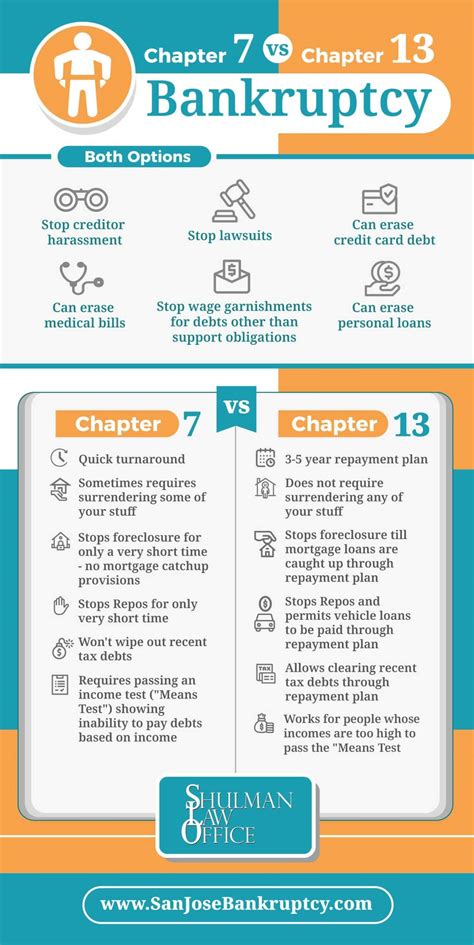

5 Chapter 13 Tips

Introduction to Chapter 13

Chapter 13, also known as the wage earner’s plan, is a type of bankruptcy that allows individuals to create a plan to repay all or part of their debts. This chapter is ideal for individuals who have a steady income and want to pay off their debts over time. In this post, we will provide 13 tips to help you navigate the Chapter 13 process.

Understanding the Chapter 13 Process

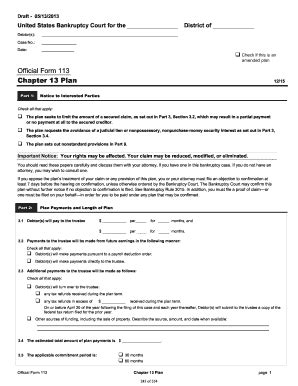

Before we dive into the tips, it’s essential to understand the Chapter 13 process. The process typically begins with the filing of a petition with the bankruptcy court. The petition will include a list of all your debts, income, and expenses. Once the petition is filed, the court will appoint a trustee to oversee the case. The trustee will collect payments from you and distribute them to your creditors.

Tip 1: Determine if Chapter 13 is Right for You

The first step in the Chapter 13 process is to determine if it’s the right choice for you. Chapter 13 is ideal for individuals who have a steady income and want to pay off their debts over time. However, it may not be the best option for individuals who have a lot of debt and cannot afford to make payments. It’s essential to consult with a bankruptcy attorney to determine if Chapter 13 is the right choice for you.

Tip 2: Gather All Necessary Documents

To file for Chapter 13, you will need to gather all necessary documents, including: * Income statements * Expense reports * Debt lists * Asset valuations It’s essential to have all the necessary documents to ensure that your petition is accurate and complete.

Tip 3: Create a Budget

Creating a budget is essential to ensure that you can afford to make payments under the Chapter 13 plan. Your budget should include all your income and expenses, as well as any debt payments. It’s essential to prioritize your debts and make sure that you are making the minimum payments required under the plan.

Tip 4: Prioritize Your Debts

When creating your budget, it’s essential to prioritize your debts. Secured debts, such as mortgage and car loans, should be prioritized over unsecured debts, such as credit card debt. This is because secured debts are tied to collateral, and failure to pay them can result in the loss of the collateral.

Tip 5: Make Timely Payments

Making timely payments is essential to ensure that your Chapter 13 plan is successful. You should make all payments on time and in full to avoid any penalties or fines. If you are having trouble making payments, it’s essential to contact your trustee or bankruptcy attorney to discuss your options.

Tip 6: Communicate with Your Trustee

Communicating with your trustee is essential to ensure that your Chapter 13 plan is successful. You should contact your trustee regularly to discuss your payments and any issues that may arise. Your trustee can help you navigate the Chapter 13 process and ensure that you are in compliance with all requirements.

Tip 7: Be Aware of the Risks

While Chapter 13 can be a powerful tool for debt relief, there are risks involved. If you fail to make payments or comply with the terms of the plan, you may face penalties or fines. Additionally, Chapter 13 can have a negative impact on your credit score.

Tip 8: Consider a Debt Management Plan

A debt management plan can be a useful tool for individuals who are struggling with debt. A debt management plan can help you consolidate your debts and make one monthly payment. This can be a useful alternative to Chapter 13, especially for individuals who do not want to file for bankruptcy.

Tip 9: Avoid New Debt

While you are in the Chapter 13 process, it’s essential to avoid new debt. You should not take on any new credit or debt, including credit cards or loans. This can help you stay on track with your payments and ensure that you do not accumulate more debt.Tip 10: Keep Records

Keeping records is essential to ensure that you are in compliance with all requirements. You should keep records of all payments, correspondence, and documents related to your Chapter 13 case. This can help you stay organized and ensure that you are meeting all the requirements of the plan.Tip 11: Be Patient

The Chapter 13 process can take several years to complete. It’s essential to be patient and stay committed to the plan. You should not expect to see immediate results, but rather a long-term solution to your debt problems.Tip 12: Seek Professional Help

Seeking professional help is essential to ensure that you are getting the best possible outcome. You should consult with a bankruptcy attorney to determine if Chapter 13 is the right choice for you. A bankruptcy attorney can help you navigate the process and ensure that you are in compliance with all requirements.Tip 13: Review and Revise Your Plan

Finally, it’s essential to review and revise your plan as necessary. You should regularly review your budget and plan to ensure that you are on track to meet your goals. If you need to make any changes, you should contact your trustee or bankruptcy attorney to discuss your options.📝 Note: It's essential to stay informed and educated throughout the Chapter 13 process. You should regularly review your budget and plan to ensure that you are on track to meet your goals.

In summary, Chapter 13 can be a powerful tool for debt relief, but it’s essential to approach the process with caution and careful planning. By following these 13 tips, you can ensure that you are getting the best possible outcome and achieving financial stability.

What is Chapter 13 bankruptcy?

+

Chapter 13 bankruptcy is a type of bankruptcy that allows individuals to create a plan to repay all or part of their debts over time.

How long does the Chapter 13 process take?

+

The Chapter 13 process can take several years to complete, typically between 3-5 years.

What are the benefits of Chapter 13 bankruptcy?

+

The benefits of Chapter 13 bankruptcy include the ability to repay debts over time, stop foreclosure, and avoid wage garnishment.