5 Tips File Taxes

Introduction to Tax Filing

Filing taxes can be a daunting task, especially for those who are new to the process. With the numerous forms, deductions, and deadlines to keep track of, it’s easy to feel overwhelmed. However, with the right guidance and preparation, tax filing can be a breeze. In this article, we will provide you with 5 tips to help you file your taxes efficiently and effectively.

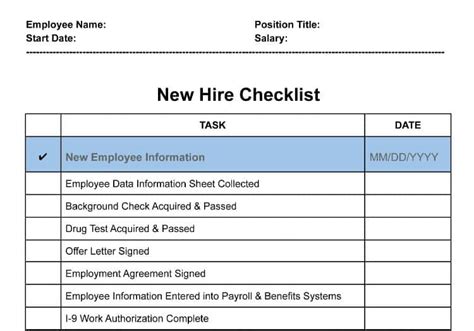

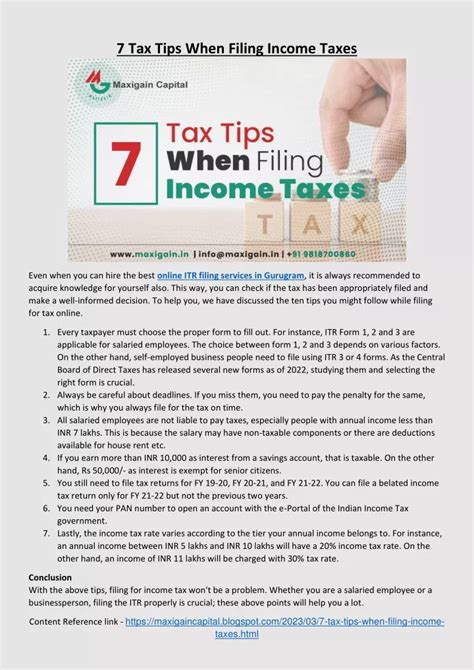

Tip 1: Gather All Necessary Documents

Before you start the tax filing process, it’s essential to gather all the necessary documents. This includes: * W-2 forms from your employer * 1099 forms for any freelance or contract work * Interest statements from your bank * Charitable donation receipts * Medical expense receipts Having all these documents in one place will make it easier to fill out your tax forms and ensure you don’t miss any important deductions.

Tip 2: Choose the Right Filing Status

Your filing status can significantly impact your tax liability. The most common filing statuses are: * Single * Married filing jointly * Married filing separately * Head of household * Qualifying widow(er) It’s crucial to choose the correct filing status to ensure you receive the maximum refund and minimize your tax liability.

Tip 3: Take Advantage of Tax Deductions

Tax deductions can help reduce your taxable income, resulting in a lower tax bill. Some common tax deductions include: * Mortgage interest * Charitable donations * Medical expenses * Business expenses * Education expenses Keep accurate records of your expenses throughout the year to ensure you can claim these deductions on your tax return.

Tip 4: Consider Hiring a Tax Professional

If you’re new to tax filing or have a complex tax situation, it may be beneficial to hire a tax professional. They can help you: * Navigate the tax code * Identify deductions and credits * Ensure accuracy and compliance * Represent you in case of an audit While hiring a tax professional may seem like an added expense, it can save you time and money in the long run.

Tip 5: File Electronically and On Time

Filing your taxes electronically can help reduce errors and speed up the refund process. It’s also essential to file your taxes on time to avoid penalties and interest. The IRS deadline for filing taxes is typically April 15th, but this can vary depending on your location and circumstances. Make sure to check the IRS website for the most up-to-date information and plan accordingly.

| Tax Filing Deadline | Consequences of Late Filing |

|---|---|

| April 15th | Penalties and interest on unpaid taxes |

| October 15th (with extension) | Loss of refund and potential audit |

📝 Note: It's essential to keep accurate records of your tax filings, including receipts, forms, and correspondence with the IRS.

To summarize, filing taxes requires careful planning, attention to detail, and a basic understanding of tax laws and regulations. By following these 5 tips, you can ensure a smooth and efficient tax filing process. Remember to stay organized, take advantage of deductions, and consider hiring a tax professional if needed. With the right approach, you can minimize your tax liability and maximize your refund.

What is the deadline for filing taxes?

+

The deadline for filing taxes is typically April 15th, but this can vary depending on your location and circumstances.

What are the consequences of late tax filing?

+

The consequences of late tax filing include penalties and interest on unpaid taxes, loss of refund, and potential audit.

Can I file my taxes electronically?

+

Yes, you can file your taxes electronically through the IRS website or with the help of a tax professional.