5 Tax Paperwork Tips

Understanding Tax Paperwork: A Comprehensive Guide

When it comes to managing tax paperwork, it’s essential to stay organized and informed to avoid any potential issues or penalties. Tax season can be a stressful time, especially with the numerous forms and documents that need to be completed and submitted. In this article, we will explore five valuable tips to help you navigate the world of tax paperwork with ease and confidence.

Tip 1: Gather All Necessary Documents

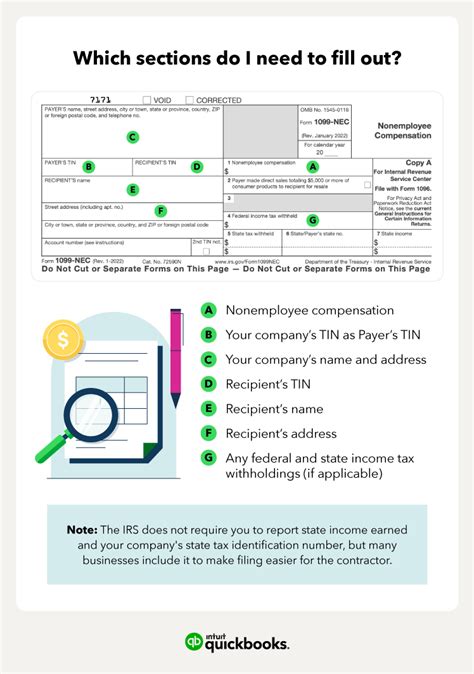

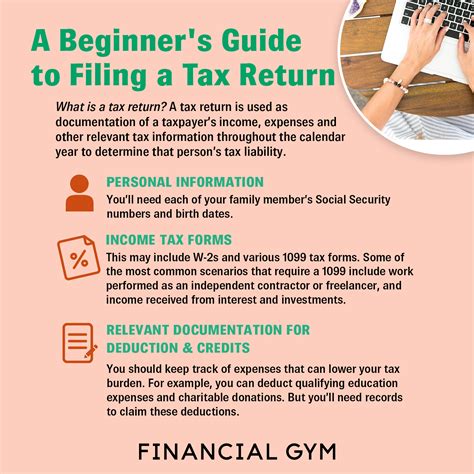

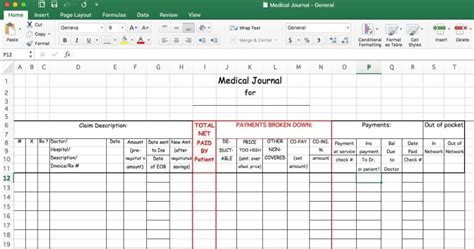

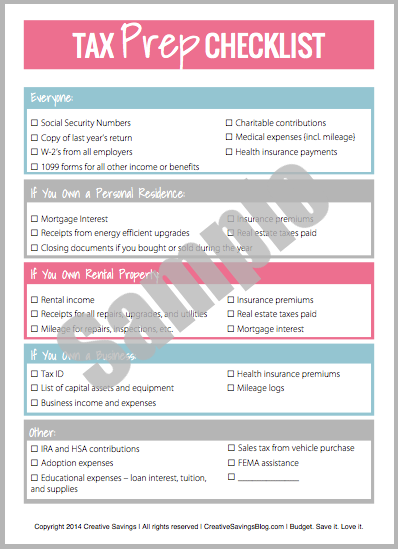

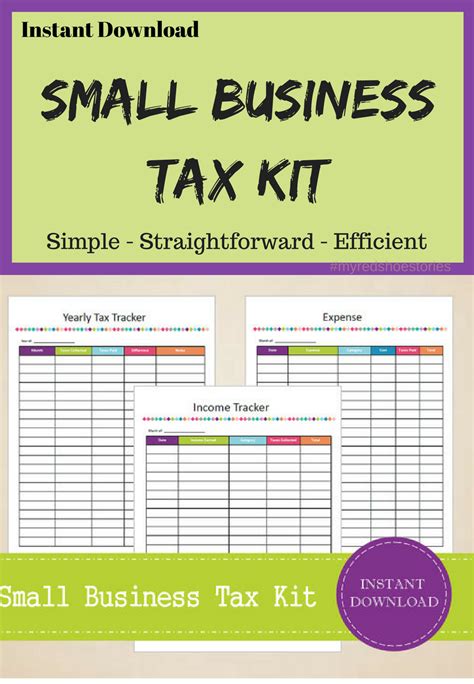

Before starting your tax return, make sure you have all the required documents at your disposal. This includes: * W-2 forms from your employer, showing your income and taxes withheld * 1099 forms for any freelance or contract work * Interest statements from banks and investments (1099-INT) * Dividend statements (1099-DIV) * Charitable donation receipts * Medical expense receipts Having all these documents in one place will save you time and reduce the likelihood of errors in your tax return.

Tip 2: Choose the Right Filing Status

Your filing status can significantly impact your tax liability. It’s crucial to choose the correct status to ensure you receive the maximum refund you’re eligible for. The most common filing statuses are: * Single * Married filing jointly * Married filing separately * Head of household * Qualifying widow(er) Each status has its own set of rules and benefits, so take the time to understand which one applies to your situation.

Tip 3: Take Advantage of Tax Deductions and Credits

Tax deductions and credits can substantially reduce your tax bill. Tax deductions lower your taxable income, while tax credits directly reduce the amount of tax you owe. Some common deductions and credits include: * Mortgage interest * Charitable donations * Medical expenses * Child tax credit * Earned income tax credit (EITC) Keep accurate records of your expenses and research the credits you’re eligible for to maximize your savings.

Tip 4: File Electronically and On Time

Filing your tax return electronically is faster, more secure, and often required by the IRS. It also reduces the risk of errors and provides faster refund processing. Make sure to submit your return by the designated deadline to avoid late fees and penalties. If you need more time, you can file for an extension, but be aware that this doesn’t extend the payment deadline.

Tip 5: Seek Professional Help When Needed

Tax laws and regulations can be complex and overwhelming. If you’re unsure about any aspect of your tax return or need help with a specific issue, consider consulting a tax professional. They can provide personalized advice, ensure accuracy, and help you navigate any audits or disputes with the IRS.

📝 Note: Always keep a copy of your tax return and supporting documents for at least three years in case of an audit or if you need to reference them in the future.

In summary, managing tax paperwork effectively requires organization, knowledge of tax laws, and attention to detail. By following these five tips, you’ll be well on your way to a stress-free tax season. Remember to stay informed, take advantage of deductions and credits, and don’t hesitate to seek professional help when needed.

What is the deadline for filing tax returns?

+

The deadline for filing tax returns is typically April 15th of each year, but it may vary if the 15th falls on a weekend or federal holiday.

Can I file for an extension if I need more time?

+

Yes, you can file for an automatic six-month extension by submitting Form 4868 by the original deadline. However, this only extends the filing deadline, not the payment deadline.

How long should I keep my tax records?

+

It’s recommended to keep your tax records, including supporting documents, for at least three years in case of an audit or if you need to reference them in the future.