5 Tips Cobra Paperwork

Understanding COBRA Paperwork: A Comprehensive Guide

When an individual leaves a job or experiences a reduction in work hours, they may be eligible for Consolidated Omnibus Budget Reconciliation Act (COBRA) benefits. COBRA allows them to continue their health insurance coverage for a limited time. However, navigating the COBRA paperwork can be overwhelming. Here are five tips to help you understand and manage the process efficiently.

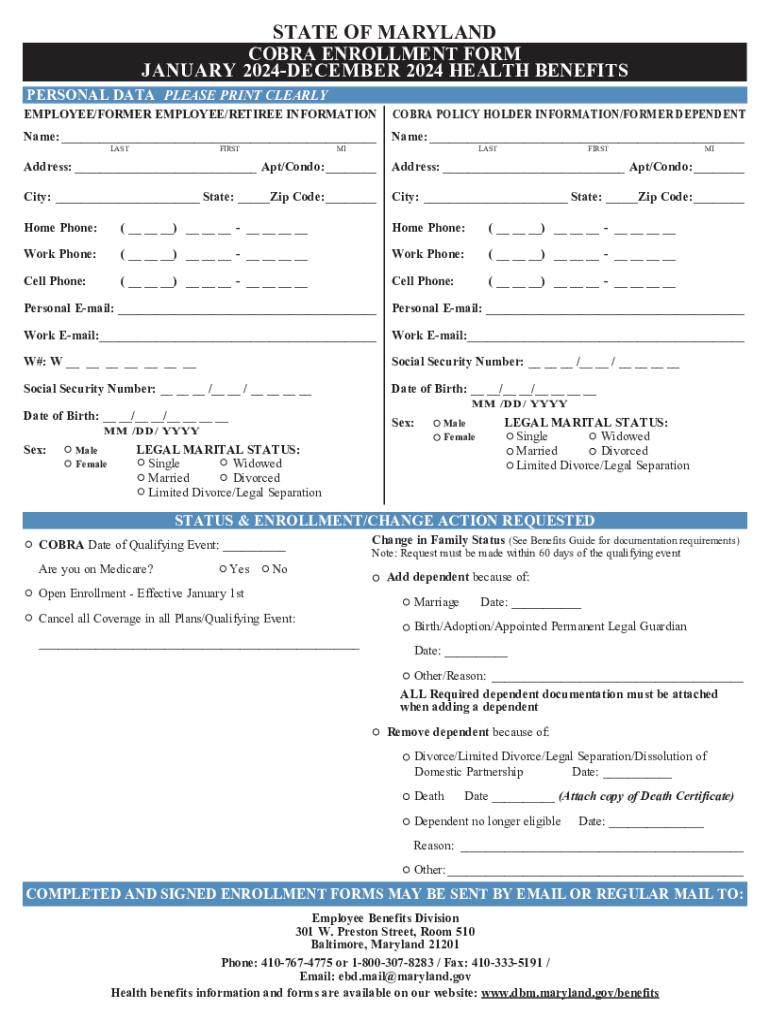

Tip 1: Familiarize Yourself with COBRA Eligibility

To be eligible for COBRA benefits, an individual must meet specific criteria. These include: - The company they worked for must have had at least 20 employees on more than 50% of its typical business days in the previous calendar year. - The individual must have been covered under the company’s health plan on the day before the qualifying event (e.g., job loss, reduction in work hours). - The individual must not be eligible for Medicare or other group health plan coverage.

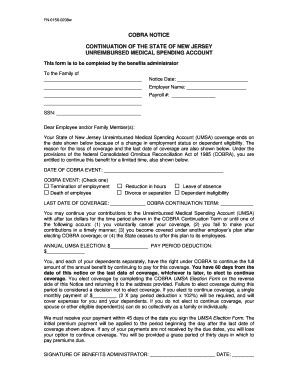

Tip 2: Understand the COBRA Qualifying Events

COBRA qualifying events are circumstances that trigger the opportunity to elect COBRA coverage. These events include: - Voluntary or involuntary termination of employment for reasons other than gross misconduct. - Reduction in work hours that results in the individual losing coverage under the company’s health plan. - Divorce or legal separation from the covered employee. - Death of the covered employee. - Dependent child ceasing to be a dependent under the plan.

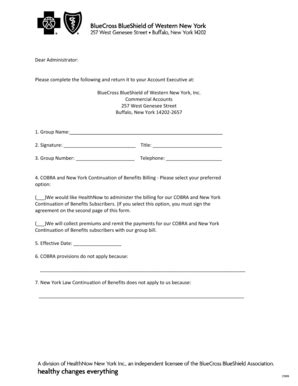

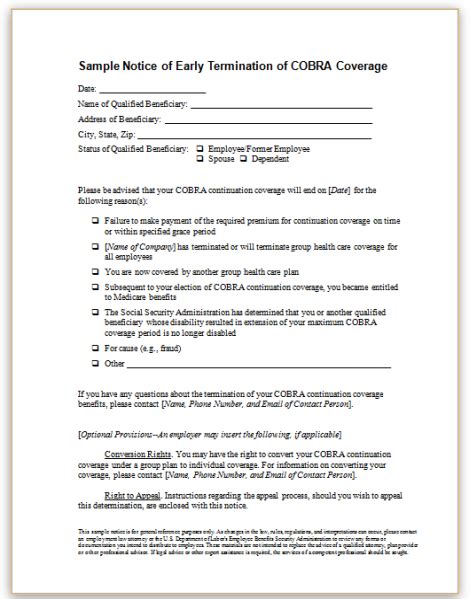

Tip 3: Managing COBRA Paperwork and Deadlines

The COBRA paperwork process involves several key steps and deadlines: - Notification of Qualifying Event: The employer must notify the plan administrator within 30 days of the qualifying event. - Election Notice: The plan administrator must provide the qualified beneficiary with an election notice within 14 days after receiving the notification of the qualifying event. - Election Period: The qualified beneficiary has 60 days from the date of the election notice or the date coverage would otherwise end, whichever is later, to elect COBRA coverage. - Premium Payments: The first premium payment is due 45 days after the COBRA coverage begins, and subsequent payments are due on the first day of each month.

Tip 4: Calculating COBRA Premiums

The cost of COBRA coverage can be significant because the individual must pay the full premium amount that the employer previously paid on their behalf, plus a 2% administrative fee. Factors to consider when calculating COBRA premiums include: - Original Premium Cost: The total premium cost before the qualifying event. - Employer Contribution: The amount the employer was contributing towards the premium. - Administrative Fee: An additional 2% of the premium cost for administrative purposes.

| Component | Description |

|---|---|

| Original Premium | The full cost of the health insurance before any employer contribution. |

| Employer Contribution | The amount the employer pays towards the premium, which the individual must now cover under COBRA. |

| Administrative Fee | An additional 2% of the premium for handling the COBRA benefits. |

Tip 5: Exploring Alternatives to COBRA

While COBRA provides temporary relief, it may not be the most cost-effective or suitable option for everyone. Alternatives to consider include: - Affordable Care Act (ACA) Marketplace Plans: These plans offer comprehensive coverage and may be more affordable, especially with subsidies for eligible individuals. - Spouse’s Plan: If the spouse has a group health plan through their employer, joining this plan might be a viable option. - Short-Term Limited-Duration Insurance (STLDI): These plans provide temporary coverage for a limited period, typically up to 12 months, and may be cheaper but offer limited benefits.

📝 Note: It's crucial to evaluate all options carefully, considering factors like coverage, cost, and any pre-existing condition limitations before making a decision.

To summarize, navigating COBRA paperwork requires a thorough understanding of eligibility, qualifying events, deadlines, premiums, and potential alternatives. By being informed and proactive, individuals can make the best decisions for their health insurance needs during transitional periods. This comprehensive approach ensures that the transition from employer-sponsored coverage to alternative plans is as seamless as possible, protecting the individual’s health and financial well-being.

What is the primary purpose of COBRA?

+

The primary purpose of COBRA is to allow individuals to continue their health insurance coverage for a limited time after experiencing a qualifying event, such as job loss or reduction in work hours.

How long does COBRA coverage last?

+

COBRA coverage typically lasts for 18 months, although it can be extended to 29 months under certain circumstances, such as disability, or 36 months for spouses and dependents in the case of the employee’s death or divorce.

What are the key factors to consider when deciding between COBRA and alternative health insurance options?

+

Key factors include the cost of premiums, the comprehensiveness of coverage, any limitations due to pre-existing conditions, the duration of coverage needed, and the potential for subsidies or discounts with alternative plans.