5 Tips After 401k Rollover

Introduction to 401k Rollover

When changing jobs or retiring, one of the most important financial decisions you’ll make is what to do with your 401(k) plan. A 401(k) rollover allows you to move your retirement savings from your previous employer’s plan into an Individual Retirement Account (IRA) or a new employer’s 401(k) plan. This decision can have significant implications for your financial future, including how your money is invested, the fees you pay, and the flexibility you have to access your funds. In this article, we’ll explore five key tips to consider after completing a 401k rollover, helping you navigate the next steps in managing your retirement savings effectively.

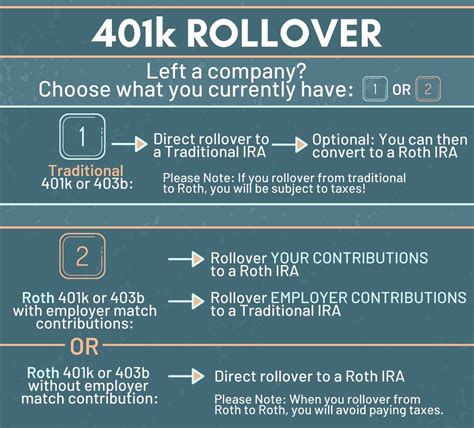

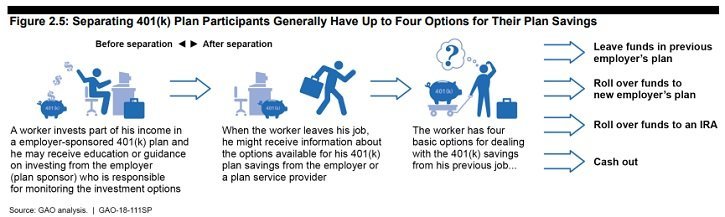

Understanding Your Options

Before diving into the tips, it’s essential to understand the basics of a 401(k) rollover. You have a few options when deciding what to do with your 401(k) from a previous employer: - Leave the money in the former employer’s plan, if allowed. - Roll over the funds into a new employer’s 401(k) plan, if permitted. - Roll over the funds into an IRA. - Cash out the account, though this is generally not recommended due to tax penalties and the loss of retirement savings.

Tips After 401k Rollover

Here are five tips to consider after you’ve decided to roll over your 401(k):

1. Review and Adjust Your Investment Portfolio

After completing the rollover, take the time to review your investment portfolio. Your previous 401(k) plan may have had limited investment options, but with an IRA, you often have a broader range of investments to choose from. Consider diversifying your portfolio to minimize risk and potentially increase returns over the long term. This might involve allocating your investments across different asset classes, such as stocks, bonds, and real estate, based on your risk tolerance and retirement goals.

2. Consider Consolidating Accounts

If you have multiple retirement accounts from previous employers, you might want to consider consolidating them into a single IRA. This can make it easier to manage your retirement savings, reduce paperwork, and potentially lower fees. However, before consolidating, ensure you understand any potential fees associated with the transfer and confirm that you won’t lose any benefits by moving your funds.

3. Understand the Fees

Different retirement accounts come with various fees, which can significantly impact your savings over time. After a 401(k) rollover, review the fee structure of your new account. Look for management fees, administrative fees, and any transaction fees. Consider working with a financial advisor who can help you navigate these fees and find the most cost-effective options for your situation.

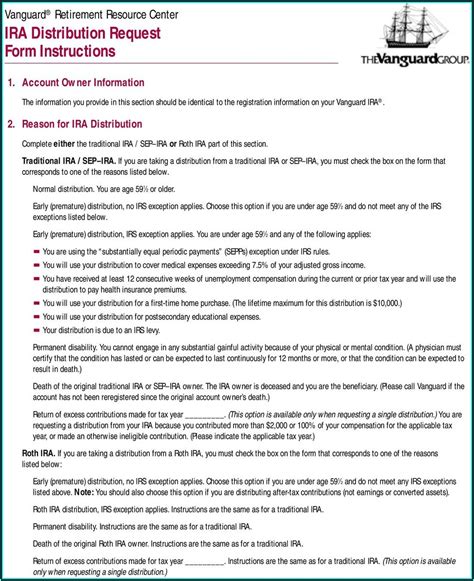

4. Plan for Withdrawals

While it’s essential to save for retirement, it’s also crucial to plan for how you’ll withdraw those funds. If you’ve rolled over your 401(k) into an IRA, understand the rules regarding withdrawals. Generally, you can withdraw funds from a traditional IRA without penalty after age 59 1⁄2, but you’ll pay taxes on those withdrawals. A Roth IRA, on the other hand, allows tax-free withdrawals if certain conditions are met. Planning your withdrawals strategically can help minimize taxes and ensure a steady income stream in retirement.

5. Reassess Your Retirement Goals and Contributions

A 401(k) rollover is a good opportunity to reassess your retirement goals and how much you need to save to achieve them. Consider increasing your contributions to your retirement accounts, especially if you’re nearing retirement age. Even small, consistent increases can make a significant difference over time due to the power of compound interest.

💡 Note: Always consult with a financial advisor before making significant changes to your retirement savings strategy to ensure you're making the best decisions for your individual circumstances.

Conclusion and Next Steps

In conclusion, a 401(k) rollover is not just a transfer of funds; it’s an opportunity to reassess and potentially improve your retirement savings strategy. By reviewing your investment portfolio, considering consolidation, understanding fees, planning for withdrawals, and reassessing your retirement goals, you can make informed decisions that set you up for success in your retirement years. Remember, managing your retirement savings is an ongoing process, and staying informed and proactive will help you achieve your long-term financial goals.

What are the main benefits of rolling over a 401(k) to an IRA?

+

The main benefits include a broader range of investment options, the potential for lower fees, and greater control over your retirement savings. Additionally, IRAs often have more flexible withdrawal rules than 401(k) plans.

Can I roll over my 401(k) into a new employer’s 401(k) plan?

+

Yes, many employers allow you to roll over your previous 401(k) or IRA into their 401(k) plan. However, not all plans permit this, so it’s essential to check with your new employer’s HR or benefits department to see if this option is available.

What are the penalties for cashing out a 401(k) before age 59 1⁄2?

+

Cashing out a 401(k) before age 59 1⁄2 typically results in a 10% early withdrawal penalty, in addition to the income taxes you’ll owe on the withdrawal amount. There are some exceptions to this rule, such as separation from service after age 55, but these should be carefully considered and often require professional advice.