Paperwork

Car Finance Paperwork Requirements

Introduction to Car Finance Paperwork

When considering purchasing a vehicle, whether new or used, through financing, it’s essential to understand the various paperwork requirements involved. The process of car financing can be complex, with multiple documents needed to secure a loan. In this article, we will delve into the world of car finance paperwork, exploring the necessary documents, the application process, and what to expect when applying for car finance.

Understanding Car Finance Options

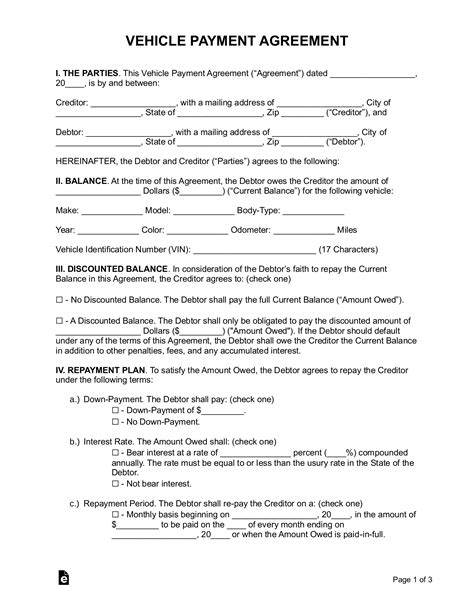

Before diving into the paperwork, it’s crucial to understand the different car finance options available. These include: - Personal Contract Purchase (PCP): A popular choice, PCP allows you to pay a deposit and monthly installments over a set period, typically between 2 to 4 years. At the end of the agreement, you have the option to return the vehicle, trade it in, or pay a balloon payment to own the car. - Hire Purchase (HP): With HP, you pay a deposit followed by fixed monthly payments. Once all payments are made, including the option to purchase fee, you become the owner of the vehicle. - Personal Loan: Unsecured or secured, personal loans can be used to purchase a vehicle. Repayments are made over a fixed term, and the interest rates can vary based on your credit score.

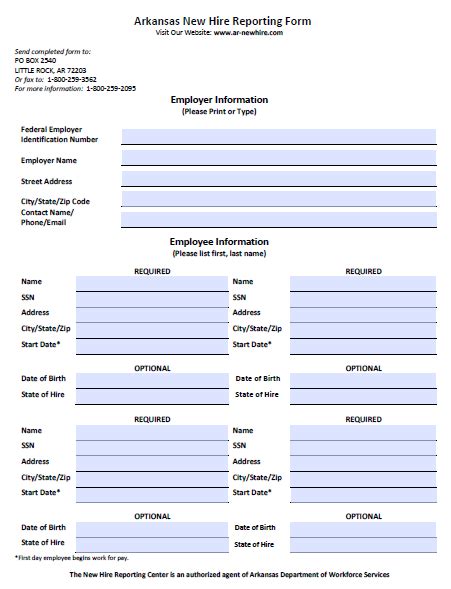

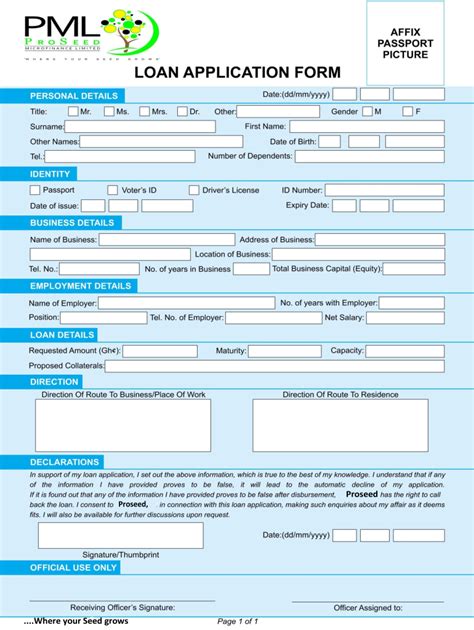

Necessary Documents for Car Finance

To apply for car finance, you’ll need to provide various documents. These typically include: - Proof of Identity (ID): A valid passport or driving license. - Proof of Income: Payslips, P60 forms, or bank statements showing your income. - Proof of Address: Utility bills, bank statements, or council tax bills. - Employment Details: Your employment status, job title, and length of employment. - Credit History: Your credit score and history play a significant role in determining the interest rate you’ll qualify for.

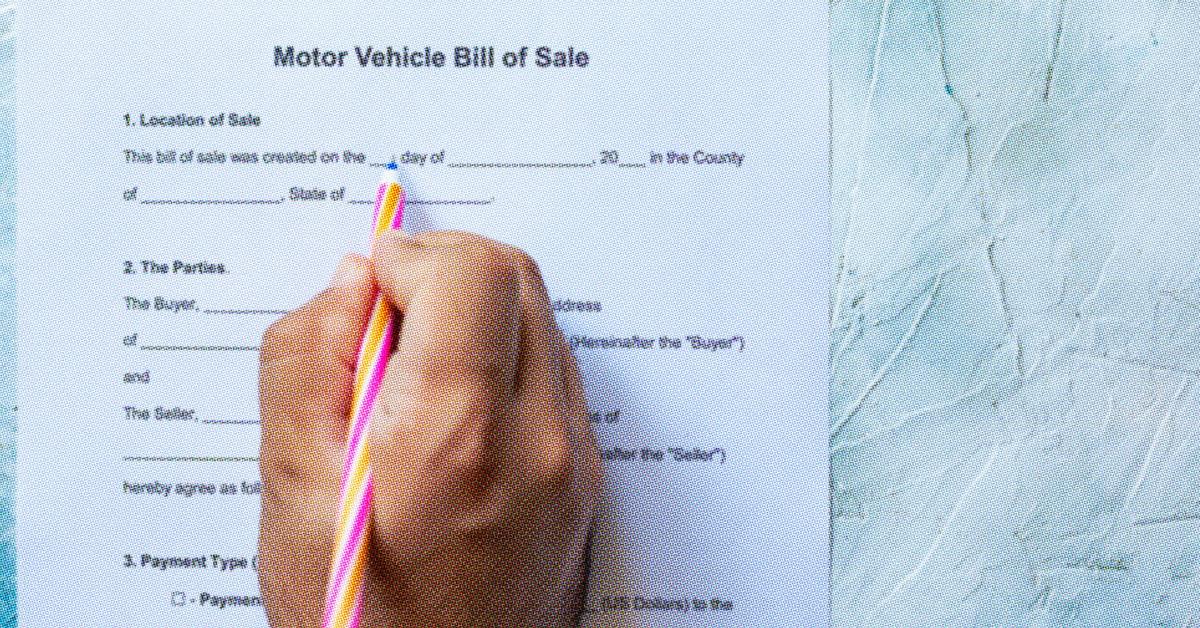

The Application Process

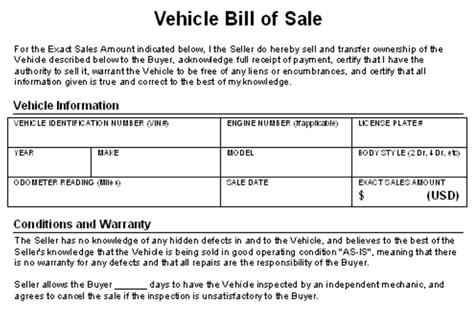

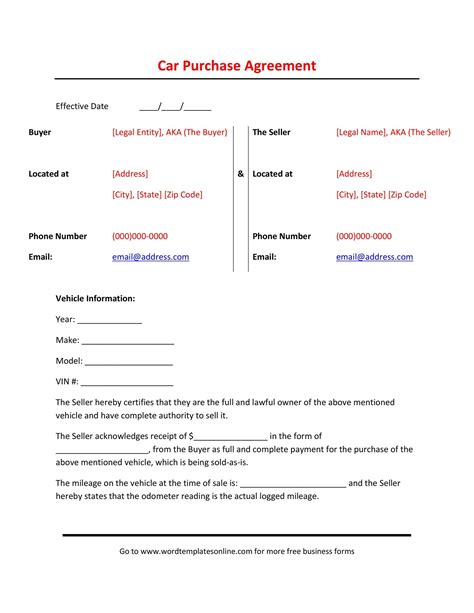

The application process for car finance involves several steps: 1. Pre-Approval: Some lenders offer pre-approval, which gives you an idea of how much you can borrow before applying formally. 2. Formal Application: Submit your application with the required documents. 3. Credit Check: The lender conducts a credit check to assess your creditworthiness. 4. Approval and Contract: If approved, you’ll receive the finance agreement to sign. Ensure you read and understand all terms and conditions before signing.

Understanding Your Credit Score

Your credit score is a crucial factor in car finance applications. It’s a three-digit number that represents your credit history and how well you manage your debts. A good credit score can lead to better interest rates and higher chances of approval. Maintaining a good credit score involves: - Making timely payments on existing debts. - Keeping credit utilization low. - Avoiding multiple credit applications in a short period.

Notes on Car Finance Paperwork

📝 Note: Always ensure you thoroughly read through any agreement before signing. The terms and conditions, including the total amount payable, interest rate, and any fees, should be clearly understood to avoid any misunderstandings.

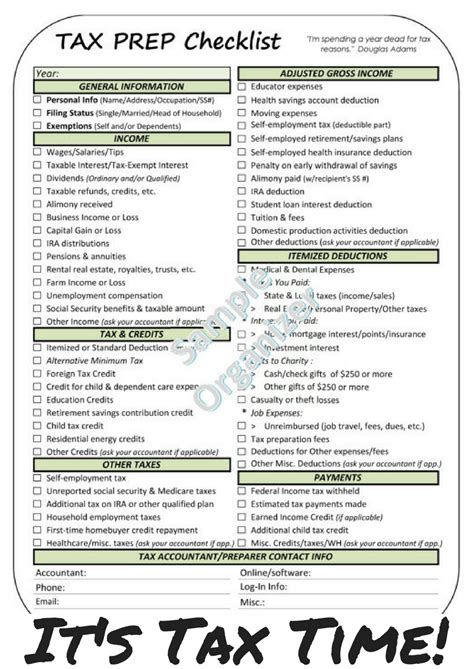

Table of Common Car Finance Fees

| Fee Type | Description |

|---|---|

| Arrangement Fee | Charged by the lender for setting up the finance agreement. |

| Option to Purchase Fee | Applies to HP agreements, paid at the end of the contract to own the vehicle. |

| Interest Charges | Applied to the borrowed amount over the term of the agreement. |

Maintaining Good Financial Health

To ensure you can manage your car finance repayments, it’s essential to maintain good financial health. This includes: - Budgeting: Plan your income and expenses to ensure you can afford the monthly payments. - Saving: Having a savings cushion can help in case of unexpected expenses or income reduction. - Monitoring Credit Report: Regularly check your credit report for errors and work on improving your credit score.

In the end, understanding and managing the paperwork requirements for car finance can make the process less daunting. By being prepared with the necessary documents, understanding your finance options, and maintaining good financial health, you can navigate the car buying process with confidence. The key to a successful car finance experience is knowledge and preparation, ensuring that you find the best deal for your new vehicle.