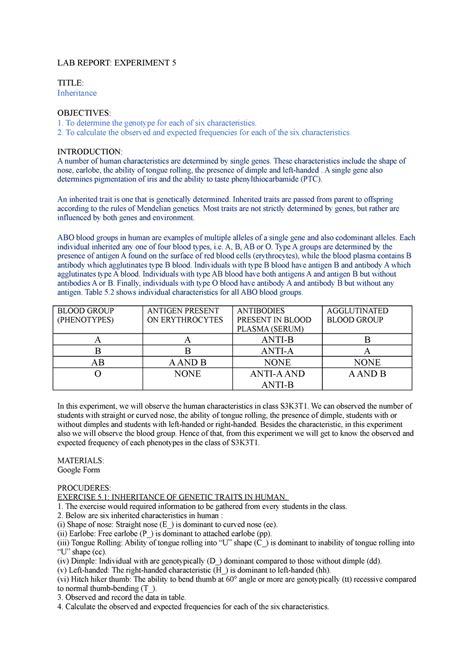

5 Inheritance Papers

Introduction to Inheritance Papers

Inheritance papers are legal documents that play a crucial role in the distribution of a deceased person’s assets, properties, and belongings among their heirs or beneficiaries. These documents can include wills, trusts, and other legal instruments that outline the wishes of the deceased regarding the distribution of their estate. Understanding the different types of inheritance papers and their purposes is essential for individuals who want to ensure that their assets are distributed according to their wishes after they pass away.

Types of Inheritance Papers

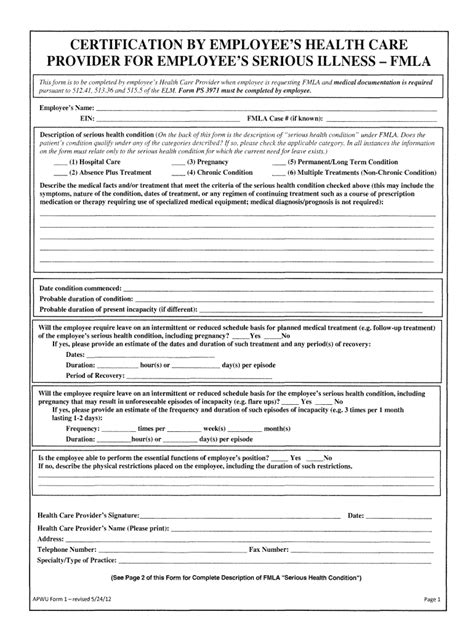

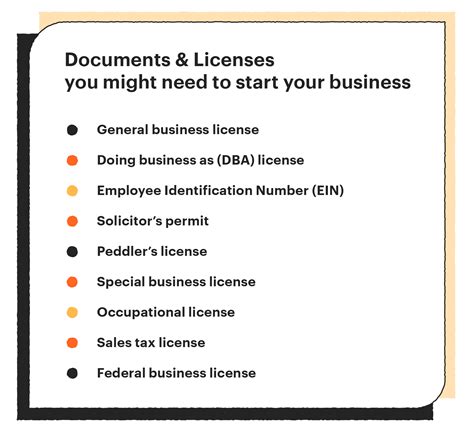

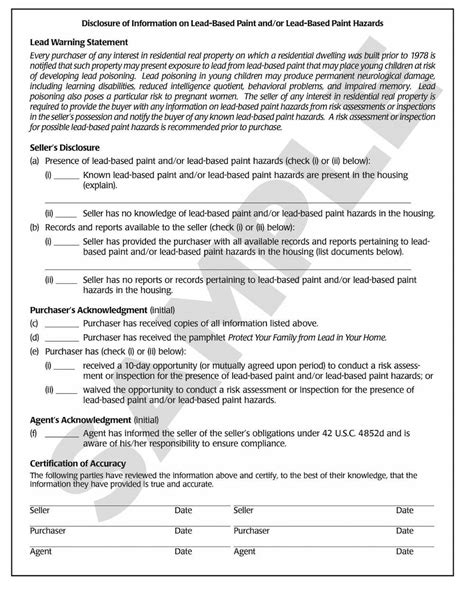

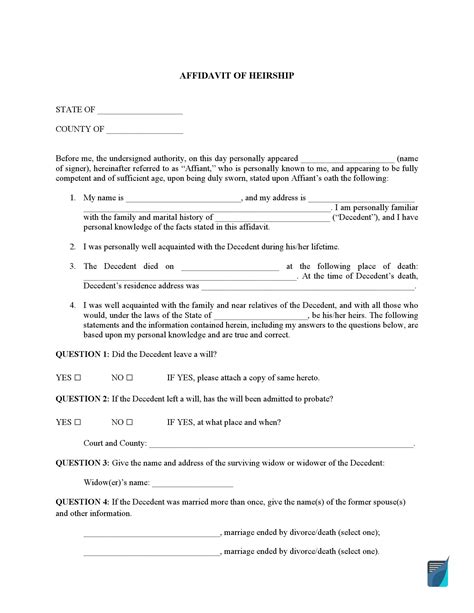

There are several types of inheritance papers, each with its own unique characteristics and purposes. Some of the most common types of inheritance papers include: * Wills: A will is a legal document that outlines the wishes of the deceased regarding the distribution of their assets, properties, and belongings. Wills can be used to distribute assets to specific individuals or organizations, and they can also be used to appoint guardians for minor children or to establish trusts. * Trusts: A trust is a legal instrument that allows individuals to transfer assets to a trustee, who manages the assets for the benefit of the beneficiaries. Trusts can be used to avoid probate, reduce taxes, and protect assets from creditors. * Codocils: A codocil is a supplement to a will that can be used to make changes or additions to the original will. Codocils are often used to update the will to reflect changes in the individual’s assets or wishes. * Living Wills: A living will is a legal document that outlines an individual’s wishes regarding end-of-life medical care. Living wills can be used to specify the types of medical treatments that an individual wants to receive or avoid if they become incapacitated. * Powers of Attorney: A power of attorney is a legal document that grants an individual the authority to manage another person’s assets and make decisions on their behalf. Powers of attorney can be used to manage an individual’s finances, make medical decisions, or conduct other business on their behalf.

Importance of Inheritance Papers

Inheritance papers are essential for ensuring that an individual’s assets are distributed according to their wishes after they pass away. Without inheritance papers, the distribution of assets will be determined by the laws of the state, which may not reflect the individual’s wishes. Some of the importance of inheritance papers include: * Avoiding Probate: Probate is the legal process of settling an estate after an individual passes away. Probate can be time-consuming and expensive, and it can also lead to disputes among heirs. Inheritance papers can help avoid probate by specifying how assets should be distributed and by establishing trusts or other legal instruments that can manage assets outside of probate. * Reducing Taxes: Inheritance papers can help reduce taxes by establishing trusts or other legal instruments that can minimize tax liabilities. For example, a trust can be used to transfer assets to beneficiaries without triggering taxes, or a will can be used to make charitable donations that can reduce tax liabilities. * Protecting Assets: Inheritance papers can help protect assets from creditors or other individuals who may try to claim them. For example, a trust can be used to transfer assets to beneficiaries while protecting them from creditors, or a will can be used to establish a trust that can manage assets for the benefit of beneficiaries.

Creating Inheritance Papers

Creating inheritance papers requires careful planning and consideration. Some of the steps involved in creating inheritance papers include: * Consulting with an Attorney: It is essential to consult with an attorney who specializes in estate planning to ensure that inheritance papers are created correctly and in accordance with state laws. * Identifying Assets: Individuals should identify all of their assets, including properties, investments, and personal belongings, to determine how they should be distributed. * Specifying Wishes: Individuals should specify their wishes regarding the distribution of their assets, including who should inherit what and how assets should be managed. * Updating Documents: Inheritance papers should be updated regularly to reflect changes in an individual’s assets or wishes.

💡 Note: Creating inheritance papers can be a complex and time-consuming process, and it is essential to seek professional advice to ensure that documents are created correctly and in accordance with state laws.

Challenges of Inheritance Papers

Inheritance papers can be challenging to create and manage, especially for individuals who have complex assets or family situations. Some of the challenges of inheritance papers include: * Contesting Wills: Wills can be contested by heirs or beneficiaries who disagree with the distribution of assets. Contesting a will can lead to lengthy and expensive legal battles. * Managing Trusts: Trusts can be complex and difficult to manage, especially for individuals who are not experienced in managing assets. * Updating Documents: Inheritance papers should be updated regularly to reflect changes in an individual’s assets or wishes, which can be time-consuming and expensive.

| Type of Inheritance Paper | Purpose | Benefits |

|---|---|---|

| Wills | Distribute assets according to wishes | Avoid probate, reduce taxes, protect assets |

| Trusts | Manage assets for beneficiaries | Avoid probate, reduce taxes, protect assets |

| Codocils | Update wills to reflect changes | Update wills without creating new documents |

| Living Wills | Specify end-of-life medical care | Ensure wishes are respected, avoid disputes |

| Powers of Attorney | Grant authority to manage assets | Manage finances, make medical decisions, conduct business |

In conclusion, inheritance papers are essential for ensuring that an individual’s assets are distributed according to their wishes after they pass away. Understanding the different types of inheritance papers and their purposes is crucial for creating effective documents that reflect an individual’s wishes. By consulting with an attorney, identifying assets, specifying wishes, and updating documents regularly, individuals can ensure that their assets are distributed correctly and in accordance with state laws.

What is the purpose of a will?

+

A will is a legal document that outlines an individual’s wishes regarding the distribution of their assets, properties, and belongings after they pass away.

What is the difference between a will and a trust?

+

A will is a legal document that distributes assets according to an individual’s wishes, while a trust is a legal instrument that manages assets for the benefit of beneficiaries.

How do I create inheritance papers?

+

To create inheritance papers, individuals should consult with an attorney, identify their assets, specify their wishes, and update documents regularly to reflect changes in their assets or wishes.

What are the benefits of creating inheritance papers?

+

The benefits of creating inheritance papers include avoiding probate, reducing taxes, protecting assets, and ensuring that an individual’s wishes are respected after they pass away.

How often should I update my inheritance papers?

+

Inheritance papers should be updated regularly to reflect changes in an individual’s assets or wishes. It is recommended to review and update inheritance papers at least once a year or when significant changes occur.