Finance a Car Paperwork Needed

Introduction to Financing a Car

When it comes to financing a car, there are several steps involved, and one of the most crucial aspects is the paperwork. Financing a car can be a complex process, and having the right documents is essential to ensure a smooth transaction. In this article, we will discuss the various types of paperwork needed to finance a car, the benefits of financing, and the steps involved in the process.

Benefits of Financing a Car

Financing a car can be beneficial for several reasons. Firstly, it allows you to purchase a car that may be out of your budget if you were to pay cash. Secondly, financing can help you build credit, which can be useful for future loans or credit applications. Finally, financing can provide tax benefits, such as deducting interest payments on your tax return. However, it is essential to weigh the pros and cons of financing a car, as it can also lead to debt and financial strain if not managed properly.

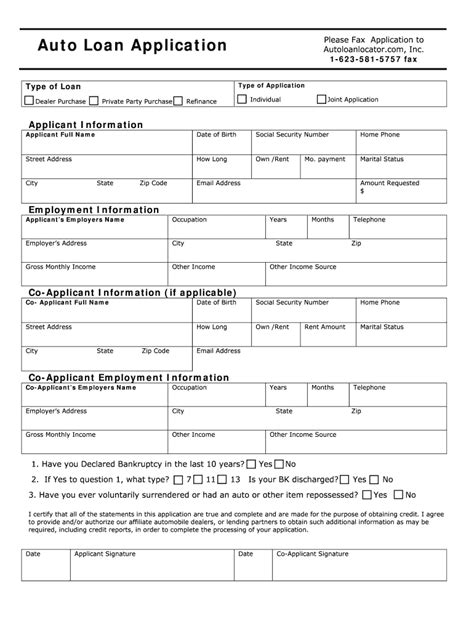

Paperwork Needed to Finance a Car

To finance a car, you will need to provide various documents to the lender. These documents may include: * Identification: A valid driver’s license, passport, or state ID * Income proof: Pay stubs, W-2 forms, or tax returns * Employment verification: A letter from your employer or a copy of your employment contract * Credit report: A copy of your credit report, which can be obtained from the three major credit bureaus * Car information: The make, model, and year of the car, as well as the Vehicle Identification Number (VIN) * Insurance information: Proof of insurance, which may include the policy number and expiration date * Down payment proof: Proof of the down payment, which can be a cashier’s check or a bank statement

📝 Note: The required paperwork may vary depending on the lender and the type of loan. It is essential to check with the lender beforehand to ensure you have all the necessary documents.

Types of Car Financing

There are several types of car financing options available, including: * Secured loans: These loans use the car as collateral and typically have lower interest rates * Unsecured loans: These loans do not use the car as collateral and may have higher interest rates * Leasing: This option allows you to use the car for a set period in exchange for monthly payments * Personal loans: These loans can be used to purchase a car and may have more flexible repayment terms

Steps Involved in Financing a Car

The steps involved in financing a car may vary depending on the lender and the type of loan. However, the general process typically includes: * Application: Submitting an application to the lender, which may include providing personal and financial information * Pre-approval: Receiving pre-approval for the loan, which can give you an idea of how much you can borrow * Car selection: Choosing the car you want to purchase and providing the necessary information to the lender * Loan approval: Receiving final approval for the loan, which may include reviewing and signing the loan agreement * Disbursement: Receiving the loan funds, which can be used to purchase the car

| Loan Type | Interest Rate | Repayment Term |

|---|---|---|

| Secured Loan | 5-7% | 3-5 years |

| Unsecured Loan | 7-10% | 3-5 years |

| Leasing | N/A | 2-3 years |

Tips for Financing a Car

To ensure a smooth financing process, it is essential to: * Check your credit report: Ensure there are no errors or negative marks on your credit report * Shop around: Compare rates and terms from different lenders to find the best option * Read the fine print: Carefully review the loan agreement before signing * Ask questions: Do not hesitate to ask the lender questions if you are unsure about any aspect of the loan

In the end, financing a car can be a complex process, but having the right paperwork and understanding the steps involved can make it more manageable. By doing your research, shopping around, and carefully reviewing the loan agreement, you can ensure a smooth and successful financing experience.

What are the benefits of financing a car?

+

The benefits of financing a car include being able to purchase a car that may be out of your budget, building credit, and potentially receiving tax benefits.

What paperwork is needed to finance a car?

+

The paperwork needed to finance a car may include identification, income proof, employment verification, credit report, car information, insurance information, and down payment proof.

What are the different types of car financing options?

+

The different types of car financing options include secured loans, unsecured loans, leasing, and personal loans.