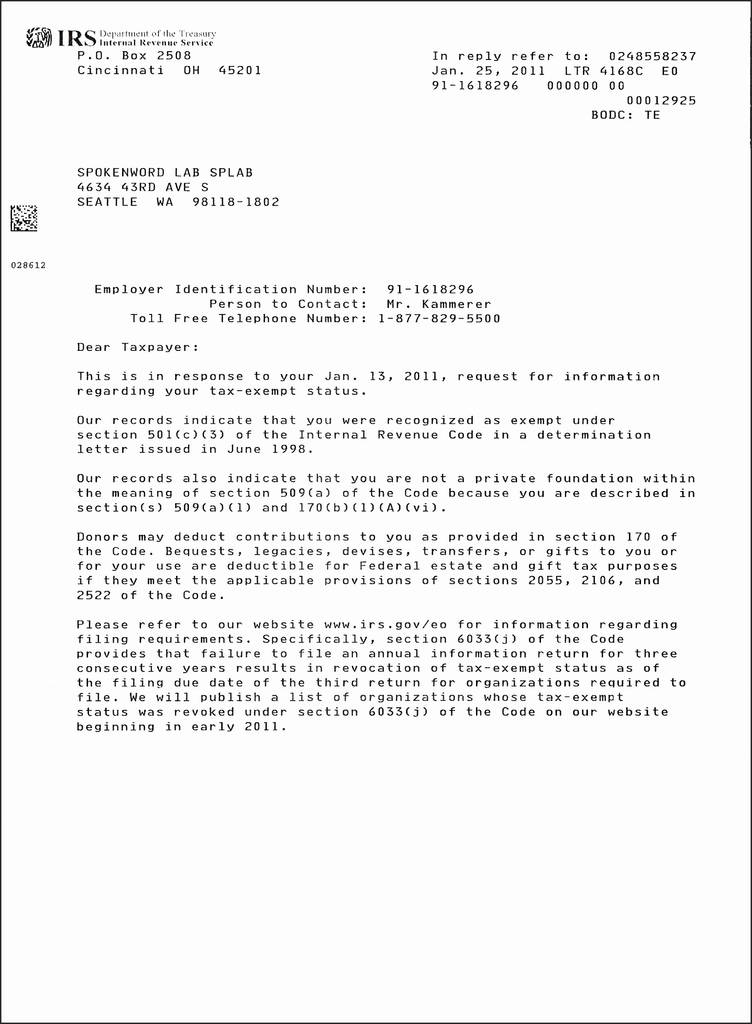

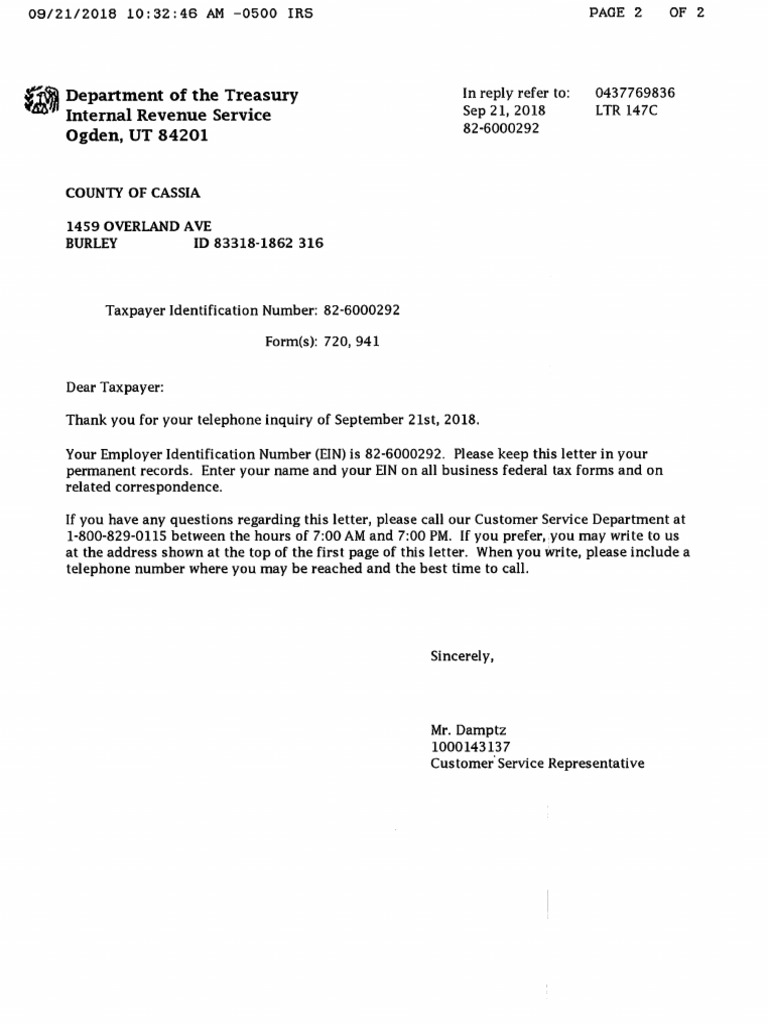

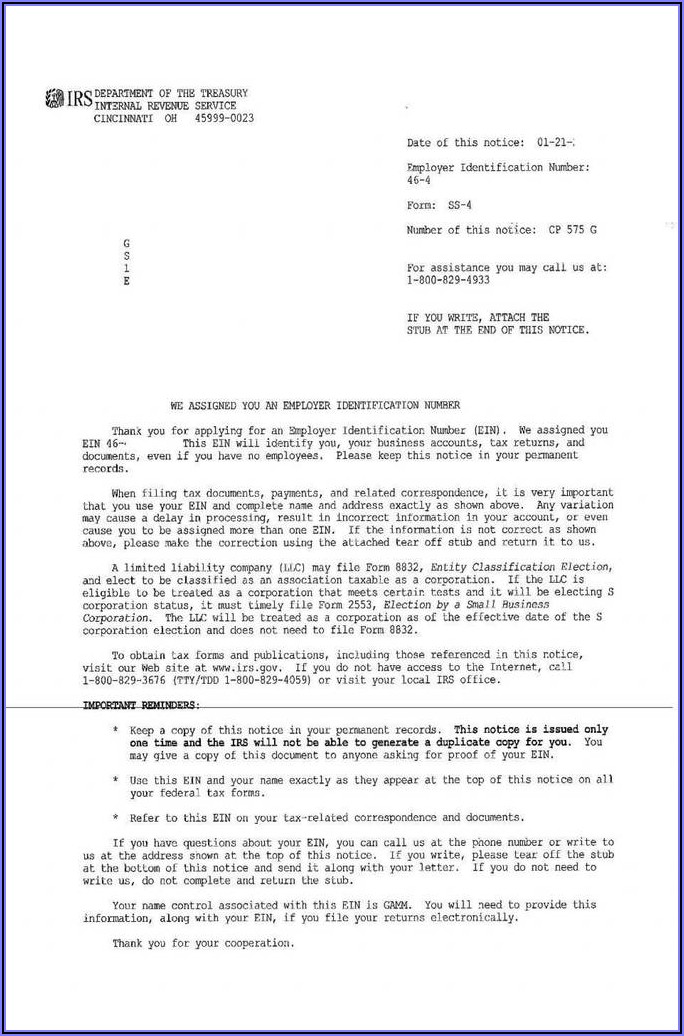

When you apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS), you receive a confirmation letter, also known as the EIN paperwork, which is a crucial document for your business. This paperwork serves as proof that your business has been assigned an EIN, which is necessary for tax filing, hiring employees, and opening business bank accounts. If you have lost your EIN confirmation letter or need a copy for any reason, there are steps you can follow to obtain one.

Why You Might Need a Copy of Your EIN Paperwork

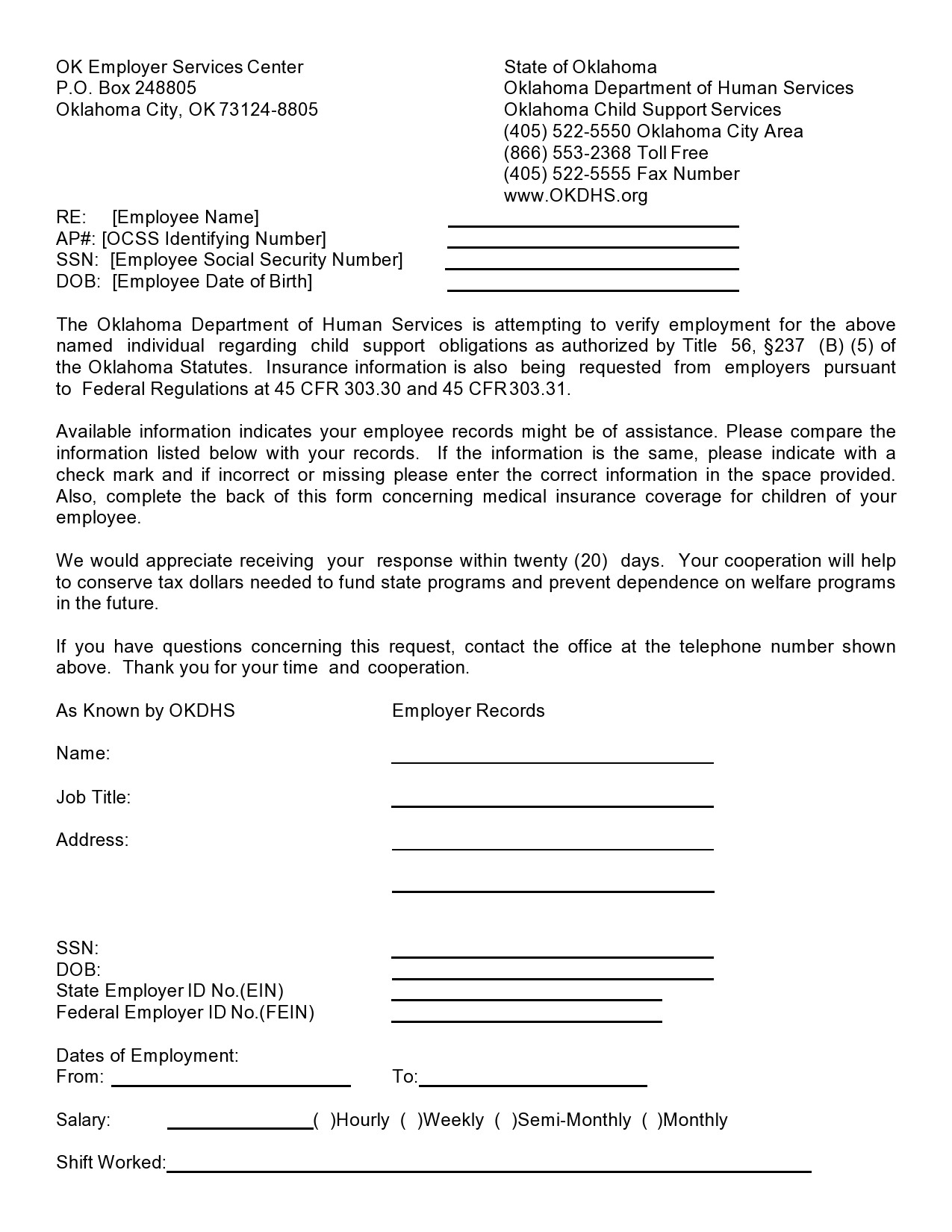

There are several reasons why you might need a copy of your EIN paperwork: - Verification for Business Accounts: Banks and other financial institutions may request a copy of your EIN confirmation letter to verify your business’s identity when you open a business bank account or apply for a loan. - Tax Compliance: You may need to provide your EIN to comply with tax laws, especially during tax season or when dealing with tax audits. - Employee Hiring: When hiring employees, you’ll need your EIN for payroll taxes and other employment-related paperwork. - Business Licenses and Permits: Depending on your business type and location, you might need your EIN to apply for certain licenses and permits.

Steps to Get a Copy of Your EIN Paperwork

If you need a copy of your EIN confirmation letter, follow these steps: - Contact the IRS: The most direct way to get a copy of your EIN confirmation letter is by contacting the IRS Business and Specialty Tax Line. You can call them at (800) 829-4933. Be prepared to provide your business name, address, and other identifying information to verify your identity. - Visit the IRS Website: While the IRS does not provide a downloadable copy of your EIN confirmation letter through their website, you can find information on how to contact them to request a copy. - Check Your Email: If you applied for your EIN online, you would have received an electronic confirmation. Check your email archives for this confirmation.

📝 Note: The IRS may request additional information or verification to ensure the security of your business's tax information. Be patient and provide all necessary details to facilitate the process.

Preventing Loss of EIN Paperwork in the Future

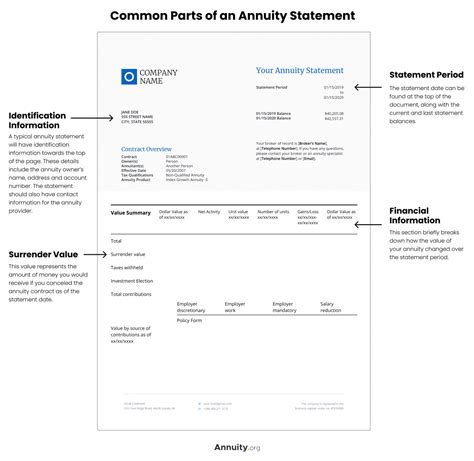

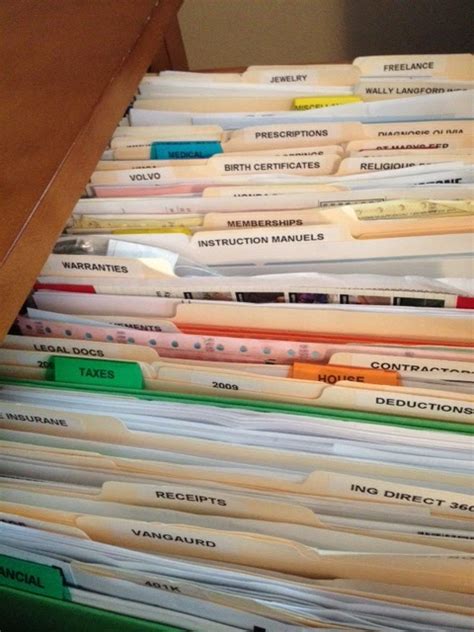

To avoid the hassle of requesting a copy of your EIN paperwork in the future, consider the following: - Digital Storage: Scan your EIN confirmation letter and store it securely in a digital format. Use cloud storage services or encrypted local storage to protect your documents. - Physical Storage: Keep a physical copy of your EIN confirmation letter in a safe and secure location, such as a fireproof safe or a locked cabinet. - Record Keeping: Maintain accurate and detailed records of all your business documents, including your EIN paperwork. This practice will help you stay organized and ensure that you can easily find the documents you need.

Security and Privacy Considerations

Your EIN is sensitive information that should be protected against unauthorized access. When sharing your EIN confirmation letter, ensure that you are doing so with trusted parties who have a legitimate need to know this information. Be cautious of phishing scams or other fraudulent activities that might target your business’s tax information.

| Action | Recommended Approach |

|---|---|

| Storing EIN Confirmation | Digital and physical storage in secure locations |

| Sharing EIN Information | Only share with trusted parties who have a legitimate need to know |

| Requesting a Copy | Contact the IRS Business and Specialty Tax Line |

In summary, your EIN paperwork is a critical document that verifies your business’s identity for tax purposes, banking, and other legal requirements. If you need a copy, contacting the IRS is the most straightforward method. Always prioritize the security and privacy of your EIN and related documents to protect your business from potential fraud or identity theft.

How do I apply for an EIN if I haven’t already?

+

You can apply for an EIN through the IRS website, by phone, or by mail. The online application is the quickest method, available Monday through Friday. You will need to provide your business and personal information to complete the application.

Can I use my Social Security Number instead of an EIN for my business?

+

While you can use your Social Security Number for sole proprietorships, it is recommended to obtain an EIN for your business to protect your personal identity and to comply with tax laws, especially if you plan to hire employees or form a partnership, corporation, or LLC.

How long does it take to get a copy of my EIN confirmation letter from the IRS?

+

The time it takes to receive a copy of your EIN confirmation letter can vary. If you call the IRS, they can provide you with the information over the phone immediately. However, if you need a physical copy mailed to you, it may take several days to arrive.

Related Terms:

- EIN confirmation letter PDF

- IRS EIN verification letter

- EIN letter sample

- CP 575 EIN confirmation letter

- 147C form

- IRS EIN phone number