Refinance Paperwork Requirements

Introduction to Refinance Paperwork Requirements

When considering refinancing a mortgage, it’s essential to understand the paperwork requirements involved in the process. Refinancing a mortgage can be a great way to lower monthly payments, switch from an adjustable-rate to a fixed-rate loan, or tap into home equity. However, the process can be complex and requires careful preparation. In this article, we’ll guide you through the necessary paperwork and steps to ensure a smooth refinance experience.

Understanding the Refinance Process

Before diving into the paperwork requirements, it’s crucial to understand the refinance process. The process typically involves: * Pre-approval: The lender reviews your creditworthiness and provides a pre-approval letter indicating the loan amount you qualify for. * Application: You submit a mortgage application, providing personal and financial information. * Processing: The lender reviews your application, orders an appraisal, and underwrites the loan. * Closing: You sign the final loan documents, and the refinance is complete.

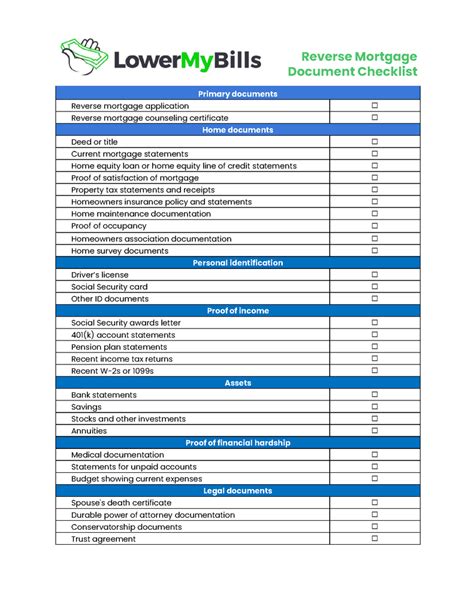

Required Documents for Refinance

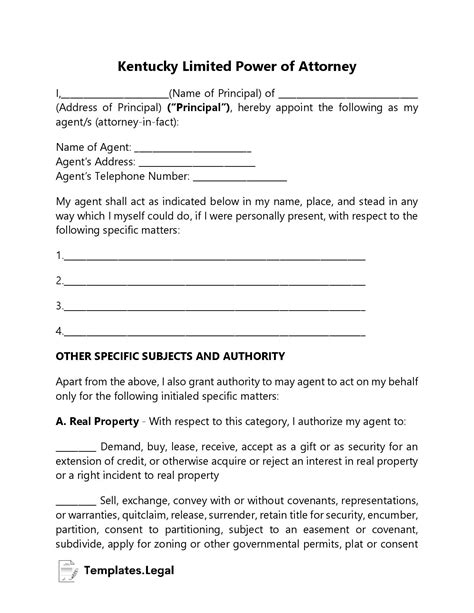

To begin the refinance process, you’ll need to gather the following documents: * Identification: A valid government-issued ID, such as a driver’s license or passport. * Income verification: Pay stubs, W-2 forms, and tax returns to demonstrate your income stability. * Employment verification: A letter from your employer or a copy of your employment contract. * Credit reports: The lender will pull your credit reports, but it’s a good idea to review them yourself to ensure accuracy. * Property documents: The original mortgage note, deed of trust, and any other relevant property documents. * Appraisal: An appraisal report, which may be required by the lender to determine the property’s value. * Insurance: Proof of homeowners insurance, which may include a policy declaration page and payment receipts.

Additional Requirements for Specific Loan Types

Depending on the type of loan you’re refinancing into, additional documentation may be required: * FHA loans: You may need to provide an FHA case number, appraisal report, and other FHA-specific documents. * VA loans: You’ll need to provide a Certificate of Eligibility, DD Form 214, and other VA-specific documents. * Jumbo loans: You may need to provide additional income verification, asset documentation, and other documents to support the larger loan amount.

Streamlining the Refinance Process

To make the refinance process more efficient, consider the following tips: * Organize your documents: Keep all required documents in a single folder or digital file to easily access them when needed. * Work with a mortgage broker: A mortgage broker can help guide you through the process and ensure you have all the necessary documents. * Stay in communication: Regularly communicate with your lender and mortgage broker to stay informed about the progress of your refinance.

💡 Note: It's essential to carefully review your loan documents before signing to ensure you understand the terms and conditions of your new loan.

Common Refinance Mistakes to Avoid

When refinancing a mortgage, it’s easy to make mistakes that can cost you time and money. Avoid the following common mistakes: * Not shopping around: Failing to compare rates and terms from multiple lenders can result in a less favorable loan. * Not reviewing loan documents: Carefully review your loan documents to ensure you understand the terms and conditions of your new loan. * Not considering all costs: Factor in all costs associated with the refinance, including closing costs, appraisal fees, and other expenses.

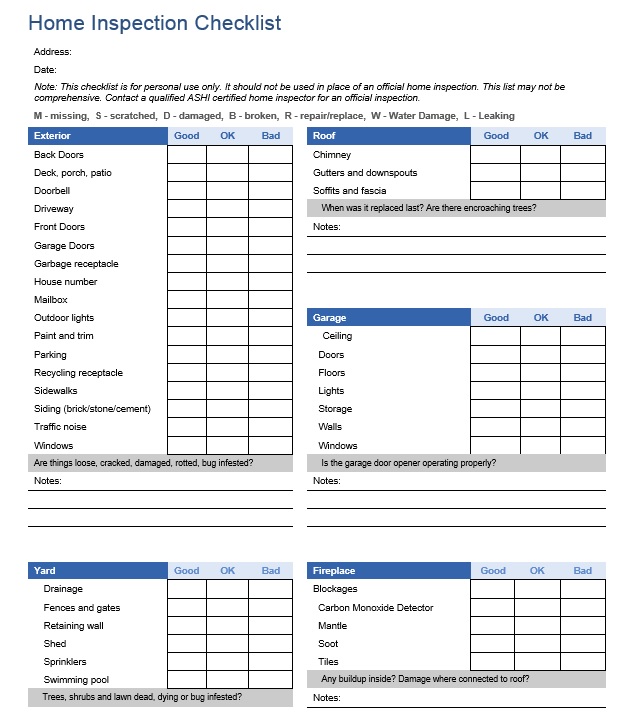

Refinance Paperwork Checklist

To help you stay organized, here’s a checklist of the required documents for refinancing a mortgage:

| Document | Description |

|---|---|

| Identification | Valid government-issued ID |

| Income verification | Pay stubs, W-2 forms, and tax returns |

| Employment verification | Letter from employer or employment contract |

| Credit reports | Current credit reports |

| Property documents | Original mortgage note, deed of trust, and other property documents |

| Appraisal | Appraisal report (if required) |

| Insurance | Proof of homeowners insurance |

In summary, refinancing a mortgage requires careful preparation and attention to detail. By understanding the paperwork requirements and following the tips outlined in this article, you can ensure a smooth and successful refinance experience. Remember to stay organized, work with a mortgage broker, and carefully review your loan documents to avoid common mistakes. With the right approach, you can lower your monthly payments, improve your financial situation, and achieve your long-term goals.

What is the first step in the refinance process?

+

The first step in the refinance process is to get pre-approved by a lender, which involves reviewing your creditworthiness and providing a pre-approval letter indicating the loan amount you qualify for.

What documents do I need to refinance a mortgage?

+

To refinance a mortgage, you’ll need to provide identification, income verification, employment verification, credit reports, property documents, appraisal (if required), and insurance.

How long does the refinance process typically take?

+

The refinance process can take anywhere from 30 to 60 days, depending on the complexity of the loan and the efficiency of the lender.