5 Guarantor Paperwork Needed

Introduction to Guarantor Paperwork

When an individual applies for a loan, credit card, or rental agreement, they may be required to provide a guarantor. A guarantor is a person who agrees to take on the debt or responsibility if the primary borrower defaults on their payments. In such cases, certain paperwork is necessary to formalize the agreement and protect all parties involved. This article will outline the essential guarantor paperwork needed for various financial and rental transactions.

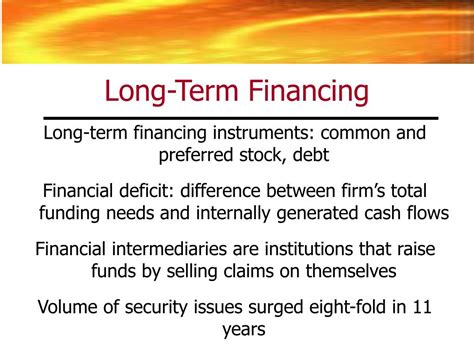

Types of Guarantor Paperwork

The types of guarantor paperwork required can vary depending on the specific transaction, such as a loan, credit card application, or rental agreement. Below are some of the most common types of guarantor paperwork:

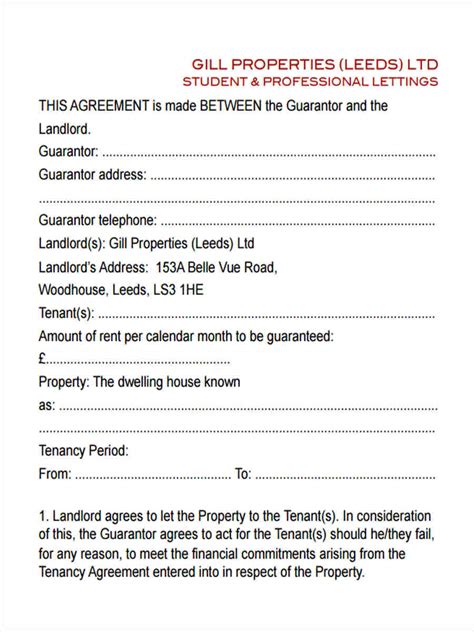

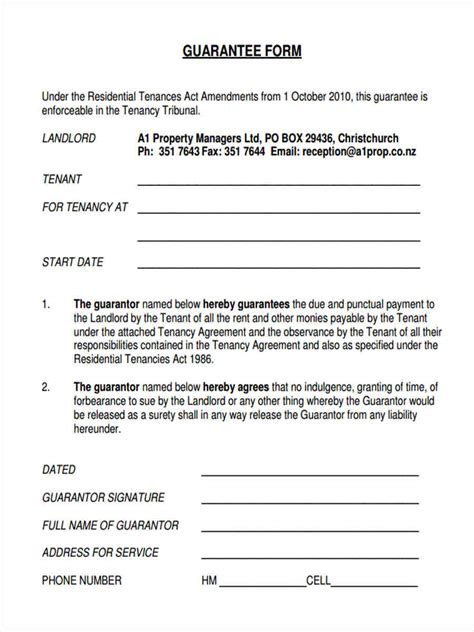

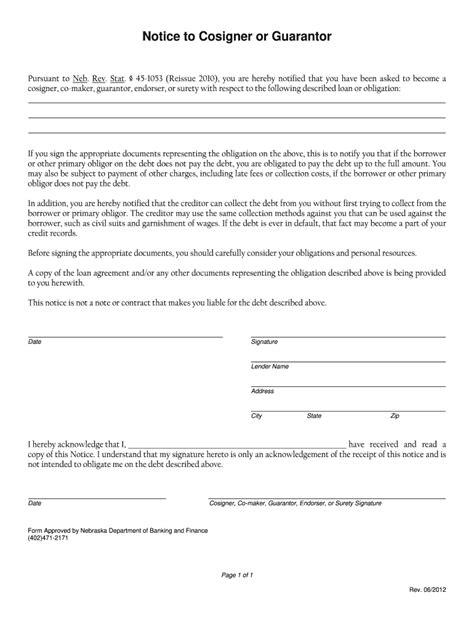

- Guarantee Agreement: This is a legal contract between the guarantor, the borrower, and the lender. It outlines the terms and conditions of the guarantee, including the amount of debt the guarantor is responsible for and the circumstances under which the guarantor will be required to pay.

- Indemnity Agreement: This type of agreement protects the lender in case the borrower defaults on their payments. The guarantor agrees to indemnify the lender against any losses incurred due to the borrower’s default.

- Security Agreement: In some cases, a security agreement may be required, where the guarantor provides collateral to secure the loan or debt.

5 Essential Guarantor Paperwork

Here are five essential guarantor paperwork needed for various transactions:

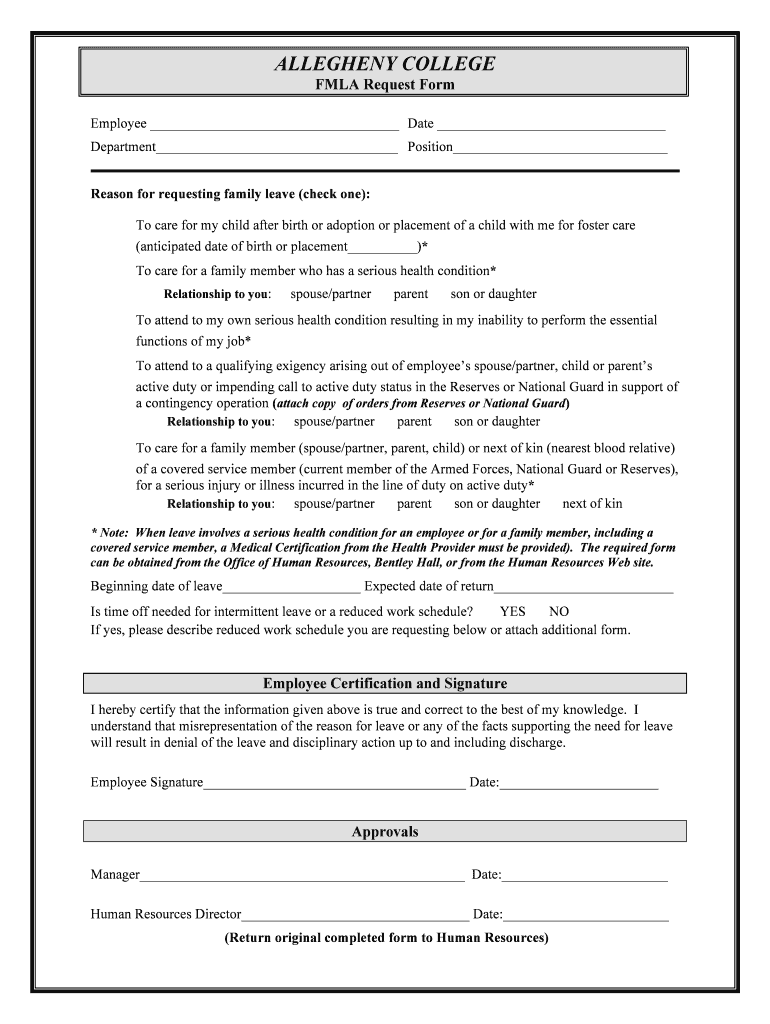

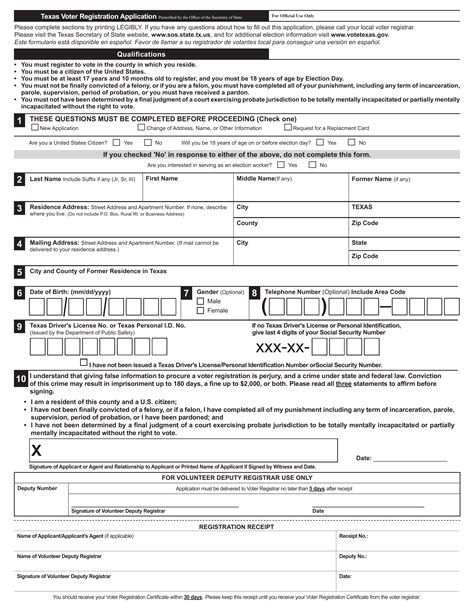

- Guarantor Application Form: This form is used to collect information about the guarantor, including their personal and financial details. The form typically requires the guarantor’s name, address, employment status, income, and credit history.

- Guarantee Deed: A guarantee deed is a legal document that outlines the terms and conditions of the guarantee. It includes the amount of debt the guarantor is responsible for, the interest rate, and the repayment terms.

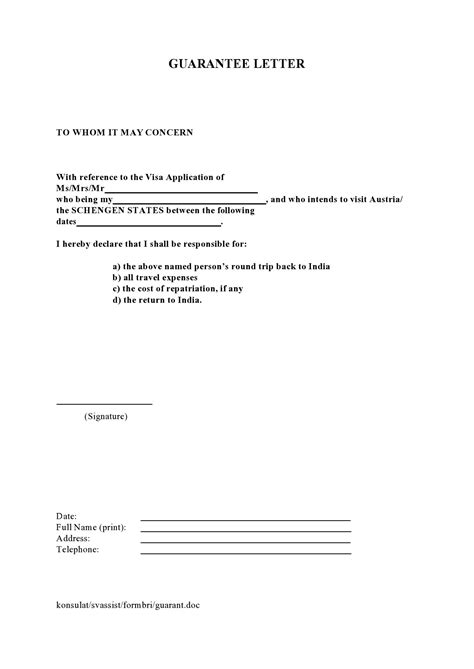

- Letter of Guarantee: A letter of guarantee is a formal letter from the guarantor to the lender, confirming their agreement to act as a guarantor for the borrower. The letter should include the guarantor’s name, address, and contact information, as well as the details of the loan or debt.

- Financial Statement: The guarantor may be required to provide a financial statement, which includes their income, expenses, assets, and liabilities. This information helps the lender assess the guarantor’s creditworthiness and ability to repay the debt.

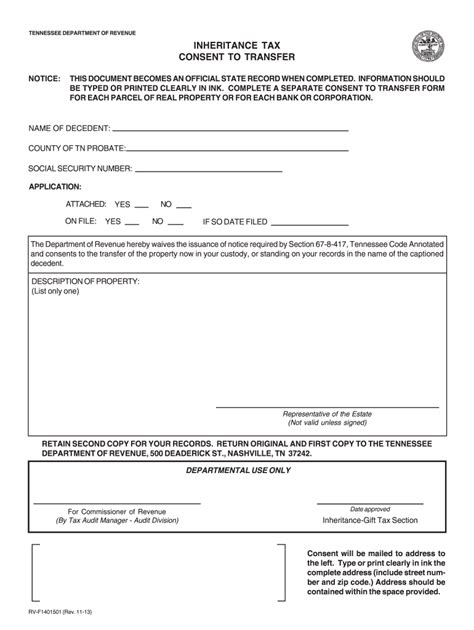

- Identification Documents: The guarantor may be required to provide identification documents, such as a passport, driver’s license, or national ID card. These documents help verify the guarantor’s identity and ensure that they are who they claim to be.

📝 Note: The specific guarantor paperwork required may vary depending on the lender, the type of loan or debt, and the jurisdiction. It's essential to check with the lender or a financial advisor to determine the exact paperwork needed.

Benefits of Guarantor Paperwork

Guarantor paperwork provides several benefits to all parties involved, including:

- Protection for the lender: Guarantor paperwork provides the lender with an added layer of protection in case the borrower defaults on their payments.

- Peace of mind for the borrower: Knowing that a guarantor is responsible for the debt in case of default can provide peace of mind for the borrower.

- Clarity and transparency: Guarantor paperwork ensures that all parties understand their responsibilities and obligations, reducing the risk of disputes or misunderstandings.

Conclusion

In summary, guarantor paperwork is an essential aspect of any financial or rental transaction that involves a guarantor. The five essential guarantor paperwork needed include a guarantor application form, guarantee deed, letter of guarantee, financial statement, and identification documents. By understanding the importance of guarantor paperwork, individuals can ensure that their financial transactions are secure, transparent, and protected.

What is a guarantor, and why is guarantor paperwork necessary?

+

A guarantor is a person who agrees to take on the debt or responsibility if the primary borrower defaults on their payments. Guarantor paperwork is necessary to formalize the agreement and protect all parties involved.

What are the benefits of guarantor paperwork for the lender?

+

Guarantor paperwork provides the lender with an added layer of protection in case the borrower defaults on their payments. It ensures that the lender can recover their losses from the guarantor if the borrower is unable to repay the debt.

Can a guarantor withdraw from the agreement after signing the guarantor paperwork?

+

Generally, a guarantor cannot withdraw from the agreement after signing the guarantor paperwork. However, it’s essential to review the terms and conditions of the agreement to understand the specific circumstances under which a guarantor can withdraw or be released from their obligations.