5 Tips Cobra Paperwork

Understanding Cobra Paperwork: A Comprehensive Guide

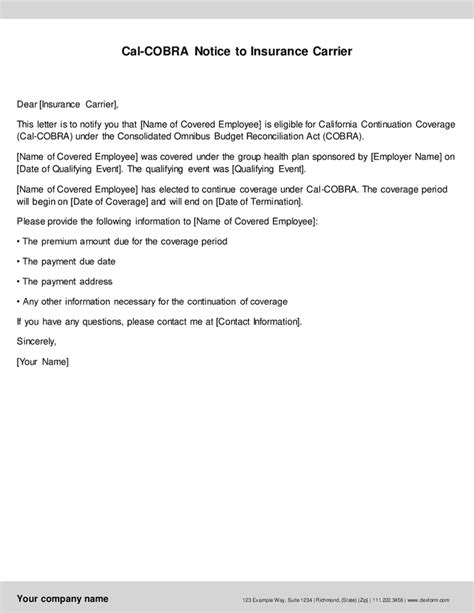

When it comes to managing employee benefits, particularly in the context of employment termination or reduction in work hours, the Consolidated Omnibus Budget Reconciliation Act (COBRA) plays a crucial role. COBRA paperwork is essential for both employers and employees to navigate the continuation of health coverage. Here, we’ll delve into the nuances of COBRA paperwork, highlighting five critical tips to ensure compliance and smooth processing.

Tip 1: Timely Notification

The first and foremost aspect of COBRA paperwork is the timely notification of eligible employees and their beneficiaries. Employers must notify the plan administrator within 30 days of a qualifying event, such as termination of employment, reduction in work hours, or other triggering events as defined by COBRA. This prompt action ensures that the coverage continuation process is initiated without delay, allowing affected individuals to make informed decisions about their health insurance.

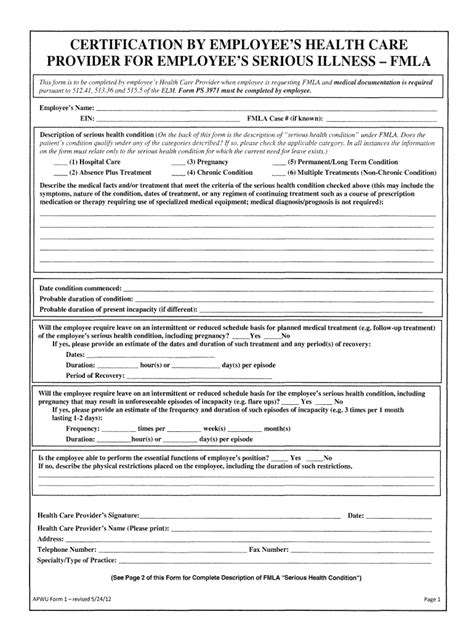

Tip 2: Accurate Completion of Forms

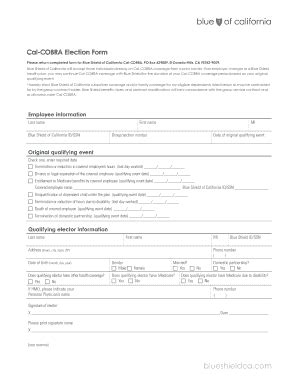

COBRA paperwork involves several forms, each serving a specific purpose. The General Notice form is a critical document that must be provided to covered employees and spouses at the commencement of coverage, detailing their rights under COBRA. When a qualifying event occurs, the Notice of Qualifying Event form must be accurately completed and submitted to the plan administrator. Accuracy and completeness are vital to avoid any potential disputes or delays in processing.

Tip 3: Understanding the Election Period

Upon receipt of the COBRA election notice, qualified beneficiaries have 60 days to decide whether to elect continuation coverage. This election period is crucial, as it determines whether the individual or family will continue their health insurance under COBRA. Employers and plan administrators must clearly communicate the terms of the election, including the cost of coverage, the duration of coverage, and any other relevant details, to facilitate an informed decision.

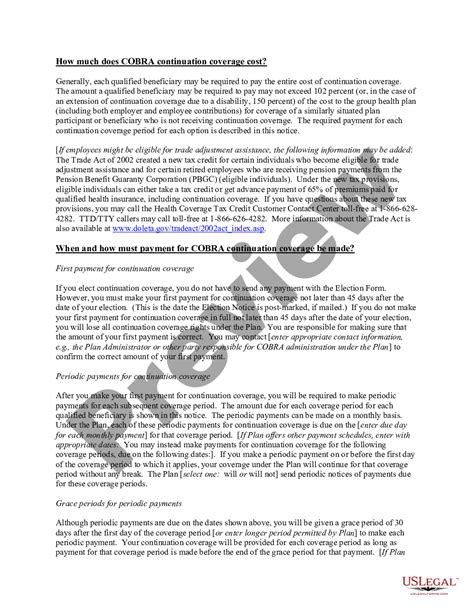

Tip 4: Payment and Premium Considerations

Once the election is made, the next critical step involves the payment of premiums. Qualified beneficiaries are responsible for paying 102% of the premium (which includes a 2% administrative fee) for the coverage period. Employers must provide clear instructions on the payment process, including deadlines and acceptable payment methods. Timely payment is essential to maintain continuous coverage, as failure to pay premiums can result in termination of COBRA benefits.

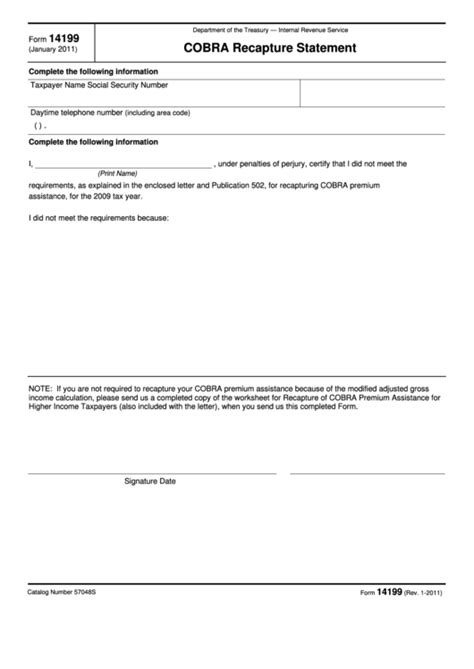

Tip 5: Record Keeping and Compliance

Finally, maintaining accurate and detailed records of all COBRA-related transactions and communications is indispensable for compliance and potential audits. Employers should keep a record of all notices sent to qualified beneficiaries, including proof of mailing, and a log of payments received. This documentation not only ensures that the employer has fulfilled their legal obligations under COBRA but also provides a clear audit trail in case of any disputes or investigations.

📝 Note: Employers must ensure that all COBRA paperwork and communications are handled in accordance with federal regulations to avoid potential legal and financial repercussions.

To further illustrate the process, consider the following steps in a simplified table format:

| Step | Description |

|---|---|

| 1. Qualifying Event | Employment termination, reduction in work hours, etc. |

| 2. Notification | Employer notifies plan administrator within 30 days. |

| 3. Election Notice | Plan administrator sends election notice to qualified beneficiaries. |

| 4. Election Period | Beneficiaries have 60 days to elect continuation coverage. |

| 5. Premium Payment | Beneficiaries pay 102% of the premium for continued coverage. |

In summary, navigating COBRA paperwork requires attention to detail, timely action, and a thorough understanding of the legal and procedural aspects involved. By following these tips and maintaining a proactive approach to COBRA administration, employers can ensure compliance with federal regulations and provide valuable support to their employees during significant life changes.

What is the primary purpose of COBRA paperwork?

+

The primary purpose of COBRA paperwork is to facilitate the continuation of health coverage for employees and their beneficiaries after a qualifying event, ensuring that they can maintain their health insurance without interruption.

How long do qualified beneficiaries have to elect COBRA continuation coverage?

+

Qualified beneficiaries have 60 days from the date of the election notice to decide whether to elect COBRA continuation coverage.

What percentage of the premium must qualified beneficiaries pay for COBRA coverage?

+

Qualified beneficiaries are responsible for paying 102% of the premium for COBRA coverage, which includes a 2% administrative fee.