401k Tax Paperwork Requirements

Understanding 401k Tax Paperwork Requirements

When it comes to managing a 401k plan, one of the most critical aspects is handling the tax paperwork requirements. The Internal Revenue Service (IRS) has set forth specific guidelines that must be followed to ensure compliance and avoid any potential penalties. In this article, we will delve into the world of 401k tax paperwork, exploring the necessary forms, deadlines, and best practices for plan administrators and participants alike.

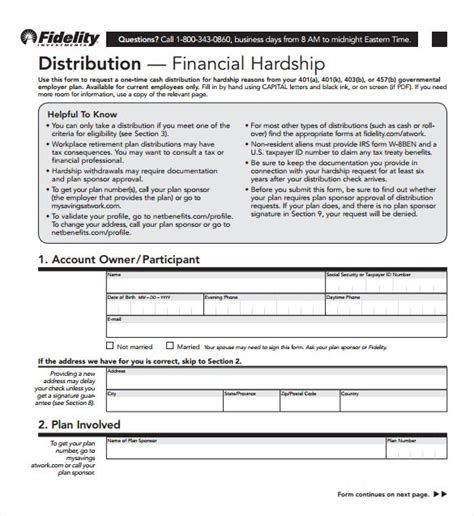

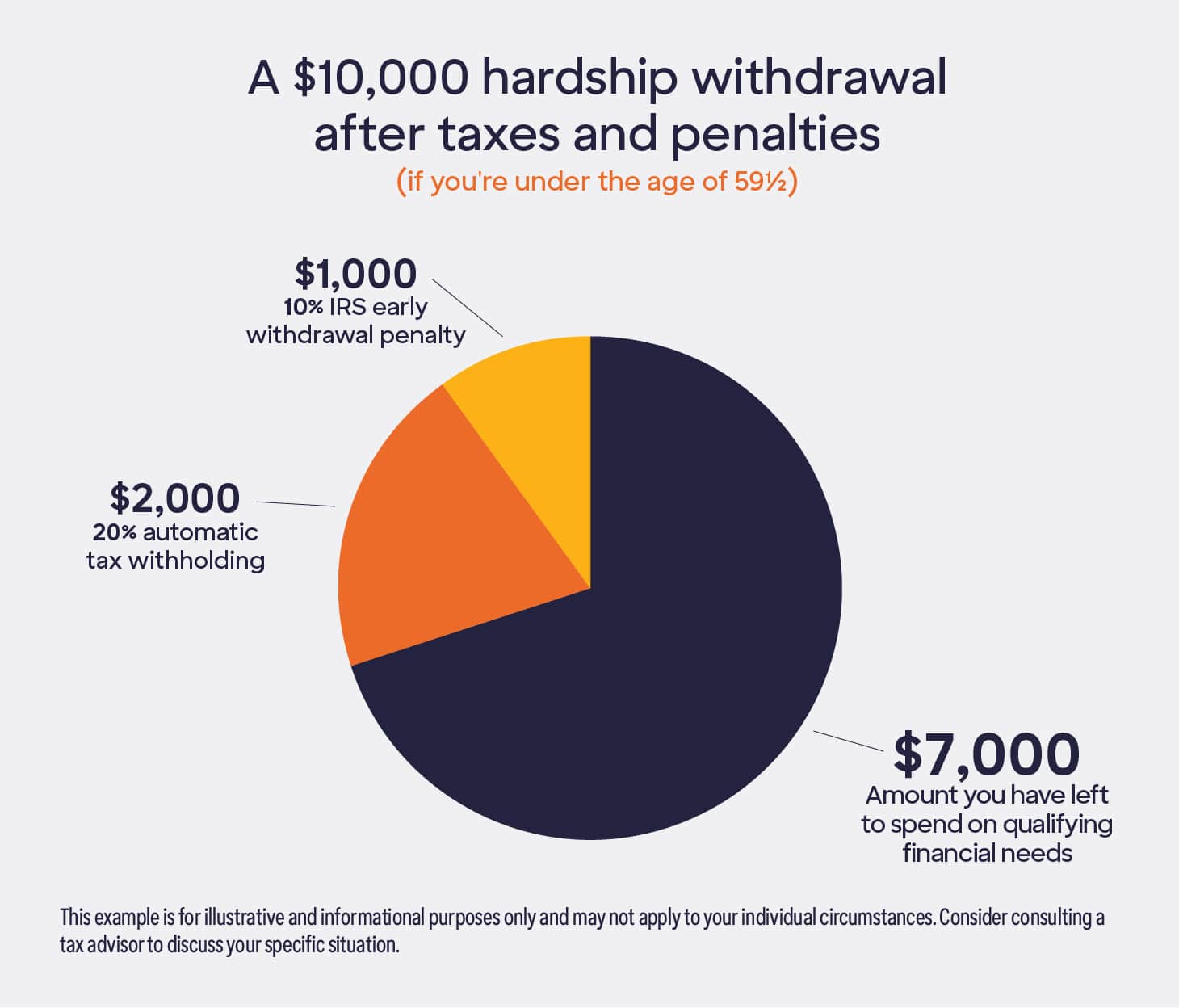

Key Forms and Documents

To navigate the complexities of 401k tax paperwork, it is essential to familiarize yourself with the following key forms and documents: * Form 5500: This is the primary form used to report information about the 401k plan to the IRS and the Department of Labor (DOL). It includes details such as plan assets, income, and expenses. * Form 1099-R: This form is used to report distributions from the 401k plan, including withdrawals and loans. * Form W-2: This form is used to report income and taxes withheld from employee contributions to the 401k plan. * Summary Annual Report (SAR): This report provides a summary of the 401k plan’s financial information and is typically distributed to plan participants.

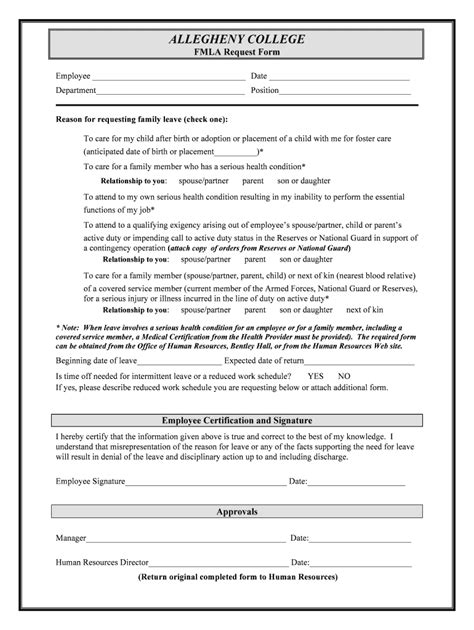

Tax Paperwork Deadlines

Meeting the deadlines for 401k tax paperwork is crucial to avoid penalties and ensure compliance. The following deadlines are critical: * July 31st: This is the deadline for filing Form 5500 with the IRS and the DOL. * January 31st: This is the deadline for distributing Form 1099-R to plan participants who received distributions during the previous year. * January 31st: This is the deadline for distributing Form W-2 to employees who contributed to the 401k plan. * September 30th: This is the deadline for distributing the SAR to plan participants.

Best Practices for Plan Administrators

To ensure seamless management of 401k tax paperwork, plan administrators should follow these best practices: * Maintain accurate records: Keep detailed records of all plan transactions, including contributions, distributions, and loans. * Monitor deadlines: Stay on top of deadlines for filing forms and distributing reports to avoid penalties. * Communicate with participants: Keep plan participants informed about their account balances, investment options, and any changes to the plan. * Seek professional help: Consider hiring a professional administrator or consultant to help with 401k tax paperwork and ensure compliance.

Common Mistakes to Avoid

When managing 401k tax paperwork, it is essential to avoid the following common mistakes: * Missing deadlines: Failing to meet deadlines for filing forms and distributing reports can result in penalties and fines. * Inaccurate reporting: Providing incorrect or incomplete information on forms and reports can lead to compliance issues. * Insufficient record-keeping: Failing to maintain accurate records can make it difficult to prepare tax paperwork and demonstrate compliance. * Lack of communication: Failing to communicate with plan participants can lead to confusion and dissatisfaction.

📝 Note: It is crucial to review and understand the specific requirements for your 401k plan, as failure to comply can result in penalties and fines.

Technology and Automation

In recent years, technology has played an increasingly important role in managing 401k tax paperwork. Plan administrators can leverage automation tools to streamline the process, reduce errors, and improve efficiency. Some benefits of technology and automation include: * Improved accuracy: Automation tools can help reduce errors and ensure accurate reporting. * Increased efficiency: Automation can save time and resources, allowing plan administrators to focus on other aspects of plan management. * Enhanced communication: Technology can facilitate communication with plan participants, providing them with access to their account information and plan documents.

| Form | Description | Deadline |

|---|---|---|

| Form 5500 | Reports information about the 401k plan to the IRS and DOL | July 31st |

| Form 1099-R | Reports distributions from the 401k plan | January 31st |

| Form W-2 | Reports income and taxes withheld from employee contributions | January 31st |

| Summary Annual Report (SAR) | Provides a summary of the 401k plan's financial information | September 30th |

In summary, managing 401k tax paperwork requires attention to detail, a thorough understanding of the necessary forms and deadlines, and a commitment to best practices. By leveraging technology and automation, plan administrators can streamline the process, reduce errors, and improve efficiency. By following the guidelines outlined in this article, plan administrators can ensure compliance and provide a positive experience for plan participants.

What is the deadline for filing Form 5500?

+

The deadline for filing Form 5500 is July 31st.

What is the purpose of the Summary Annual Report (SAR)?

+

The SAR provides a summary of the 401k plan’s financial information and is typically distributed to plan participants.

Can technology and automation help with 401k tax paperwork?

+

Yes, technology and automation can help streamline the process, reduce errors, and improve efficiency.