5 Tips Employer Life Insurance

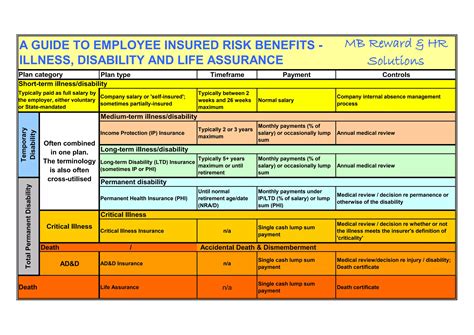

Understanding Employer Life Insurance

Employer life insurance, also known as group life insurance, is a type of life insurance that is offered by an employer to their employees as a benefit. This type of insurance provides a death benefit to the employee’s beneficiaries if the employee dies while employed by the company. Group life insurance is usually offered as part of a benefits package and may be paid for entirely or partially by the employer. In this article, we will explore 5 tips that employees should consider when evaluating employer life insurance.

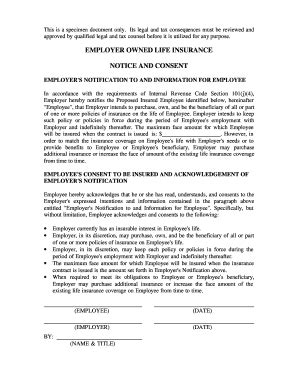

Tip 1: Understand the Policy Terms

When evaluating employer life insurance, it’s essential to understand the policy terms. This includes knowing the coverage amount, which is the amount of money that will be paid to the beneficiary in the event of the employee’s death. The coverage amount is usually a multiple of the employee’s salary, such as 1-3 times the annual salary. Employees should also understand the eligibility requirements, which may include being a full-time or part-time employee, and the enrollment process, which may involve completing a application or providing medical information.

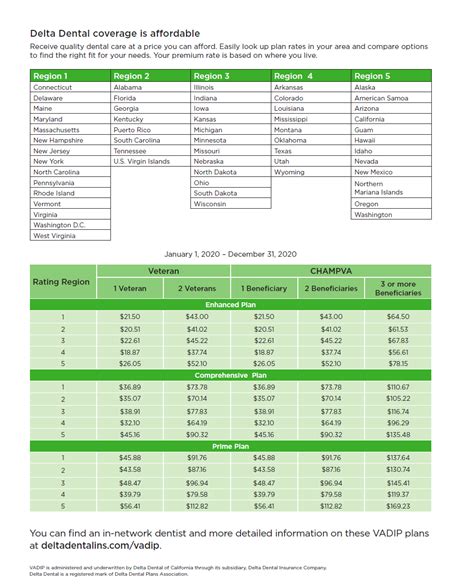

Tip 2: Consider the Cost

While employer life insurance may be offered as a free or low-cost benefit, employees should consider the cost of the coverage. If the employer pays the entire premium, the employee may not have to pay anything out of pocket. However, if the employee is required to pay a portion of the premium, they should consider whether the cost is worth the benefit. Premium costs can vary depending on the employer, the coverage amount, and the employee’s age and health.

Tip 3: Evaluate the Coverage Amount

The coverage amount is an essential aspect of employer life insurance. Employees should evaluate whether the coverage amount is sufficient to provide for their beneficiaries in the event of their death. Factors to consider include the employee’s income, debts, and dependents. If the coverage amount is not sufficient, employees may want to consider purchasing additional life insurance coverage.

Tip 4: Consider Portability

Employer life insurance is usually non-portable, meaning that the coverage ends when the employee leaves the company. Employees should consider whether they want to maintain life insurance coverage after leaving the company. If so, they may want to consider purchasing an individual life insurance policy or converting their group life insurance policy to an individual policy. Conversion options may be available, but employees should review their policy to determine if this is an option.

Tip 5: Review and Update Beneficiaries

Employees should regularly review and update their beneficiaries to ensure that the death benefit is paid to the correct person. Beneficiaries can be updated by completing a beneficiary form and submitting it to the employer or insurance company. Factors to consider when designating beneficiaries include the employee’s spouse, children, or other dependents.

💡 Note: Employees should carefully review their employer life insurance policy to understand the terms, conditions, and coverage amounts. They should also consider their individual circumstances and needs when evaluating this benefit.

In summary, employer life insurance can be a valuable benefit for employees, providing a death benefit to their beneficiaries in the event of their death. By understanding the policy terms, considering the cost, evaluating the coverage amount, considering portability, and reviewing and updating beneficiaries, employees can make informed decisions about their employer life insurance coverage.

What is employer life insurance?

+

Employer life insurance, also known as group life insurance, is a type of life insurance that is offered by an employer to their employees as a benefit.

How much does employer life insurance cost?

+

The cost of employer life insurance can vary depending on the employer, the coverage amount, and the employee’s age and health. In some cases, the employer may pay the entire premium, while in other cases, the employee may be required to pay a portion of the premium.

Can I keep my employer life insurance coverage if I leave my job?

+

Employer life insurance is usually non-portable, meaning that the coverage ends when the employee leaves the company. However, employees may be able to convert their group life insurance policy to an individual policy or purchase a new individual life insurance policy.