File 1023 EZ Additional Paperwork Requirements

Introduction to File 1023 EZ

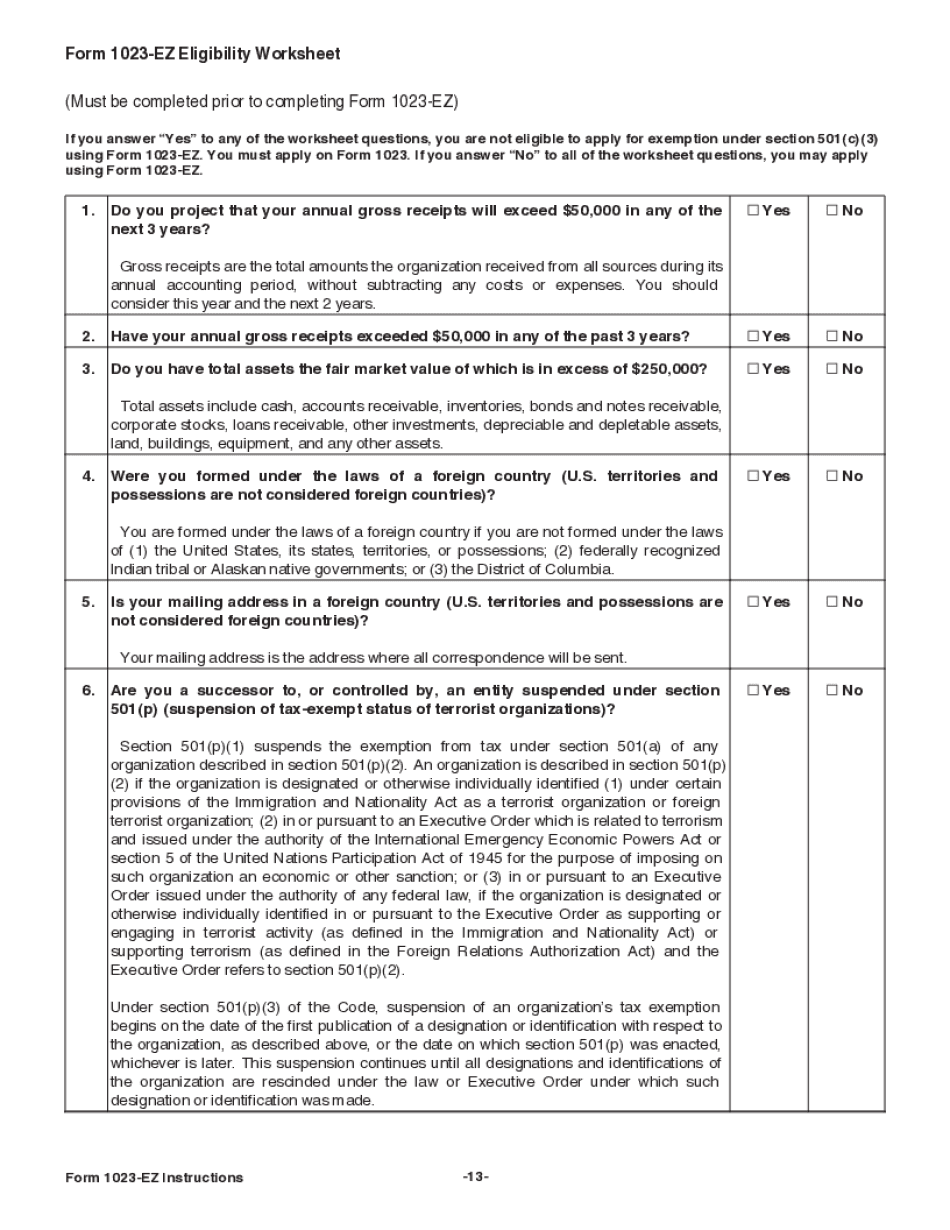

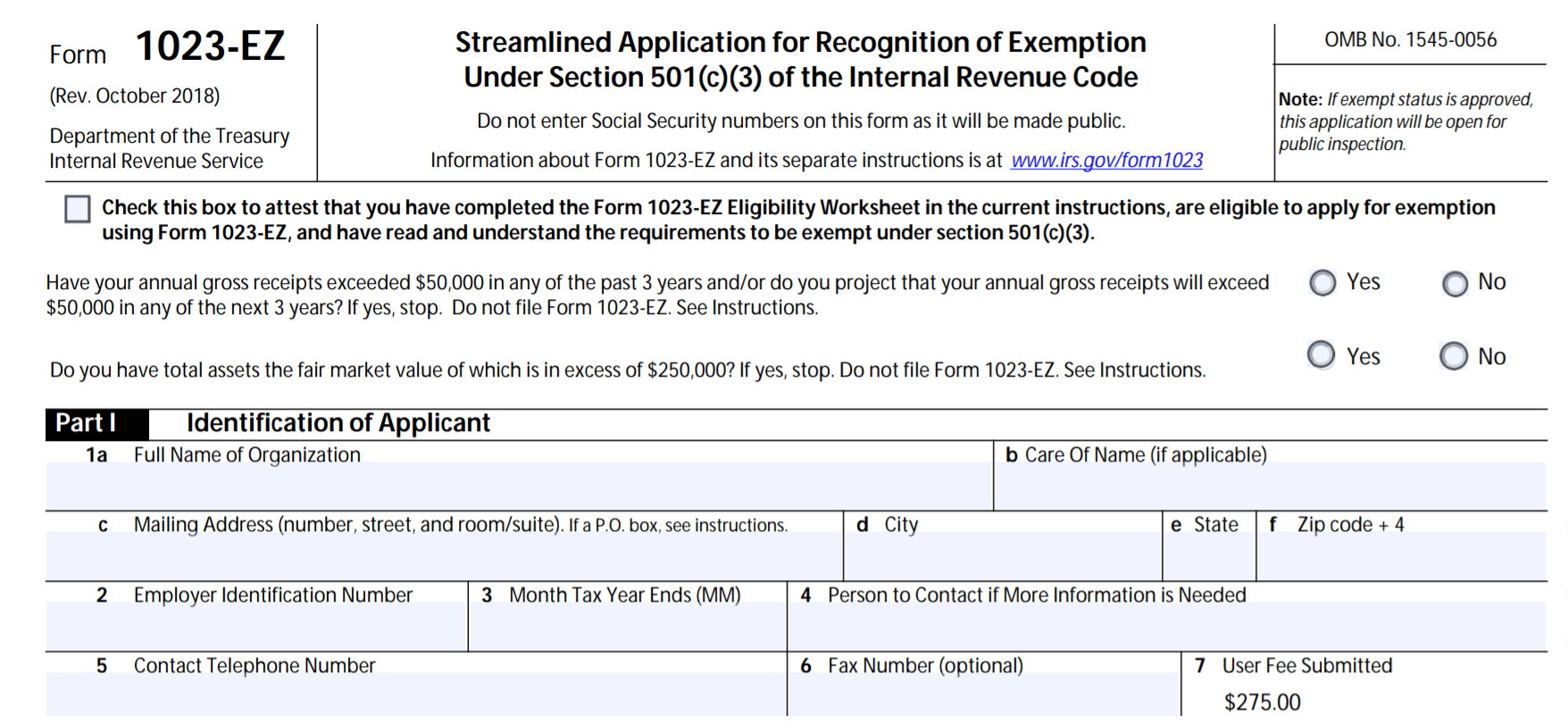

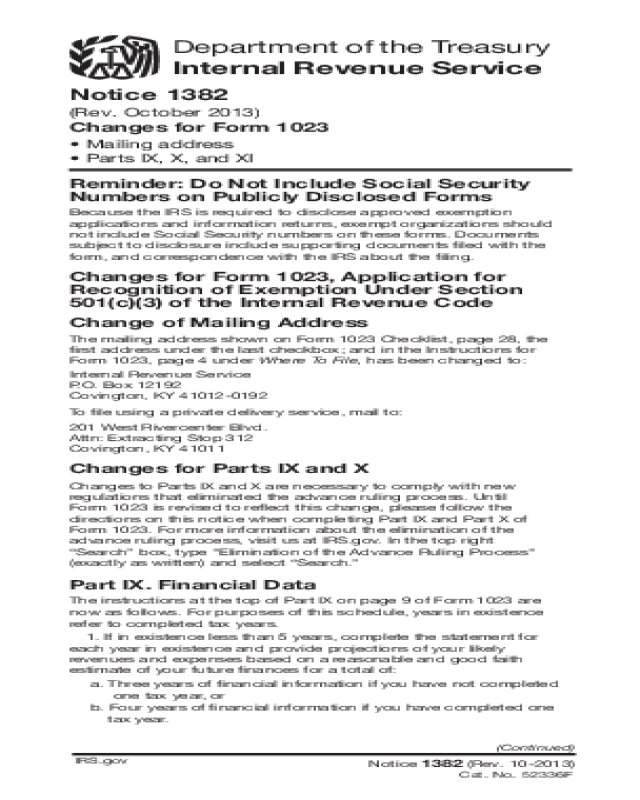

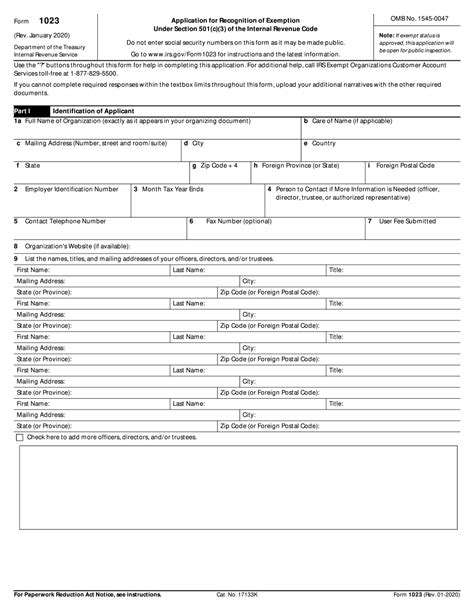

When applying for tax-exempt status under Section 501©(3) of the Internal Revenue Code, smaller organizations may be eligible to use the streamlined Form 1023-EZ, also known as the Streamlined Application for Recognition of Exemption Under Section 501©(3) of the Internal Revenue Code. This form is designed for organizations with annual gross receipts of 50,000 or less and <b>total assets</b> of 250,000 or less. The use of Form 1023-EZ simplifies the application process for smaller nonprofits, reducing the amount of information required compared to the standard Form 1023.

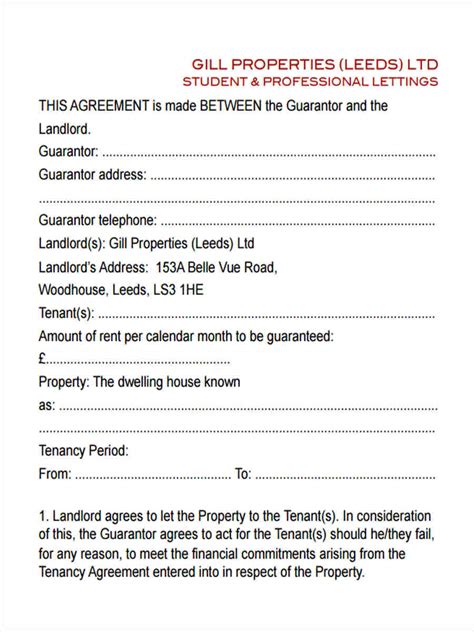

Eligibility Criteria for Form 1023-EZ

To be eligible to file Form 1023-EZ, an organization must meet specific criteria: - The organization must be a corporation, trust, or association. - It must be organized and operated exclusively for one or more of the following purposes: charitable, educational, scientific, religious, literary, testing for public safety, fostering national or international amateur sports competition, preventing cruelty to children or animals. - No part of its net earnings may inure to the benefit of private shareholders or individuals. - It must not be a private foundation or a supporting organization as described in Section 509(a)(3). - It must have annual gross receipts of 50,000 or less for the past 3 years and anticipate gross receipts of 50,000 or less annually for the next 3 years. - Its total assets must be $250,000 or less.

Required Additional Paperwork

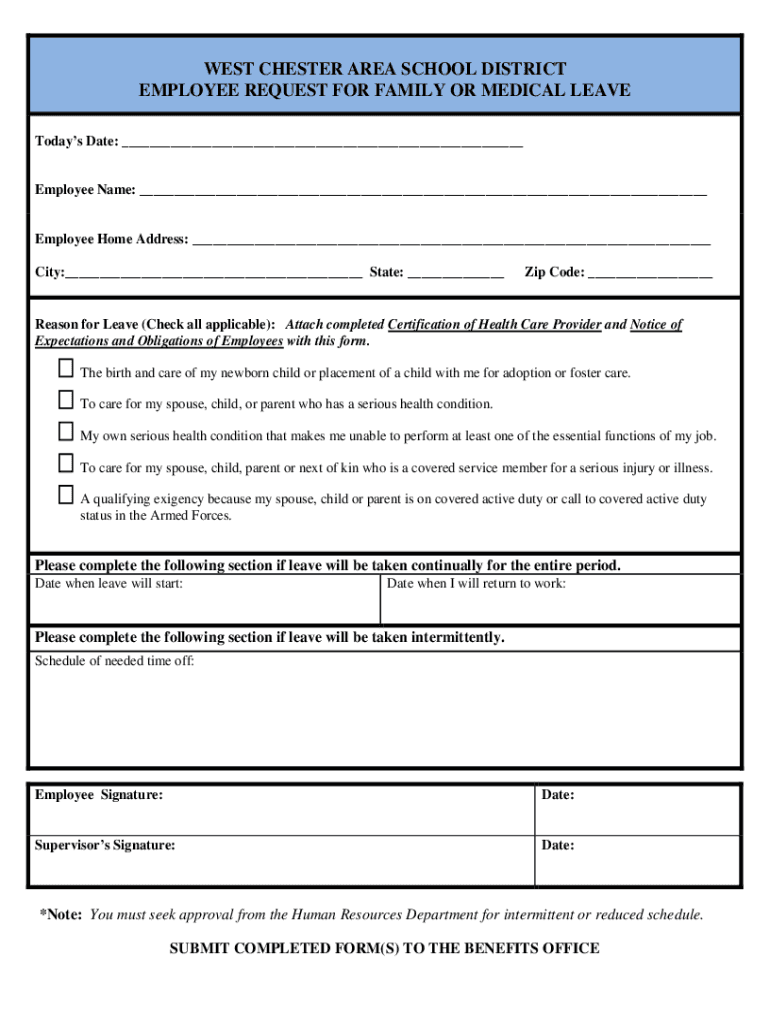

While Form 1023-EZ is more streamlined than Form 1023, there are still certain additional paperwork requirements that organizations need to be aware of: - Articles of Incorporation: The organization must have articles of incorporation that limit its purposes to one or more exempt purposes and that do not empower it to engage in activities that are not in furtherance of one or more exempt purposes. - Bylaws or Other Governing Documents: Although not required to be submitted with the application, the organization must have adopted bylaws or other governing documents that outline the rules and procedures for the organization’s operations and management. - EIN (Employer Identification Number): The organization must have an EIN, which can be obtained by filing Form SS-4 with the IRS.

Preparation and Submission

To prepare and submit Form 1023-EZ, the following steps should be taken: - Ensure the organization meets the eligibility criteria. - Gather all necessary information and documents. - Complete Form 1023-EZ accurately and thoroughly. - Pay the required

Notes on the Application Process

💡 Note: The IRS reviews applications for completeness and to ensure that the organization has provided all necessary information. If the application is incomplete, the IRS will contact the organization to request additional information, which can delay the processing of the application.

It is crucial for organizations to carefully review the instructions and ensure they meet all eligibility criteria before submitting their application. Failure to comply with any requirement can result in the application being returned or the recognition of tax-exempt status being delayed.Steps After Filing Form 1023-EZ

After filing Form 1023-EZ: - The organization should receive an email confirming receipt of the application from the IRS. - The IRS will review the application. This process can take several months. - Once the application is approved, the organization will receive a determination letter from the IRS, which officially recognizes its tax-exempt status under Section 501©(3). - The organization must then comply with all requirements for tax-exempt organizations, including filing an annual information return with the IRS (typically Form 990-N for small organizations).

Conclusion Summary

In summary, while Form 1023-EZ offers a more streamlined process for smaller nonprofits to apply for tax-exempt status, it is essential for these organizations to understand the eligibility criteria and additional paperwork requirements. By carefully preparing and submitting their application, organizations can ensure a smoother process and timely recognition of their tax-exempt status. It is also crucial for these organizations to comply with ongoing requirements to maintain their exempt status.

What is the purpose of Form 1023-EZ?

+

Form 1023-EZ is a streamlined application for recognition of exemption under Section 501©(3) of the Internal Revenue Code, designed for smaller organizations with annual gross receipts of 50,000 or less and total assets of 250,000 or less.

How do I determine if my organization is eligible to file Form 1023-EZ?

+

To be eligible, your organization must meet specific criteria, including being a corporation, trust, or association, and having annual gross receipts of 50,000 or less and total assets of 250,000 or less. It must also be organized and operated exclusively for exempt purposes.

What is the process for submitting Form 1023-EZ?

+

The process involves ensuring eligibility, gathering necessary documents, completing Form 1023-EZ, paying the user fee, and submitting the form and supporting documents electronically through pay.gov.