Gift Paperwork Requirements

Introduction to Gift Paperwork Requirements

When it comes to giving gifts, especially those of significant value, it’s essential to understand the paperwork requirements involved. Gift taxes, valuations, and documentation are just a few aspects to consider. This post will delve into the details of gift paperwork requirements, providing a comprehensive guide to help you navigate the process with ease.

Understanding Gift Taxes

Gift taxes are levied on transfers of property by one individual to another, where the transfer is made without receiving something of equal value in return. The Internal Revenue Service (IRS) is responsible for collecting gift taxes in the United States. To report gifts, you must file Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, if the total value of gifts to an individual exceeds the annual exclusion limit.

Annual Exclusion Limit

The annual exclusion limit is the maximum amount you can gift to an individual in a calendar year without being subject to gift taxes. This limit is adjusted annually for inflation. For example, in the 2022 tax year, you could give up to $16,000 to any individual without incurring gift taxes. If you exceed this limit, you are required to file Form 709, even though you may not owe gift taxes due to the lifetime exemption.

Lifetime Exemption

The lifetime exemption is the total amount you can gift over your lifetime without paying gift taxes. As of the 2022 tax year, the lifetime exemption was 12.06 million per individual. This means you can gift up to 12.06 million over your lifetime, in addition to the annual exclusions, without owing gift taxes.

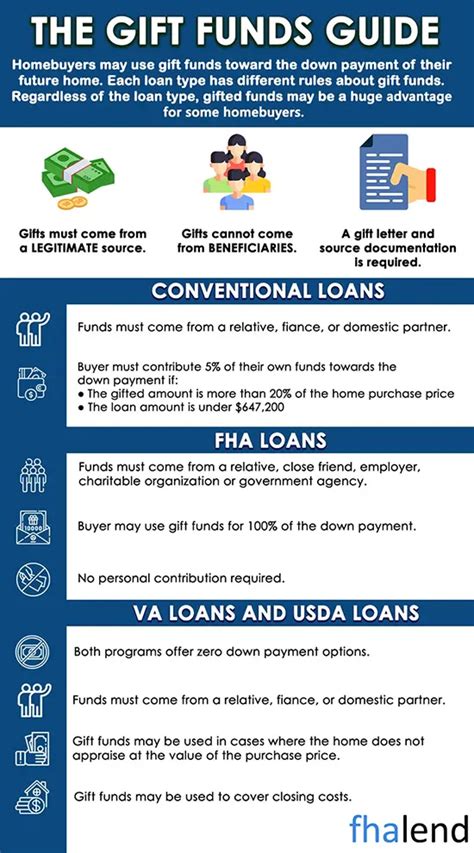

Valuation of Gifts

The valuation of gifts is crucial for determining the amount of gift taxes owed. For cash gifts, valuation is straightforward. However, for non-cash gifts, such as real estate, artwork, or businesses, you need to determine the fair market value (FMV) of the gift. This may require an appraisal by a qualified professional.

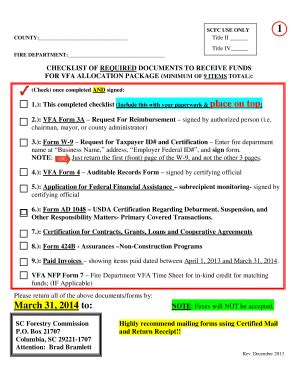

Documentation Requirements

Proper documentation is essential for gift transactions. Here are some key documents you may need: * Deed of Gift: A document that transfers ownership of a property from one person to another. * Appraisal: For non-cash gifts, an appraisal can help determine the FMV. * Form 709: If the gift exceeds the annual exclusion limit, you must file this form with the IRS. * Receipts and Records: Keep receipts and records of the gift, including any appraisals or valuations.

📝 Note: It's crucial to keep accurate and detailed records of your gifts, including receipts, appraisals, and copies of Form 709, as these may be required in case of an audit.

Special Considerations

There are special considerations for certain types of gifts, such as: * Gifts to Minors: You can use a Uniform Transfers to Minors Act (UTMA) account to make gifts to minors. * Gifts to Charities: Gifts to qualified charities can provide tax deductions. * International Gifts: Gifts to non-resident aliens may be subject to special rules and reporting requirements.

Consequences of Non-Compliance

Failure to comply with gift paperwork requirements can result in: * Penalties and Fines: The IRS can impose penalties and fines for failure to file Form 709 or for underreporting the value of gifts. * Interest on Taxes Owed: You may be required to pay interest on any taxes owed due to non-compliance. * Loss of Lifetime Exemption: In severe cases, failure to comply with gift tax laws can result in the loss of the lifetime exemption.

Seeking Professional Advice

Given the complexity of gift paperwork requirements, it’s often advisable to seek professional advice from a tax attorney, CPA, or financial advisor. They can help you navigate the process, ensure compliance with tax laws, and minimize potential liabilities.

What is the annual exclusion limit for gift taxes in the United States?

+

The annual exclusion limit for gift taxes in the United States is adjusted annually for inflation. For the 2022 tax year, the limit was $16,000 per individual.

Do I need to file Form 709 if I give a gift below the annual exclusion limit?

+

No, you do not need to file Form 709 if the total value of gifts to an individual in a calendar year does not exceed the annual exclusion limit.

How do I determine the fair market value of a non-cash gift?

+

To determine the fair market value of a non-cash gift, you may need to obtain an appraisal from a qualified professional. This is especially true for gifts such as real estate, artwork, or businesses.

In summary, navigating gift paperwork requirements involves understanding gift taxes, annual exclusion limits, lifetime exemptions, valuations, and documentation. By following these guidelines and seeking professional advice when necessary, you can ensure compliance with tax laws and minimize potential liabilities. It’s essential to keep accurate records and be aware of special considerations for certain types of gifts. With this knowledge, you can make informed decisions about your gift-giving and avoid any unintended consequences.