UK Paperwork Retention Periods Guide

Introduction to UK Paperwork Retention Periods

In the United Kingdom, businesses and individuals are required to retain certain documents for specific periods, as mandated by various laws and regulations. These paperwork retention periods are crucial for compliance, auditing, and tax purposes. The complexity of these requirements can be overwhelming, especially for small businesses or individuals who are not familiar with the laws and regulations governing document retention. This guide aims to provide a comprehensive overview of the key paperwork retention periods in the UK, helping individuals and businesses understand their obligations and ensure they are meeting the necessary requirements.

Understanding the Importance of Paperwork Retention

Before diving into the specifics of retention periods, it’s essential to understand why paperwork retention is important. Retaining documents for the appropriate amount of time can help protect against legal disputes, support tax claims, and demonstrate compliance with regulatory requirements. It also ensures that historical records are maintained, which can be vital for business decisions, audits, and historical research. Furthermore, in the event of an audit or investigation, having the necessary documents readily available can significantly reduce the risk of penalties or fines.

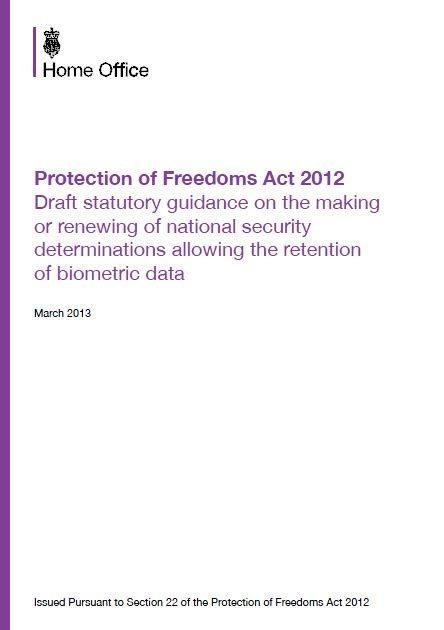

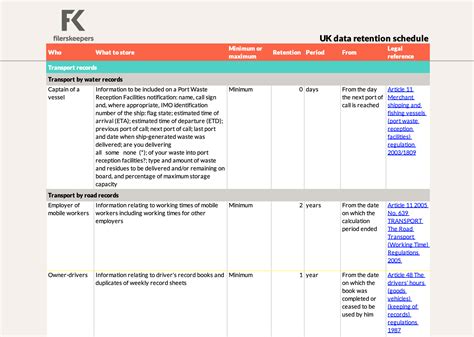

Key Legislation Governing Paperwork Retention in the UK

Several pieces of legislation govern the retention of paperwork in the UK, including: - The Companies Act 2006: Requires companies to keep certain records, such as registers of members, directors, and secretaries, for specific periods. - The Income Tax (Earnings and Pensions) Act 2003: Mandates the retention of PAYE records. - The Value Added Tax Act 1994: Requires businesses to keep VAT records. - The Health and Safety at Work etc. Act 1974: Demands the retention of health and safety records. - The Data Protection Act 2018: Includes provisions related to the retention of personal data.

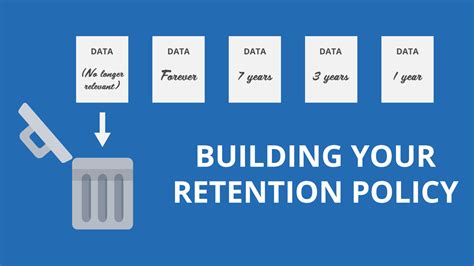

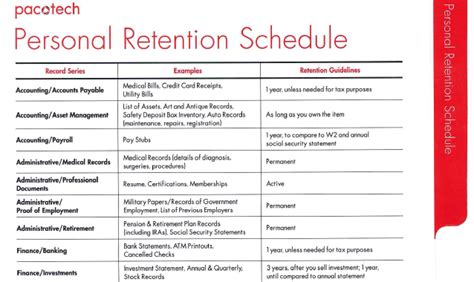

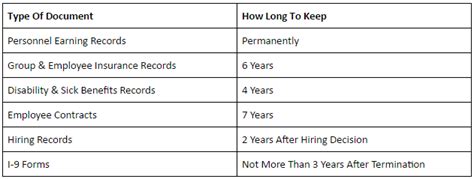

Retention Periods for Common Documents

The retention periods for documents in the UK vary widely depending on their type. Here are some common documents and their retention periods: - Financial Records: Generally, financial records, including invoices, receipts, and bank statements, should be kept for at least 6 years from the end of the last company financial year to which they relate. - Employment Records: Employee records, such as contracts and payroll information, should be retained for 3 years after the employee leaves the company. - VAT Records: Records related to VAT, including invoices and receipts, must be kept for 6 years. - PAYE Records: PAYE records, including P45s and P60s, should be retained for 3 years after the end of the tax year to which they relate. - Health and Safety Records: Accident books and other health and safety records should be kept for 3 years from the date of the last entry.

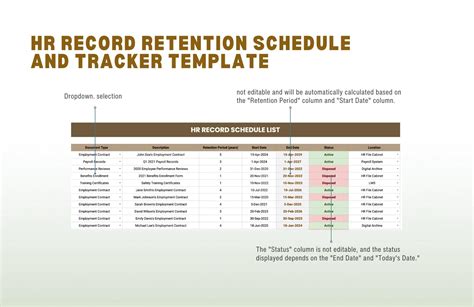

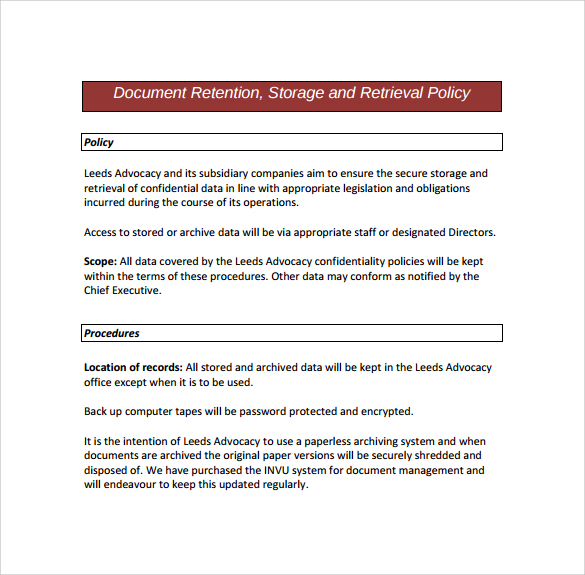

Best Practices for Document Retention

Implementing best practices for document retention can help ensure compliance with the relevant legislation and make it easier to manage paperwork. Some key practices include: - Digital Storage: Consider using digital storage solutions to keep documents secure and easily accessible. - Centralized System: Use a centralized system for storing and managing documents to prevent loss and ensure that all relevant personnel can access the necessary documents. - Regular Reviews: Regularly review your document retention policies to ensure they are up to date and compliant with current legislation. - Secure Disposal: Ensure that documents are disposed of securely when they are no longer required, to protect against data breaches.

Consequences of Non-Compliance

Failure to comply with the required paperwork retention periods can result in serious consequences, including fines, penalties, and legal action. For example, non-compliance with VAT or PAYE regulations can lead to penalties from HMRC, while failure to retain health and safety records can result in fines and prosecution under health and safety laws.

Managing Paperwork in the Digital Age

In today’s digital age, managing paperwork effectively requires a combination of digital solutions and adherence to traditional record-keeping principles. Utilizing digital tools for document management can enhance security, reduce storage needs, and improve accessibility. However, it’s crucial to ensure that digital documents are stored securely and that backup systems are in place to prevent data loss.

📝 Note: When implementing digital document management systems, ensure they comply with data protection laws, such as the Data Protection Act 2018, to protect personal data and maintain confidentiality.

Challenges and Opportunities in Paperwork Retention

While paperwork retention presents several challenges, including the need for significant storage space and the risk of non-compliance, it also offers opportunities for improved efficiency and cost savings. By streamlining document management processes and implementing effective retention policies, businesses can reduce administrative burdens and enhance their overall compliance and governance frameworks.

| Document Type | Retention Period | Purpose |

|---|---|---|

| Financial Records | 6 years | Compliance with tax laws and auditing purposes |

| Employment Records | 3 years | Compliance with employment laws and human resources management |

| VAT Records | 6 years | Compliance with VAT regulations and auditing purposes |

As we navigate the complexities of paperwork retention in the UK, it’s clear that understanding the legal requirements and implementing effective document management strategies are crucial for compliance, efficiency, and risk management. By recognizing the importance of paperwork retention and adopting best practices, individuals and businesses can ensure they are meeting their legal obligations while also leveraging the opportunities that effective document management presents.

In summary, the retention of paperwork is a critical aspect of compliance and governance in the UK, governed by a range of legislation that dictates how long different types of documents must be kept. By understanding these requirements and implementing effective document management systems, individuals and businesses can reduce risks, improve efficiency, and ensure they are in a strong position to meet their legal and regulatory obligations.

What are the main laws governing paperwork retention in the UK?

+

The main laws include The Companies Act 2006, The Income Tax (Earnings and Pensions) Act 2003, The Value Added Tax Act 1994, The Health and Safety at Work etc. Act 1974, and The Data Protection Act 2018.

How long should financial records be kept?

+

Financial records should generally be kept for at least 6 years from the end of the last company financial year to which they relate.

What are the consequences of not retaining paperwork as required?

+

Failure to comply with paperwork retention requirements can result in fines, penalties, and legal action, depending on the specific legislation and the nature of the non-compliance.