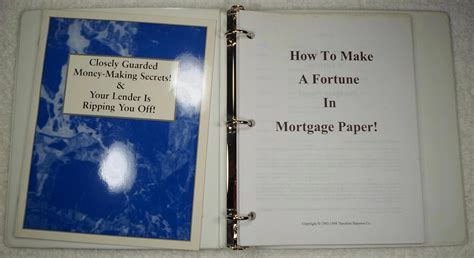

5 Mortgage Paper Tips

Introduction to Mortgage Papers

When it comes to purchasing a home, one of the most critical steps in the process is dealing with the mortgage papers. These documents are essential for the home buying process, as they outline the terms of the loan, including the interest rate, repayment terms, and the borrower’s obligations. Understanding the mortgage papers is crucial for a smooth and successful transaction. In this article, we will explore five mortgage paper tips that every homebuyer should know.

Tip 1: Understand the Types of Mortgage

There are several types of mortgages available, each with its own set of terms and conditions. The most common types of mortgages include fixed-rate mortgages, adjustable-rate mortgages, and government-backed mortgages. Fixed-rate mortgages offer a fixed interest rate for the life of the loan, while adjustable-rate mortgages have interest rates that can change over time. Government-backed mortgages, such as FHA and VA loans, offer more lenient credit score requirements and lower down payments. It’s essential to understand the differences between these types of mortgages to choose the one that best suits your needs.

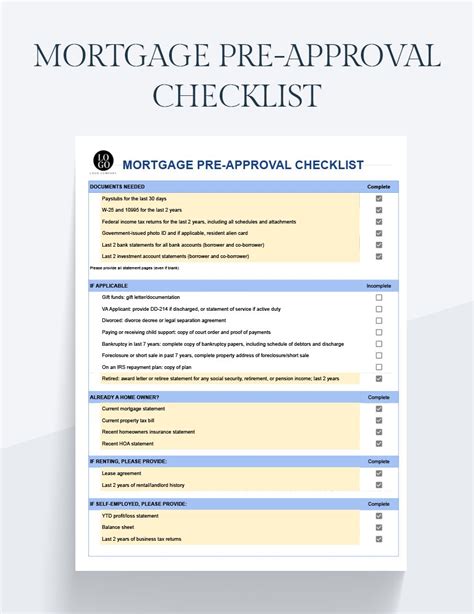

Tip 2: Review the Loan Estimate

The Loan Estimate is a document that outlines the terms of the loan, including the interest rate, monthly payment, and closing costs. This document is usually provided by the lender within three business days of applying for a mortgage. It’s crucial to review the Loan Estimate carefully, as it will give you a clear understanding of the costs associated with the loan. Make sure to check for any errors or discrepancies, and don’t hesitate to ask questions if you’re unsure about any of the terms.

Tip 3: Understand the Closing Disclosure

The Closing Disclosure is a document that outlines the final terms of the loan, including the interest rate, monthly payment, and closing costs. This document is usually provided by the lender at least three business days before closing. It’s essential to review the Closing Disclosure carefully, as it will give you a clear understanding of the final costs associated with the loan. Make sure to check for any errors or discrepancies, and don’t hesitate to ask questions if you’re unsure about any of the terms.

Tip 4: Check for Prepayment Penalties

Some mortgages come with prepayment penalties, which can charge you a fee for paying off the loan early. These penalties can be a significant amount, so it’s essential to check if your mortgage has a prepayment penalty clause. If it does, make sure you understand the terms of the penalty, including the amount and the timeframe in which it applies.

Tip 5: Keep Detailed Records

Keeping detailed records of your mortgage papers is crucial for future reference. Make sure to keep copies of all documents, including the Loan Estimate, Closing Disclosure, and promissory note. These records will come in handy if you need to dispute any errors or discrepancies in the future. It’s also a good idea to keep track of your payments, including the date and amount of each payment.

📝 Note: It's essential to keep your mortgage papers organized and easily accessible, as you may need to refer to them in the future.

Additional Tips

In addition to the five tips outlined above, here are some additional tips to keep in mind when dealing with mortgage papers: * Always read the fine print carefully before signing any documents. * Ask questions if you’re unsure about any of the terms or conditions. * Make sure to get everything in writing, including any verbal agreements or promises. * Keep a record of all correspondence with your lender, including emails and phone calls.

| Document | Description |

|---|---|

| Loan Estimate | Outlines the terms of the loan, including the interest rate and monthly payment. |

| Closing Disclosure | Outlines the final terms of the loan, including the interest rate and closing costs. |

| Promissory Note | A promise to repay the loan, including the interest rate and repayment terms. |

In summary, understanding the mortgage papers is crucial for a smooth and successful home buying process. By following these five tips, you can ensure that you’re well-prepared and informed throughout the process. Remember to always read the fine print carefully, ask questions if you’re unsure, and keep detailed records of your mortgage papers.

What is a Loan Estimate?

+

A Loan Estimate is a document that outlines the terms of the loan, including the interest rate, monthly payment, and closing costs.

What is a Closing Disclosure?

+

A Closing Disclosure is a document that outlines the final terms of the loan, including the interest rate, monthly payment, and closing costs.

What is a prepayment penalty?

+

A prepayment penalty is a fee charged for paying off the loan early. It’s essential to check if your mortgage has a prepayment penalty clause before signing any documents.