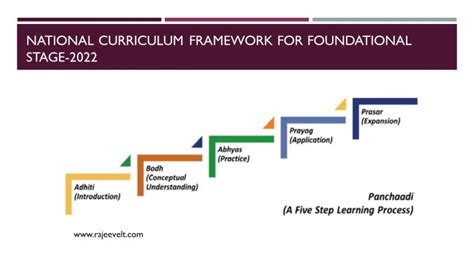

5 Steps 501c3

Understanding the Basics of 501c3

The 501c3 status is a tax exemption granted to non-profit organizations by the Internal Revenue Service (IRS). This status allows organizations to operate without paying federal income tax, and it also enables donors to claim a tax deduction for their contributions. The process of obtaining a 501c3 status involves several steps, which are crucial for non-profit organizations to follow.

In this article, we will explore the five key steps to obtain a 501c3 status, providing a comprehensive guide for non-profit organizations.

Step 1: Determine Eligibility

Before applying for a 501c3 status, it is essential to determine if your organization is eligible. The IRS has specific requirements that must be met, including: * The organization must be a corporation, trust, or association. * The organization must be organized and operated exclusively for charitable, educational, scientific, or religious purposes. * The organization’s net earnings must not benefit any private individual or shareholder. * The organization must not be involved in political campaigns or substantial lobbying activities.

It is crucial to review the IRS guidelines and ensure that your organization meets these requirements before proceeding with the application process.

Step 2: Choose a Business Structure

Non-profit organizations can be structured in various ways, including: * Corporation: This is the most common structure for non-profit organizations. It provides liability protection and is required for 501c3 status. * Trust: This structure is often used for charitable trusts or foundations. * Association: This structure is less common and is often used for membership-based organizations.

It is essential to consult with an attorney or accountant to determine the best business structure for your organization.

Step 3: Obtain an Employer Identification Number (EIN)

An EIN is a unique nine-digit number assigned to your organization by the IRS. It is used to identify your organization for tax purposes and is required for the 501c3 application process. You can apply for an EIN online, by phone, or by mail.

To apply for an EIN, you will need to provide the following information: * Organization name and address * Type of business structure * Purpose of the organization * Name and address of the principal officer

Step 4: File Form 1023

Form 1023 is the application for 501c3 status. It is a detailed form that requires information about your organization, including: * Mission statement: A brief description of your organization’s purpose and goals. * Articles of incorporation: A copy of your organization’s articles of incorporation or other organizing documents. * Bylaws: A copy of your organization’s bylaws or other governing documents. * Financial information: A detailed financial statement, including income, expenses, and balance sheet.

The form must be signed by an authorized officer of the organization, and it must be accompanied by the required fee.

Step 5: Wait for IRS Review and Approval

After submitting Form 1023, the IRS will review your application to ensure that your organization meets the requirements for 501c3 status. This process can take several months, and it is essential to be patient and responsive to any requests for additional information.

Once your application is approved, you will receive a determination letter from the IRS, which confirms your organization’s 501c3 status. This letter is essential for tax purposes and for obtaining grants and donations.

💡 Note: It is crucial to ensure that your organization is in compliance with all IRS requirements and regulations to maintain its 501c3 status.

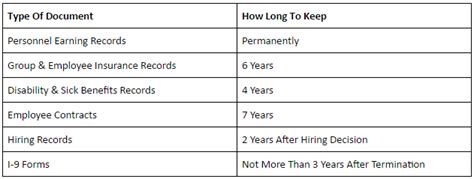

In addition to these steps, it is essential to consider the following: * Annual filing requirements: Non-profit organizations with 501c3 status must file an annual information return (Form 990) with the IRS. * Record-keeping: Non-profit organizations must maintain accurate and detailed records, including financial statements, meeting minutes, and governance documents. * Compliance with state and local regulations: Non-profit organizations must comply with state and local regulations, including registration and reporting requirements.

The following table summarizes the key steps to obtain a 501c3 status:

| Step | Description |

|---|---|

| 1. Determine Eligibility | Review IRS guidelines to ensure your organization meets the requirements for 501c3 status. |

| 2. Choose a Business Structure | Consult with an attorney or accountant to determine the best business structure for your organization. |

| 3. Obtain an EIN | Apply for an EIN online, by phone, or by mail. |

| 4. File Form 1023 | Submit the application for 501c3 status, including all required documentation and fees. |

| 5. Wait for IRS Review and Approval | Respond to any requests for additional information and wait for the IRS to review and approve your application. |

In summary, obtaining a 501c3 status requires careful planning, attention to detail, and compliance with IRS regulations. By following these five steps and maintaining accurate records, non-profit organizations can ensure that they are eligible for tax-exempt status and can focus on their mission to serve the public good.

What is the purpose of a 501c3 status?

+

The purpose of a 501c3 status is to provide tax exemption to non-profit organizations, allowing them to operate without paying federal income tax and enabling donors to claim a tax deduction for their contributions.

How long does it take to obtain a 501c3 status?

+

The processing time for a 501c3 application can vary, but it typically takes several months. The IRS will review your application to ensure that your organization meets the requirements for 501c3 status.

What are the annual filing requirements for non-profit organizations with 501c3 status?

+

Non-profit organizations with 501c3 status must file an annual information return (Form 990) with the IRS, which includes detailed financial information and governance documents.