5 Tax Health Tips

Understanding Tax Health

Tax health refers to the overall status of an individual’s or business’s tax compliance and financial well-being in relation to tax obligations. Maintaining good tax health is crucial for avoiding legal issues, minimizing tax liabilities, and maximizing refunds. It involves understanding tax laws, meeting tax deadlines, and leveraging available tax deductions and credits. In this article, we will explore five key tax health tips designed to help individuals and businesses navigate the complex world of taxation more effectively.

Tip 1: Stay Informed About Tax Laws and Changes

Staying up-to-date with the latest tax laws and regulations is essential for maintaining good tax health. Tax laws are subject to change, and these changes can significantly impact tax liabilities and benefits. For instance, new tax credits or deductions might be introduced, or existing ones might be modified or repealed. Individuals and businesses should regularly check official tax authority websites, consult with tax professionals, or subscribe to tax news updates to stay informed. Knowledge about tax law changes can help in planning and decision-making, ensuring compliance and optimizing tax strategies.

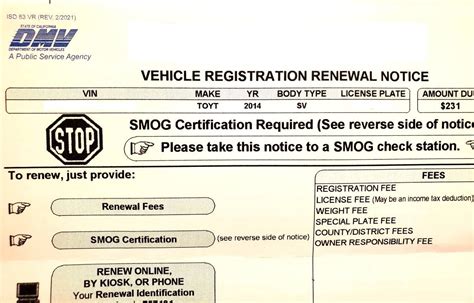

Tip 2: Keep Accurate and Organized Records

Maintaining accurate, complete, and organized tax records is vital for tax health. This includes income statements, expense records, receipts for tax-deductible expenses, and any other documents that might be needed for tax filings. Digital tools and software can be extremely helpful in organizing and storing tax-related documents securely. Good record-keeping practices not only facilitate the tax filing process but also provide a clear audit trail in case of a tax audit, reducing the risk of penalties and interest.

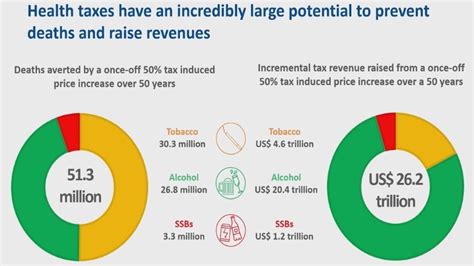

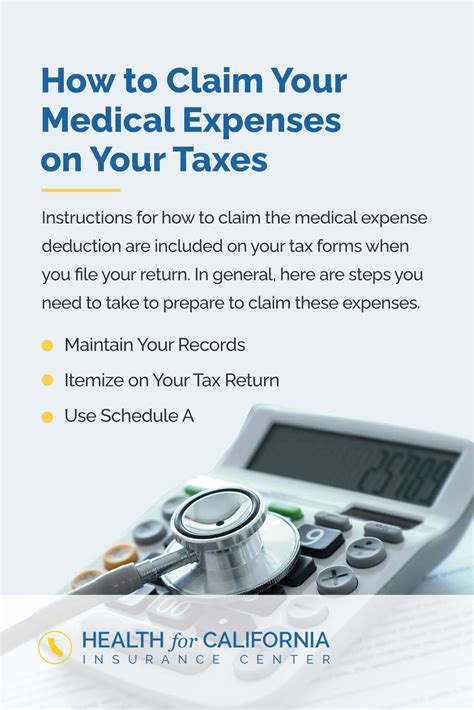

Tip 3: Leverage Tax Deductions and Credits

Tax deductions and credits can significantly reduce tax liabilities, but many individuals and businesses fail to claim all the deductions and credits they are eligible for. Tax deductions reduce taxable income, while tax credits directly reduce the amount of tax owed. Common deductions include charitable donations, mortgage interest, and business expenses. Tax credits might be available for education expenses, child care, or investments in renewable energy. Consulting a tax professional can help identify all eligible deductions and credits, ensuring that tax savings opportunities are not missed.

Tip 4: Plan for Tax Payments and Refunds

Effective tax planning involves not just minimizing tax liabilities but also managing tax payments and potential refunds wisely. Individuals and businesses should aim to balance their tax withholding or estimated tax payments to avoid large tax bills or penalties for underpayment. On the other hand, strategically planning for tax refunds can provide a significant cash infusion for savings, investments, or debt repayment. Understanding how tax payments and refunds work can help in making informed financial decisions throughout the year.

Tip 5: Seek Professional Tax Advice

Finally, seeking professional tax advice is a crucial aspect of maintaining good tax health. Tax laws and regulations are complex and often change, making it challenging for individuals and businesses to navigate without expert guidance. Tax professionals can provide personalized advice tailored to specific situations, help with tax planning and compliance, and represent clients in case of tax disputes or audits. Their expertise can help minimize tax risks, optimize tax savings, and ensure peace of mind regarding tax obligations.

📝 Note: Regularly reviewing and adjusting tax strategies as personal or business circumstances change is essential for ongoing tax health.

In summary, achieving and maintaining good tax health requires a combination of staying informed, keeping organized records, leveraging tax savings opportunities, planning for tax payments and refunds, and seeking professional advice when needed. By following these tips, individuals and businesses can better navigate the complex tax environment, minimize risks, and maximize financial benefits.

What is the importance of maintaining good tax health?

+

Maintaining good tax health is important because it helps individuals and businesses avoid legal issues, minimize tax liabilities, and maximize refunds. It involves understanding tax laws, meeting tax deadlines, and leveraging available tax deductions and credits.

How can I stay informed about tax law changes?

+

You can stay informed about tax law changes by regularly checking official tax authority websites, consulting with tax professionals, or subscribing to tax news updates. Digital tools and software can also be helpful in keeping track of tax-related information.

What are the benefits of seeking professional tax advice?

+

Seeking professional tax advice can help minimize tax risks, optimize tax savings, and ensure peace of mind regarding tax obligations. Tax professionals can provide personalized advice, help with tax planning and compliance, and represent clients in case of tax disputes or audits.