5 Healthcare Tax Tips

Introduction to Healthcare Tax Tips

The healthcare system can be complex and overwhelming, especially when it comes to taxes. With the ever-changing landscape of healthcare laws and regulations, it’s essential to stay informed about the tax implications of your healthcare decisions. In this article, we’ll explore five healthcare tax tips to help you navigate the system and potentially save money on your taxes.

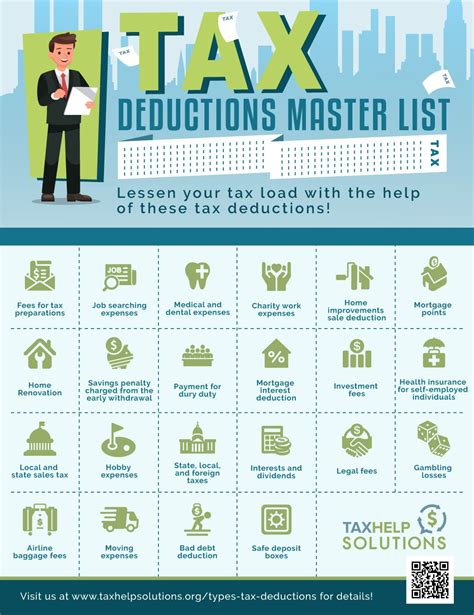

Understanding Healthcare Tax Deductions

When it comes to taxes, healthcare expenses can be a significant factor in reducing your taxable income. The Affordable Care Act (ACA) has introduced several tax provisions that can help individuals and families with healthcare expenses. For example, you can deduct medical expenses that exceed 10% of your adjusted gross income (AGI). This includes expenses such as doctor visits, hospital stays, prescriptions, and more.

Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a tax-advantaged account that allows you to set aside money for healthcare expenses. To be eligible for an HSA, you must have a high-deductible health plan (HDHP). Contributions to an HSA are tax-deductible, and the funds grow tax-free. You can use the funds in your HSA to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays.

Tax Credits for Healthcare

The Premium Tax Credit (PTC) is a tax credit that helps eligible individuals and families with low to moderate income afford health insurance. The PTC is based on your income and family size, and it can be claimed when you file your tax return. Additionally, the Small Business Health Care Tax Credit is available to small businesses that provide health insurance to their employees.

Medicare Taxes and Benefits

If you’re a Medicare beneficiary, you may be eligible for tax benefits related to your healthcare expenses. For example, you can deduct Medicare premiums as a medical expense on your tax return. Additionally, if you’re eligible for Medicare Part D, you may be able to claim a tax credit for your prescription drug expenses.

Additional Healthcare Tax Tips

Here are a few more healthcare tax tips to keep in mind: * Keep accurate records of your healthcare expenses, including receipts and invoices. * Consider consulting a tax professional or using tax software to help you navigate the tax implications of your healthcare decisions. * Be aware of the tax implications of any changes to your healthcare coverage or expenses throughout the year.

💡 Note: It's essential to consult with a tax professional or financial advisor to ensure you're taking advantage of all the healthcare tax tips available to you.

In summary, understanding healthcare tax tips can help you navigate the complex healthcare system and potentially save money on your taxes. By taking advantage of tax deductions, HSAs, tax credits, and other benefits, you can reduce your taxable income and keep more of your hard-earned money.

What is the Affordable Care Act (ACA)?

+

The Affordable Care Act (ACA) is a federal law that aims to increase healthcare accessibility and affordability for Americans. It introduced several tax provisions that can help individuals and families with healthcare expenses.

How do I qualify for a Health Savings Account (HSA)?

+

To qualify for an HSA, you must have a high-deductible health plan (HDHP) and meet certain income and eligibility requirements. You can consult with a tax professional or financial advisor to determine if you’re eligible for an HSA.

Can I deduct Medicare premiums as a medical expense?

+

Yes, you can deduct Medicare premiums as a medical expense on your tax return. This includes premiums for Medicare Part B, Medicare Part D, and Medicare Advantage plans.